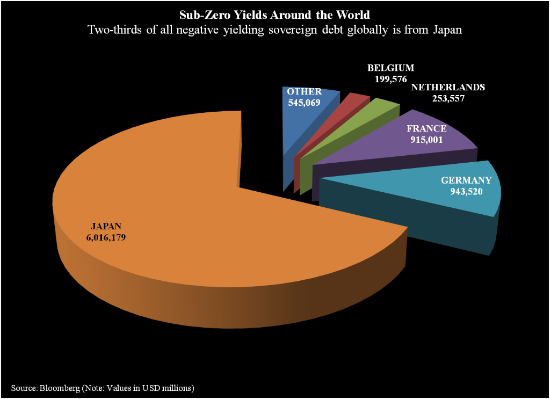

The second quarter of 2016 saw continued volatility in the equity market, while yields in the fixed-income market continued to grind lower. The downward trend in fixed-income yields was a result of a disappointing May 2016 jobs number, negative interest rate policy (NIRP), and quantitative easing from the European Central Bank (ECB) and Bank of Japan (BOJ). Falling yields resulted in what many view as a “yield grab” in US debt (as opposed to a “flight to quality,” which is more common in times of economic uncertainty). The graph below shows the record amount ($8 trillion) of negative-yielding government debt around the world.

Strong rallies in the US Treasury market and flattening of the yield curve during the second quarter has contributed a nice level of dollar price appreciation to Cumberland Advisors’ taxable fixed-income portfolios. During the second quarter we have witnessed a double-digit basis point drop in yields from the 5-year out to the 30-year Treasury. From March 31st to June 16th the 30-year Treasury dropped from 2.61% to 2.37% a 24 basis point drop in yield. The graph below shows the Treasury-curve movements across all tenors from the beginning of the quarter on 3/31/16 (blue) to 6/16/16 (green).

The Federal Reserve (Fed) chose to hold rates steady and lower the projection for future tightening during the June meeting. The statement continued to be dovish and suggests that the Fed is more concerned with labor market data than with other economic growth measures. Janet Yellen’s public address pointed out that an aging society and slow productivity growth, along with the risk of Brexit, may depress interest rates going forward. Recent polls suggest that Britain leaving the European Union is a growing possibility, and we do not expect the Fed to make a decision on rates until the Brexit vote is finalized and the situation is resolved on June 23rd.

Cumberland Advisors’ strategy going into the third quarter will be to continue positioning portfolios defensively. At the beginning of the year we increased the weighting of Treasury Inflation-Protected Securities (TIPS) in portfolios to counter an expected uptick in inflation. Cumberland also started placing agency multi-step coupons in the portfolios that utilize multiple coupon increases over the life of the bond to help protect against a rising interest rate environment. We are also starting to include a small weighting in 2-year Treasury floaters with a weekly coupon reset in place of shorter TIPS that have become negative yielding. This position is being used as a cash alternative so we can remain defensive while still earning something for the portfolios in a time of low interest rates.

As with the tax-free strategy, we are looking to slowly lower durations on the accounts. We are lightening the long end of the “barbell” and increasing the weighting on the short end. Some of the shortening has come from continuing to hold bonds that have rolled down the yield curve. At the same time, additional shortening has come from taking profits in longer-duration assets that have appreciated during the recent rally. We believe that the Fed will raise rates at least once this year; however, we are in the camp that expects rates to remain low for a longer period of time as the Fed continues to be conservative in their approach to raising short-term interest rates.