Assessing the impact of the series of US tariff changes in 2018 and 2019 is difficult. The tariffs have been revised and updated over time. Indeed, MarketsInsider lists about 27 tariff-related events and announcements between March 2018, when President Trump announced tariffs on steel and aluminum imports from all countries, and May 23, 2019. They have involved different countries and have impacted literally thousands of products. Sometimes tariffs have been imposed without allowing enough time for buyers of the products to arrange new suppliers or to make other supply chain adjustments. Still, it may still be possible to assess the impact of the tariffs based upon work done by independent groups like the Tax Foundation, the Peterson Institute for International Economics, and various Federal Reserve Banks.

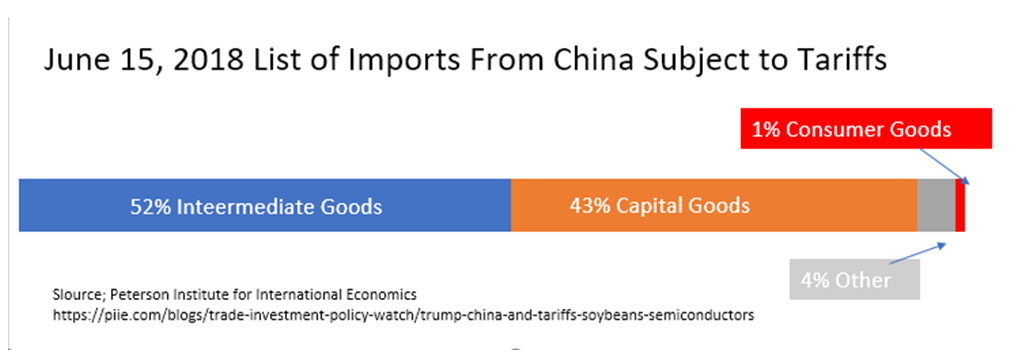

Contrary to public opinion, the first round of tariffs on Chinese imports was not focused on consumer goods but rather mainly on intermediate goods and capital goods, which amounted to products worth about $32 billion against which tariffs would be levied. The following graphic shows the breakdown. In the case of these products, the importer paid the tariff and either absorbed the cost, negotiated a lower price from the China supplier, and/or passed the price increase on to the final goods producer as an input cost increase.

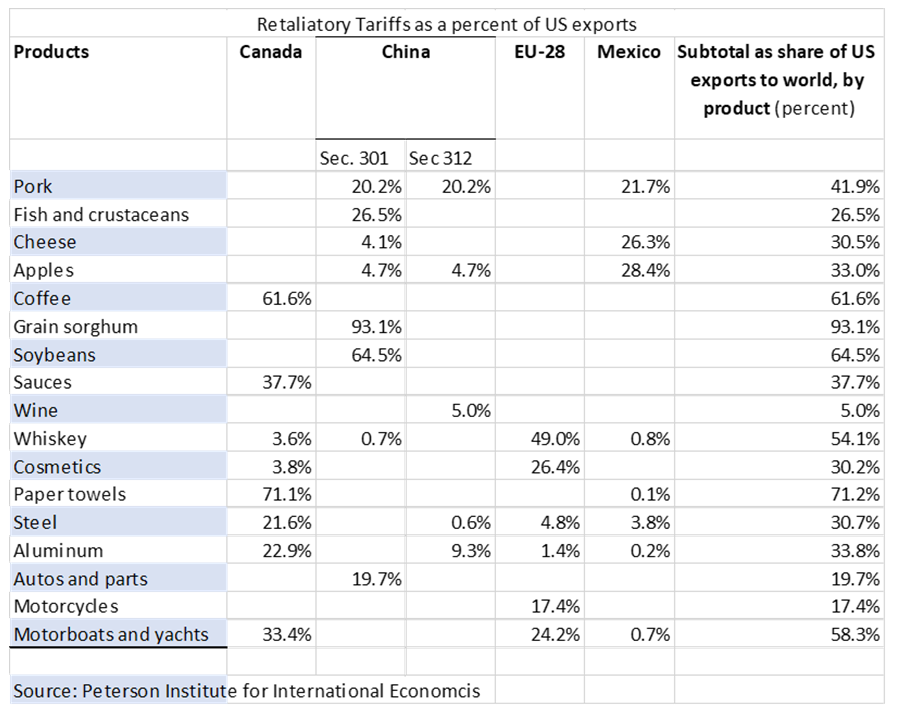

Policy changes in June 2018 added some products to the China import quota list and dropped others. For example, flat-screen televisions and aluminum were dropped, while tariffs were imposed on semiconductors and plastics. Changes were also made to components of other intermediate and capital goods. Not long after these tariffs were imposed, impacted countries responded with tariffs on US exports. The following table details those tariffs. The impact of China’s tariffs on US agricultural products is clearly significant. But interestingly, the impact was delayed, since much of the crop had already been planted and pre-sold. However, come fall, substitute crops in Brazil were planted and subject to sale to China. The real impact on US farmers didn’t show up until this planting season, when demand has dried and prices have been halved.

Since the initial rounds of import and retaliatory export tariffs have been imposed, many changes have been made in US policies, and the US has negotiated a revised trade agreement with Canada and Mexico, known as USMCA, which has yet to be approved by Congress. For example, the US lifted tariffs on steel and aluminum imports from Canada, Mexico, the EU, South Korea, Brazil, Argentina, and Australia in March, 2018. But then in June of 2018 the US removed the steel and aluminum exemptions for the EU, Canada, and Mexico, resulting in a 25% tariff on steel and 10% tariff on aluminum from those countries. Predictably, the affected countries retaliated with tariffs on US exports, detailed in the table above, that included whiskey, boats and yachts, motorcycles, blue jeans, corn, and peanut butter. Note that the tariffs imposed on most of these products and others listed in the table above impact farmers in the Midwest and manufacturers in Ohio, Michigan, and other states that supported the president in 2016. At first, it appeared that the US and China might agree on a compromise trade deal, but in early May 2019 negotiations between the US and China came to a standstill, and both countries have now imposed additional tariffs on each other’s goods.

Now, in an abrupt departure from normal trade negotiations, the administration has suddenly imposed a 5% tariff on all Mexican exports to the US as a tool to force the Mexicans to do more to stem the flow of asylum seekers through their country to the US. Furthermore, the tariffs would increase by five percentage points each month until 25% is reached unless Mexico deals with the immigration issue. Left unspecified is what steps Mexico should take, but more upsetting is that this apparent switch in policy seems to be absent a tariff strategy and puts the USMCA agreement in limbo. The uncertainty that this surprise policy has introduced is reflected in reactions not only from the US Chamber of Commerce but also from investors.

The Dow Jones index dropped over 350 points on Friday, May 31. Some have argued that the administration has exceeded its executive powers and that Congress should step in to address this issue. Indeed, key Senate Republicans have stated that they don’t support the proposals to impose tariffs. Stop-and-go, kneejerk government actions without a cohesive strategy have far-reaching economic implications for business decision making and are not good for the economy or for international relations.