Low, Lower, Lowest

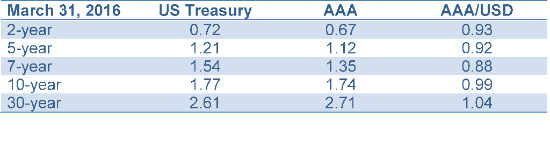

The tax-free bond market spent the second quarter slowly grinding to lower and lower yields – especially in the longer-maturity end of the curve where the muni market has set record lows for yields on the AAA scale

The drop in the muni/Treasury yield ratio on the longer-maturity end is noteworthy, as most instances of dropping Treasury yields produce higher yield ratios since municipals have a hard time keeping up with the essentially noncallable Treasury market.

There are a number of forces at work here.

A Continuing Drop in Muni Supply

Supply is down nearly 15% from the first half of 2015. The simple reason is that last year was marked by a record amount of supply to refund older higher-coupon bonds whose call dates came into play in 2015. Issuers took advantage of this, saving lots in future debt service by calling in bonds whose coupons were 5% and higher and by issuing bonds between 3.5% and 4% yields.

Demand Side Picked Up

Equity jitters early in the year spurred a reallocation into bonds and into tax-free bonds in particular. When we add in the amount of called and maturing bonds, the amount of NET new issuance has been negative the past few months. This trend has spurred yields to new lows.

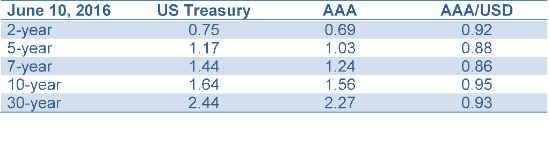

Bond Fund Inflows Picked Up

The chart below shows the increase in municipal bond fund flows.

Source: Lipper

This increase is significant, as the muni market repaired itself from the “taper tantrum” of 2013 largely without the help of bond funds. Most of the inflows since 2013 have been from private accounts, banks, and insurance companies. The resurgence of bond funds has been certainly been a force in the past few months.

Foreign Investors Increased Muni Holdings

Overall, foreign holdings of munis are double what they were since 2007. Wells Fargo (NYSE:WFC) data indicates that in the first quarter of 2016 there were $2 billion in additional foreign flows into the municipal bond market above the level in 2015. Foreign investors got great exposure to the muni market through the taxable Build America Bonds program in 2009–2010. However, the continued cheapness of tax-free muni yields relative to Treasury yields has spurred foreign demand, even for tax-free munis – especially considering the very low yields on investment-grade paper in Europe and Japan.

Strategy Going Forward

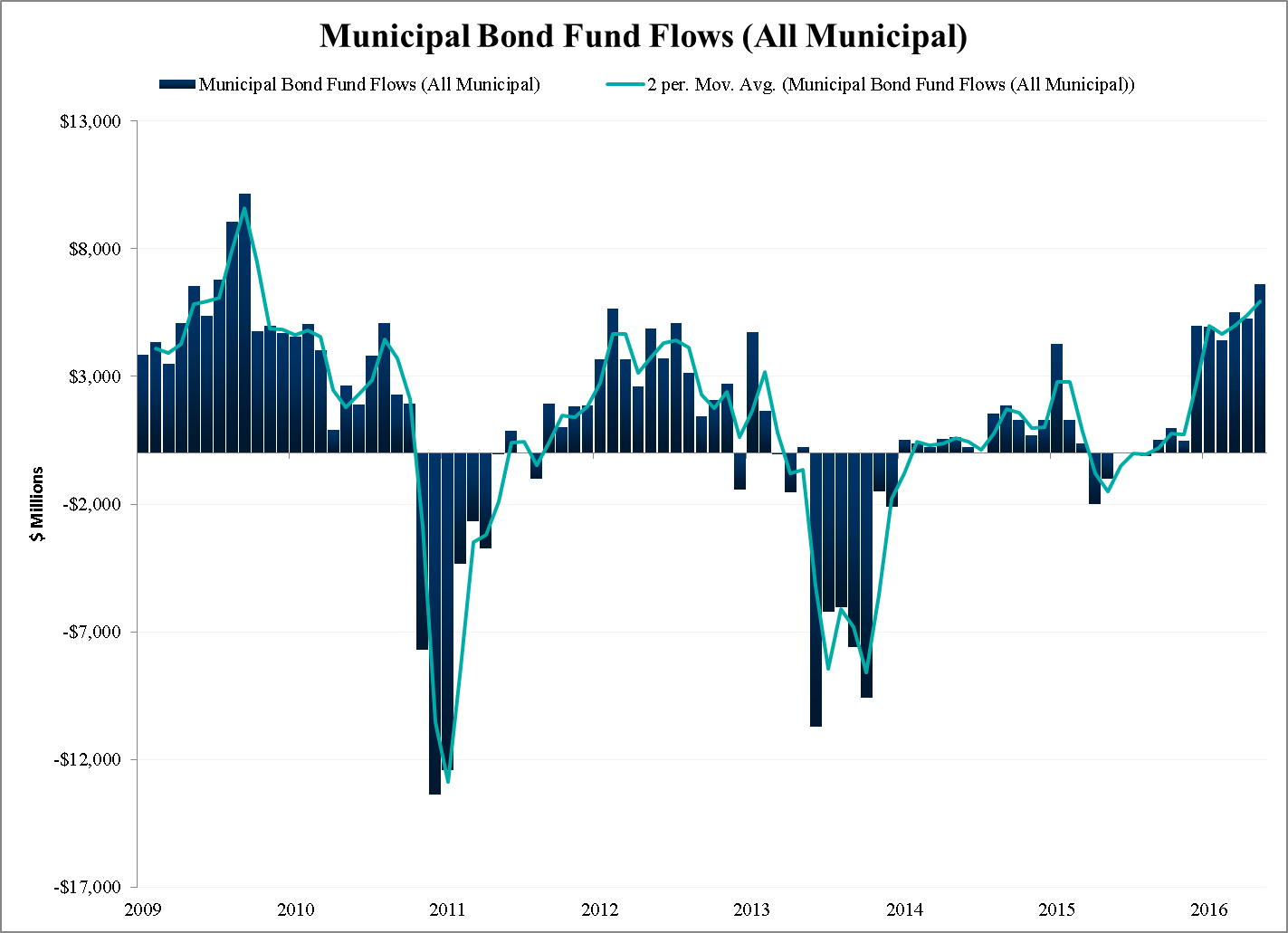

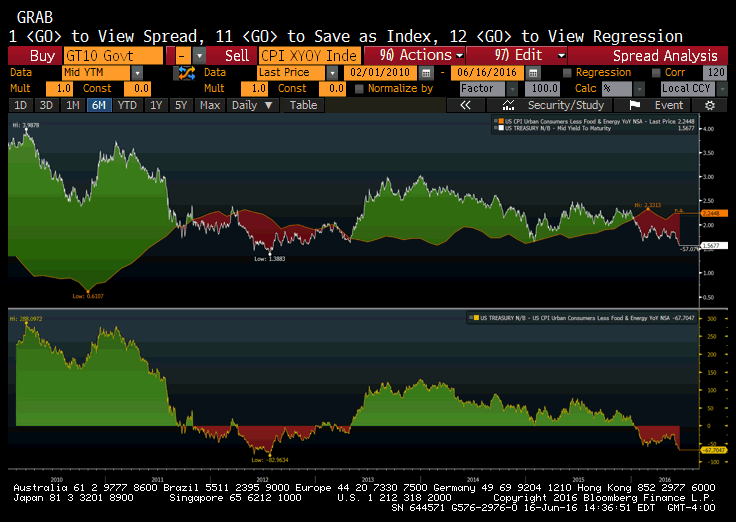

The current environment has an eerie feeling, similar to late 2012 – early 2013. There are low government yields with paltry growth as well as low muni yields. Though muni yields are still cheaper compared to Treasury yields than would be the case in a normal environment, as we have already explained, on a nominal basis they are at record lows in the longer maturities. That gives us some pause, as does some pickup in the core CPI over the past two years.

We often look at the 10-year US Treasury bond yield compared to the core inflation number to judge the relative attractiveness of bond markets.

Certainly the rise in Treasury yields (however misplaced the “taper tantrum” was) after the last time we had negative real yields should give us pause. From a total-return perspective, in the muni world we are slowly lowering the risk profile of our asset base.

- We are letting the many prerefunded bonds lie fallow. These older, higher-coupon bonds have been defeased to earlier call dates running from 2017 to 2021. They will provide ammunition to buy higher yields when they are available.

- We are slowly adding municipal inflation-indexed bonds (MIPS). We wrote about MIPS in January 2012, “Munis Cruise through a Scorching January.” MIPS pay an incremental coupon based on headline inflation. But they are payed in tax-exempt form, which makes MIPS extremely attractive.

- We are slowly lowering duration on accounts, in part by slowly shifting out of the “barbell” approach to place a greater emphasis on a shorter barbell. We have gradually allowed shorter securities to move down the yield curve, shortening their duration. The aforementioned buildup of prerefunded bonds and the addition of MIPS also work to shorten duration.

We think short-term rates will rise very slowly. However, when record lows in yields are reached, our approach is to trim the sails and steer a little closer to shore.