After yesterday's update, I do feel a little foolish. Myself and many others seem to have fallen hook line and sinker for Bill Gates' antics. So... now that everybody knows how to short bitcoin, it seems that the market is now blaming short sellers for the decline in prices.

This paper from the San Fransico Federal Reserve attempts to link the decline from December's peak to the introduction of bitcoin futures on Wall Street. They even go so far as to compare it to the financial crisis of 2008, when the introduction of new financial instruments allowing investors to short mortgage-backed securities was followed by a crash in the market.

In order to expand on this, I would like to point out that the housing bubble itself was the cause of the crash and not the CDOs that allowed investors to make speculative bets that it would fall. The ability to sell it short was simply a way of letting out some of the air.

Anyway, the housing market has since recovered and is now much stronger for the fact that the market has freer access to trade in both directions.

Today's Highlights

Trump Making Waves

Dollar Sweeping Up

Japan's Crypto Regs

Please note: All data, figures & graphs are valid as of May 9th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

He was said to be the president for the traders and so far Donald J Trump has not disappointed in bringing market volatility. Even though market participants were well prepared for the decision to exit the Iran deal, it didn't stop things from getting shaky when the announcement was made.

Here's the price of oil. The purple circle is when Trump spoke.

Expect the inventories announcement today to be exciting.

Also take a look at gold, which is falling pretty hard this morning. It's rather rare for gold to fall when political tensions are rising. Perhaps due to Dollar strength, which we will look at below.

Other than political rhetoric, it seems the economic impact of Trump's decision could be a bit more muted than most people think. Many companies had been a bit languid to spark up new deals with Iran since Obama eased the sanctions.

The exception is Boeing (NYSE:BA), who will reportedly lose out on $20 Billion worth of deals but even their stock seems to be holding up alright given the circumstances.

Over to Currencies

There's no denying it now, the Dollar is on a tear.

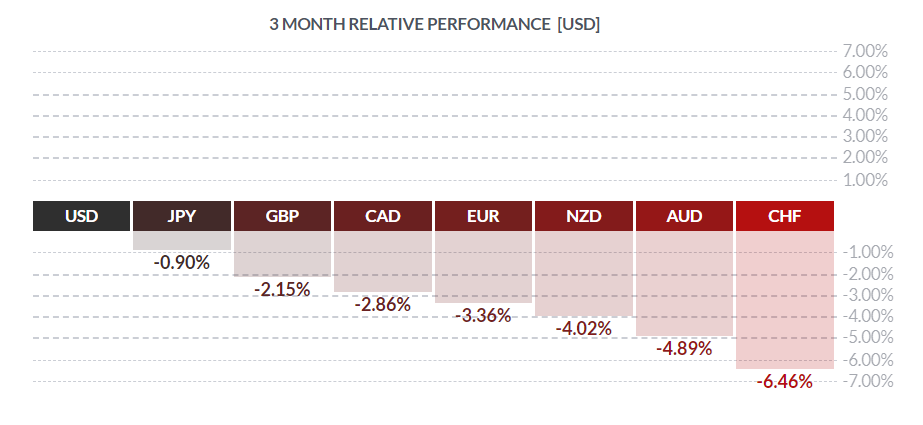

Here we can see the USD's relative performance over the last three months.

The EUR/USD has broken strongly below 1.2000, and the GBP/USD is holding on tightly to 1.3500, possibly hoping for a miracle from Mark Carney tomorrow.

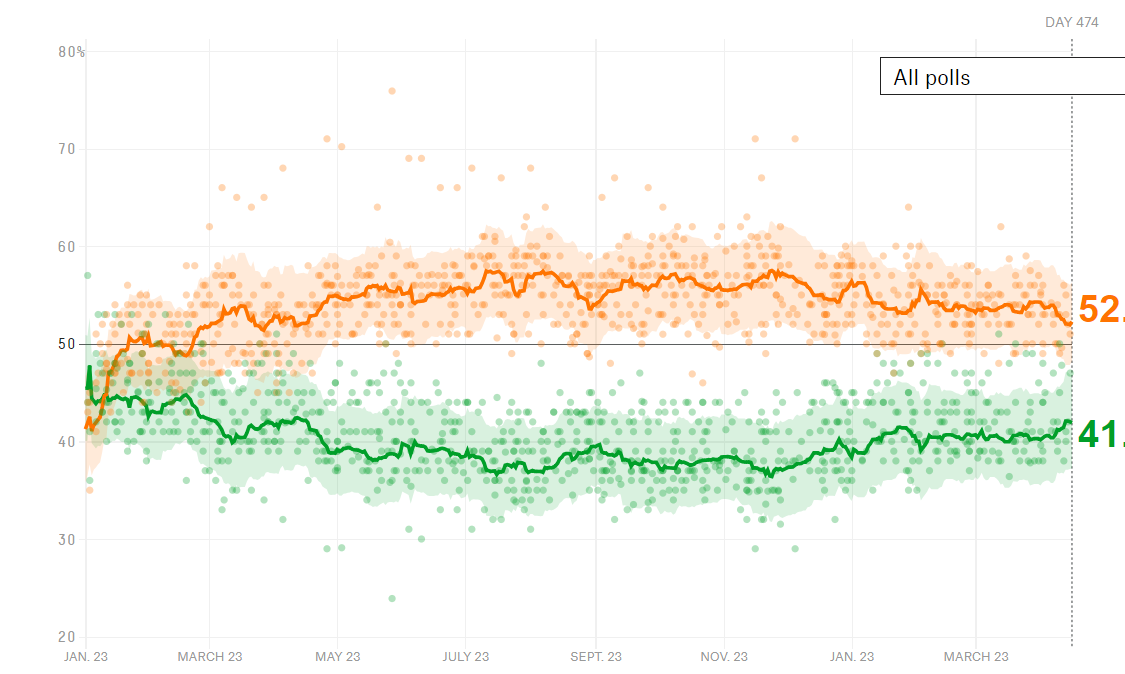

Shorting the Buck was one of the most popular trades of 2017 so what we're seeing now is likely due to some of those trades unwinding, but can also likely be linked to Trump's rapidly rising approval rating.

Also, as I'm writing I saw something interesting about a possible meeting in Turkey to sort out the country's finances. The USD/TRY is reacting.

Bitcoin Pleasantly Stable

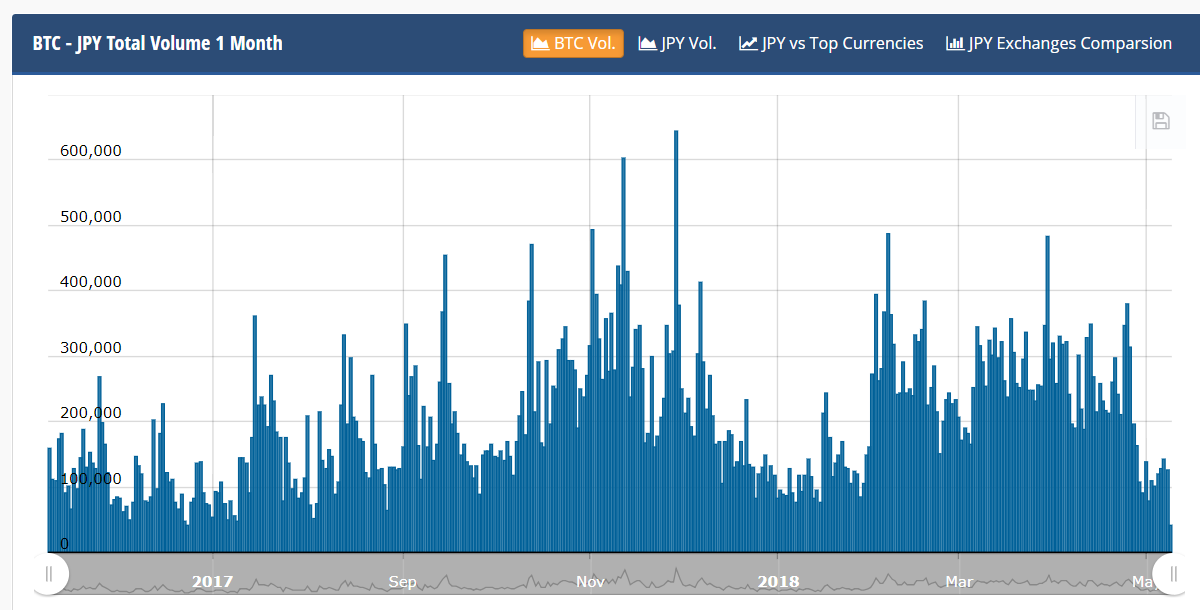

We mentioned above some of the possible reasons that cryptos are falling in the medium term. For those looking for a news event to blame for the declines of the last few days, the best explanation I've seen is the new Japanese regulations.

In the wake of the massive Coincheck hack, Japan's FSA is getting tough on local exchanges with new laws that incorporate everything from AML to anti-manipulation protections. However, in my view, the new measures are more operational and administrative. In other words, not the type of thing that would damage local cryptotrader sentiment in the long run. On the contrary, it could instill added confidence in the market.

Admittedly, BTC/JPY volumes are a tad low going into May...

In truth, there's been relatively little movement since BTC's last dash for $10k. A drop below $9k is looking increasingly likely but it doesn't bother me. There are plenty more support levels just below and the price has been remarkably stable since mid-March, which is ultimately a great thing for user adoption.

Let's have a fantastic day today!

Please continue to tag me on social media with your thoughts and opinions. They're always appreciated. :)

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.