What Forex Target Traders See

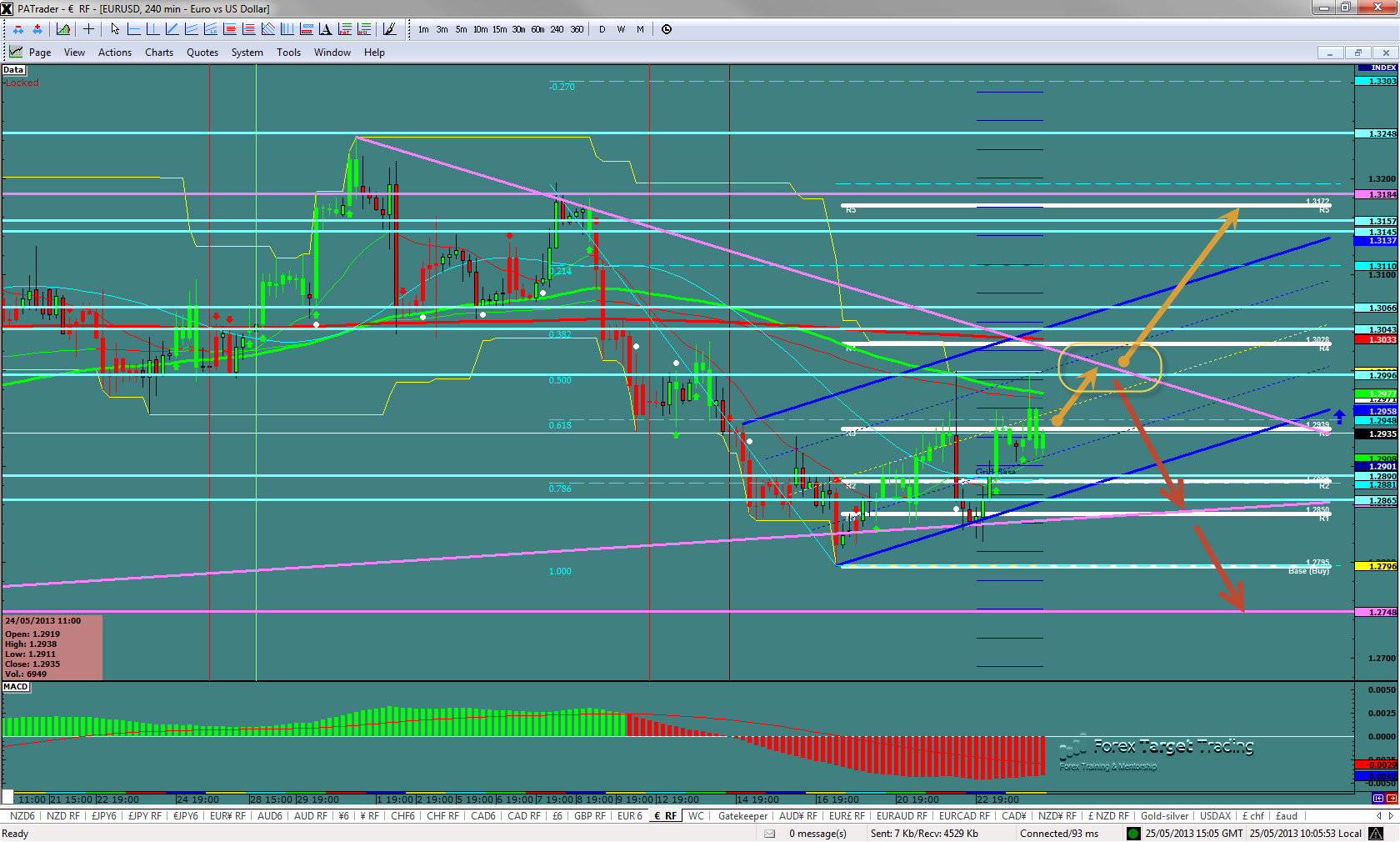

: We are currently sitting at 1.2935 after a strong bounce off the day chart trend line. We are tentatively bullish but waiting. A couple of different scenarios. 1: bullish: a move to the upper day chart trend line at 1.2996 area) and break out we will look to the R5 at 1.3172. 2: Bearish : A break down here or at the 1.2996 area would set up a nice wave to the day chart bottom at 1.2748. The average (14 day) daily true range (ATR) for the pair currently is 106 pips.

——————————————————————————–

USD/JPY

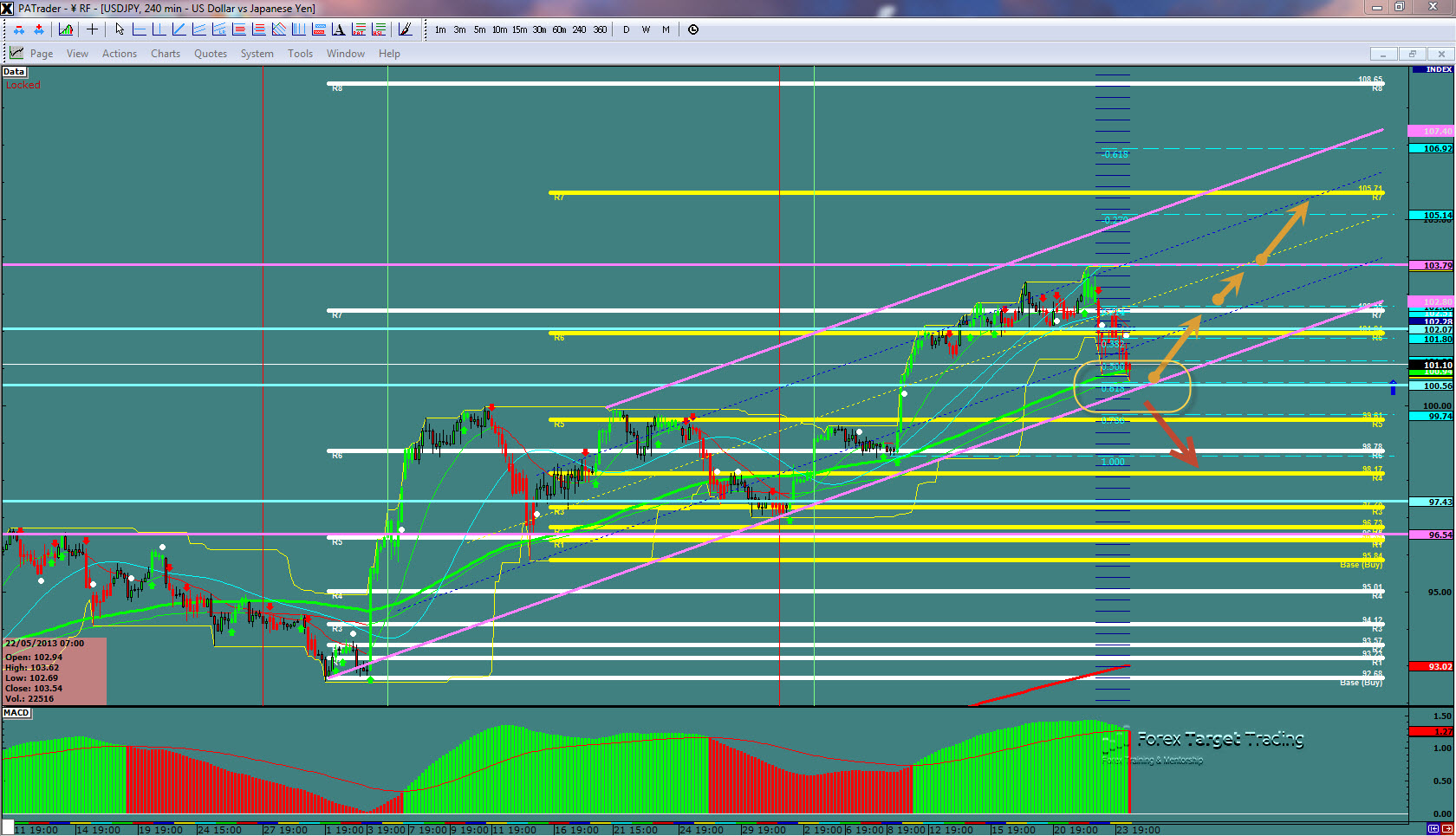

What Forex Target Traders See: We are currently at 101.10 and finishing a nice correction. Should see a bounce at the 100.50 area ( .618 Fibo, Trend line and support) and if so we will look to the R7 at 105.71 in the 5th wave. A breakdown here and will look to the 98.78 area. The average (14 day) daily true range (ATR) for the pair currently is 124 pips.

——————————————————————————–

GBP/USD

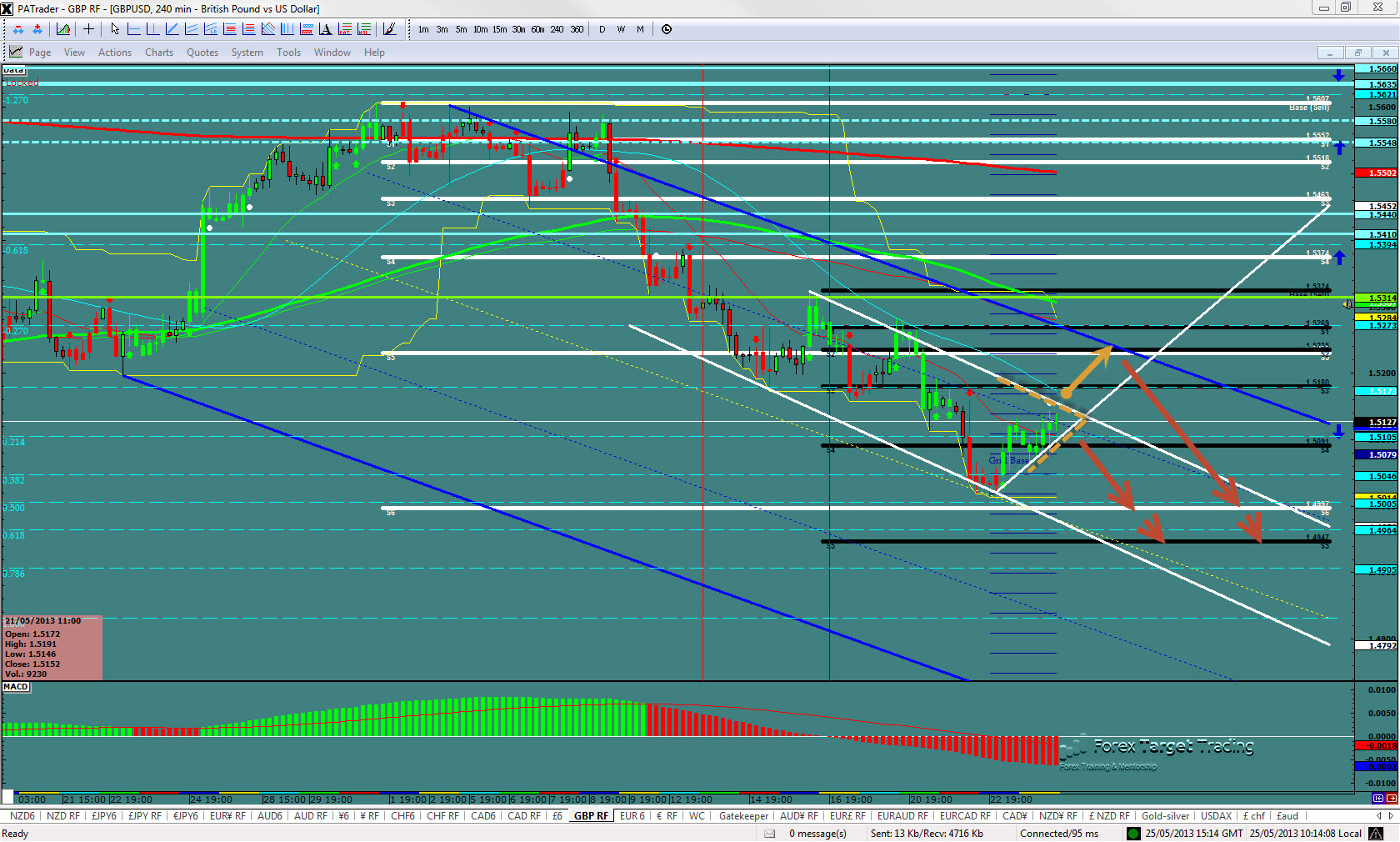

What Forex Target Traders See: Cable is currently at 1.5127 in a nice downside channel but stuck in a wedge. Look to the short side even with a higher correction to the S6 at 1.5005 and then 1.4947 to finish the down move. The average (14 day) daily true range (ATR) for the pair currently is 124 pips.

——————————————————————————–

AUD/USD – A great smooth currency for Newbie’s!

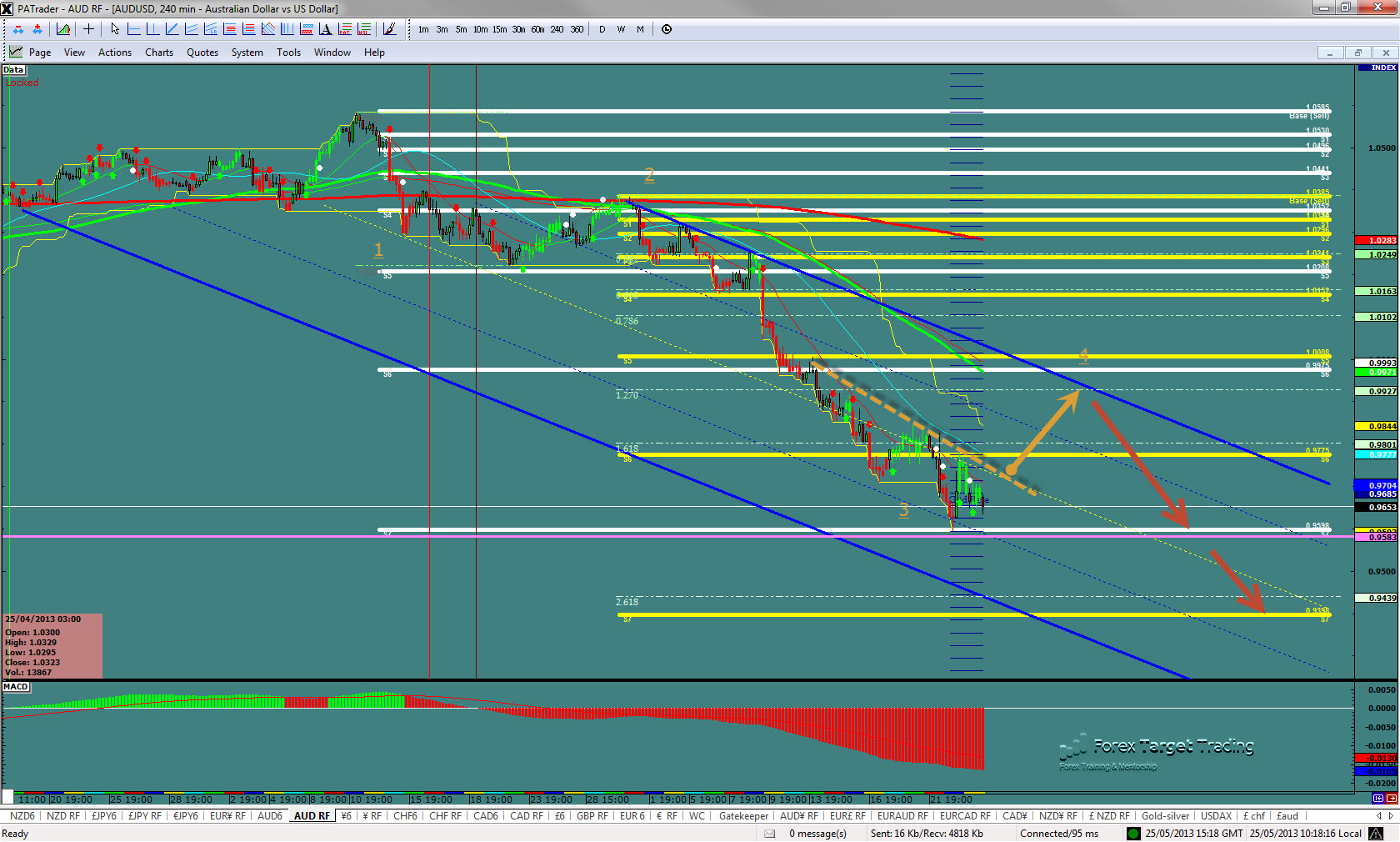

What Forex Target Traders See: Aussie is currently at 0.9653 after bouncing on the day chart bottom at 0.9583. Expecting a pullback to the upside to complete wave 4 at 0.9927 ( 1.270 fibo) and then another thrust down to the S7 target at 0.9398 area. The average (14 day) daily true range (ATR) for the pair currently is 118 pips.