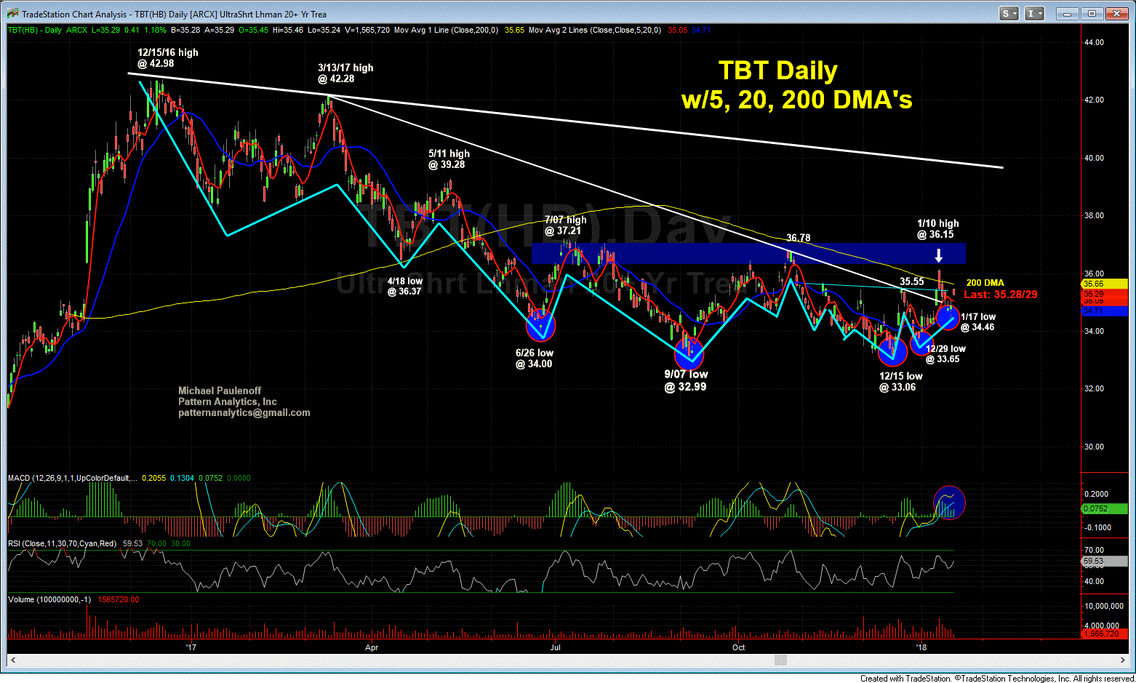

We've been long TBT – the inverse, double-levered, longer-term T-bond ETF – expecting a downturn in t-bond prices in conjunction with a generational opportunity to capture the upturn in yield and interest rates after a 35-year bear market.

Yes, "the turn" has become a marathon, certainly not a sprint. However, increasingly my big-picture technical chart set-up argues strongly that yield will inexorably grind higher toward significant bullish catalysts that will propel both yield and the TBT higher in the months ahead. The Fed will find itself behind the curve and in a vulnerable position that will increase the likelihood of a major policy mistake.

My sense is that Pres. Trump has unleashed enormous pent-up economic activity and power that was suffocated by the Obama Administration during the post-crisis years. The genie is out of the bottle and will bring with it unexpected and unintended consequences heaped on top of all of the unintended market distortions that emerged during the Bernanke Fed experimentation (QE) years, which mostly overlapped the Obama years.

The markets have a way of swinging "the pendulum" too far to one side before the inevitable correction (pendulum swing) in the opposite direction. That movement is now in progress.

Let's fasten our seat belts, because the markets are about to get much wilder, more volatile and more confusing as interest rates (on the long end) move into overdrive on the upside.