Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

The Trump Yield Rally

The movement in bond yields since the election has been dramatic. The move up in taxable as well as tax-free yields has been swift and sharp. Essentially, what could be characterized as a year’s worth of movement in bond yields was compressed into a month.

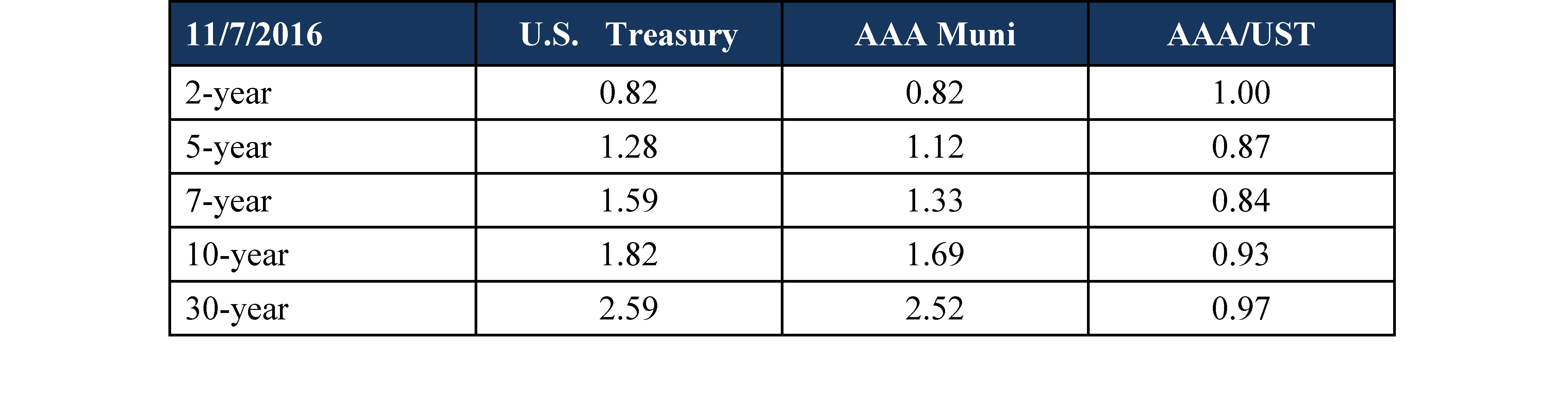

Here is where rates were on November 7th, the day before the Presidential election.

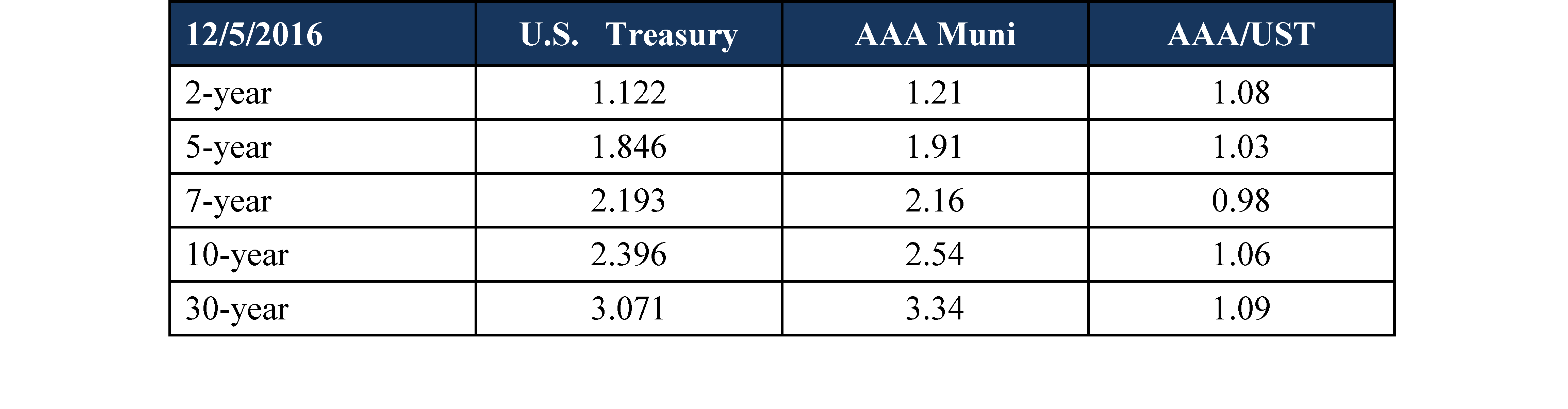

And here is where we were on December 5th – about one month after the election.

AAA-rated muni yields increased by more than 80 basis points, the 10-year by 85 basis points, and the 30-year by 82 basis points. All muni/yield ratios are above 100%, which means there was nowhere on the yield curve that muni bonds were not a great value.

The reasons? First, fear of a Trump administration. The market immediately began to discount a higher growth rate, greater government borrowing, and expanded infrastructure spending, as well as accompanying wage growth and higher inflation. In other words, the market discounted where a Trump presidency might move interest rates over the course of six months to a year and moved them to a terminal point almost immediately.

Also working against munis are the assumption of a cut in the marginal tax rate from 39.6 to 33%, a large increase in the supply of municipal bonds as a result of increased infrastructure spending, and the normal election-year fretting about Congress’s removing the tax exemption for municipal bonds.

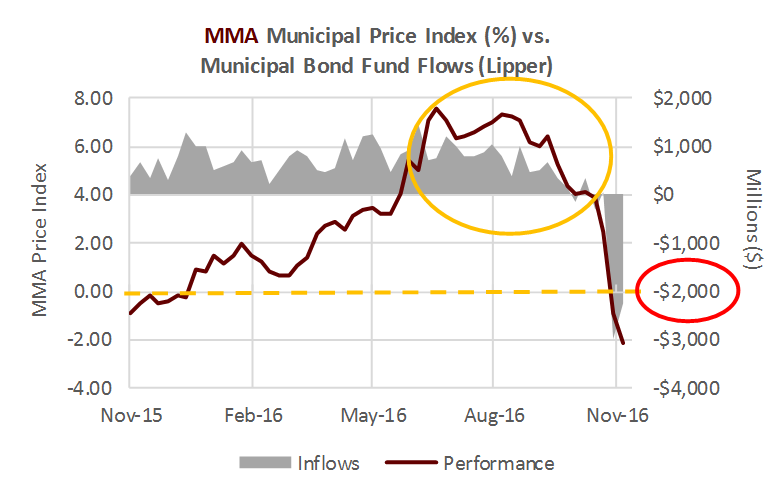

All these factors caused redemptions by the usual culprit: municipal bond funds. The following chart, courtesy of our friends at Municipal Market Advisors, illustrates the carnage inflicted on the market by fund outflows.

After the Flood

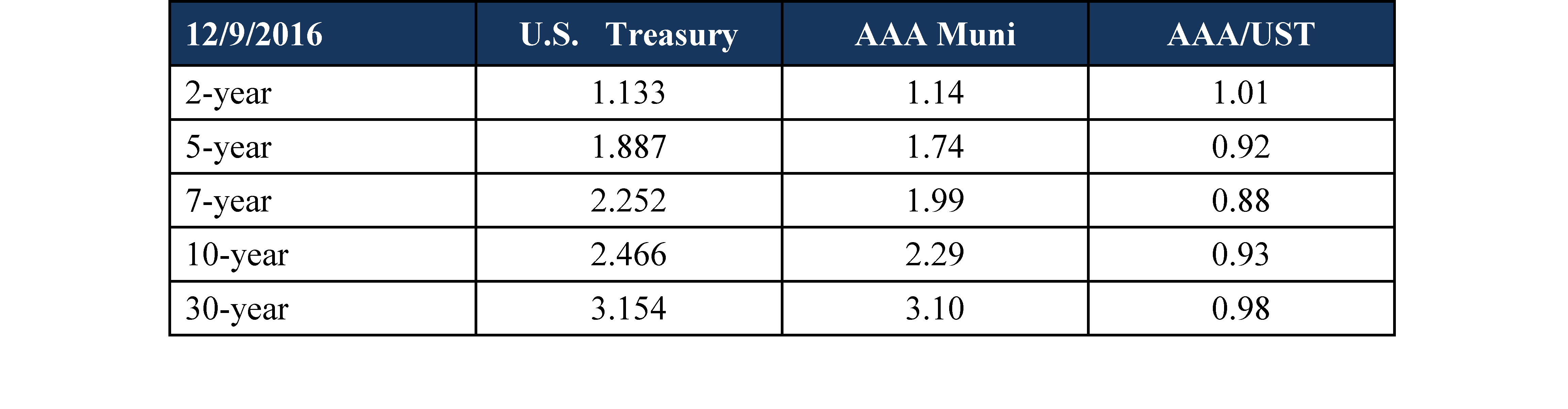

This is the market four days later, on December 9th. We began to see flows into municipal bonds from nontraditional muni buyers: life insurance companies, charitable foundations, and pension funds.

Indeed, by the end of the week the longer ratios were back under 100%:

The charts tell only part of the story. Remember, the charts represent the highest of high-grade munis. Many AA- and A-rated bonds are trading at 4.0 to 4.25% yields. This represents muni-to-Treasury yield ratios of 125% to 135%. We believe these yield levels need to be embraced for a number of reasons:

- Muni/Treasury yield ratios traditionally drop during periods of rising Treasury yields. Because of the tax exemption, you only need about a 75% move in munis compared to Treasuries to create the same increase in taxable equivalent yield. This time, yields climbed much higher than Treasuries did.

- The high yield levels resulted almost solely from bond fund selling. Thus munis are now priced extremely defensively.

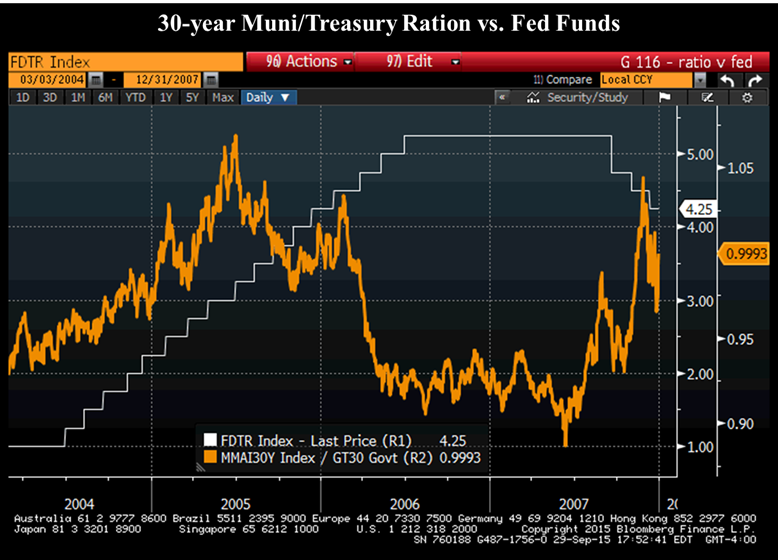

- The last time the Fed raised short-term interest rates, from 2004 to 2006, long muni/Treasury yield ratios dropped from 103% to approximately 85%. With the Fed having started to raise short-term interest rates this month, and with the strong expectation of more rate hikes next year, we think that munis at this level will hold up very well.

Source: Bloomberg

The reality of Donald Trump, president, will be different from the euphoria of Donald Trump, president-elect. The reality is that it will take time for Trump to forge a productive working relationship with Congress. Cutting marginal tax rates, designing an infrastructure program and a plan to finance it will take time. And it will take a while to get a growth rate from its current 3% to be above 4%.

Bottom line – we think the current municipal bond market is a giveaway. A 4% tax-free municipal yield equates to a 6.65% taxable equivalent yield and is higher if state or ObamaCare taxes are included. Treasury yields may drift higher, but that does not detract from the current cheapness of the tax-free bond market.

The chart below details the last four large sell-offs in the municipal market, including the Trump yield rally.

The common denominator in all four sell-offs has been the sharp uptick in yields. In other words, yields on long-term municipal bonds increasing at an increasing rate. A reversion to the mean has brought the other three fire sales back to earth. We expect the same from this one.