What Forex Target Traders See

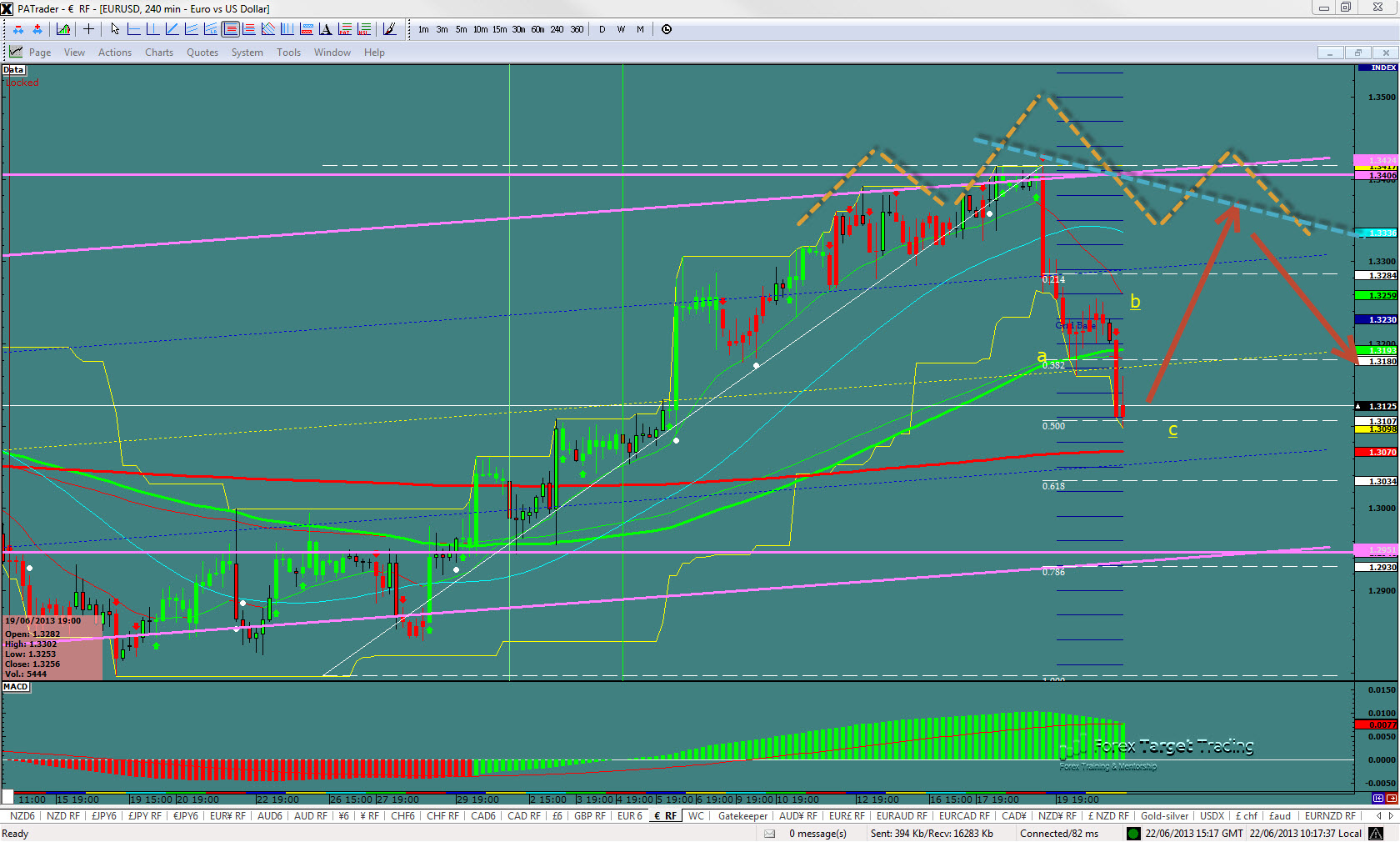

: We are currently sitting at 1.3125 on the .500 Fibo in a corrective A-B-C move down. The move is too steep to declare it a down trend. We are waiting to see if we get a bounce here (or at the .618 Fibo) back to the top at 1.3424. A move to the top may only be to set a head and shoulders and continue down. Looking for opportunities on rallies to short. The average (14 day) daily true range (ATR) for the pair currently is 108 pips.

——————————————————————————–

USD/JPY

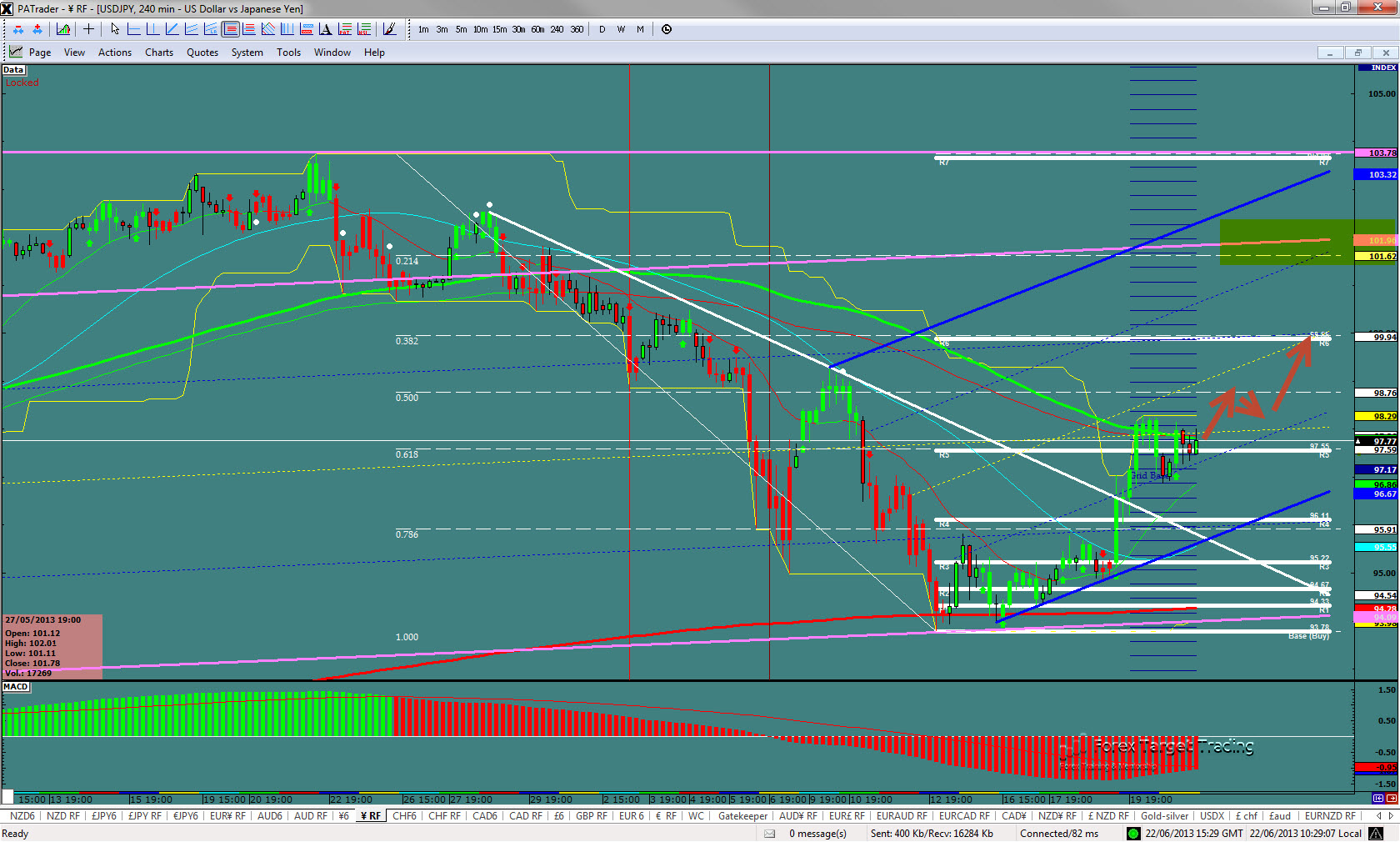

What Forex Target Traders See: We are currently at 97.77 in a wedge which is bullish for the pair. Should we see a break of the wedge and an opportunity to buy. Dips will give a great opportunity on the way to the 100.00 R6 level with the day chart top possible at 102.00. The average (14 day) daily true range (ATR) for the pair currently is 202 pips.

——————————————————————————–

GBP/USD

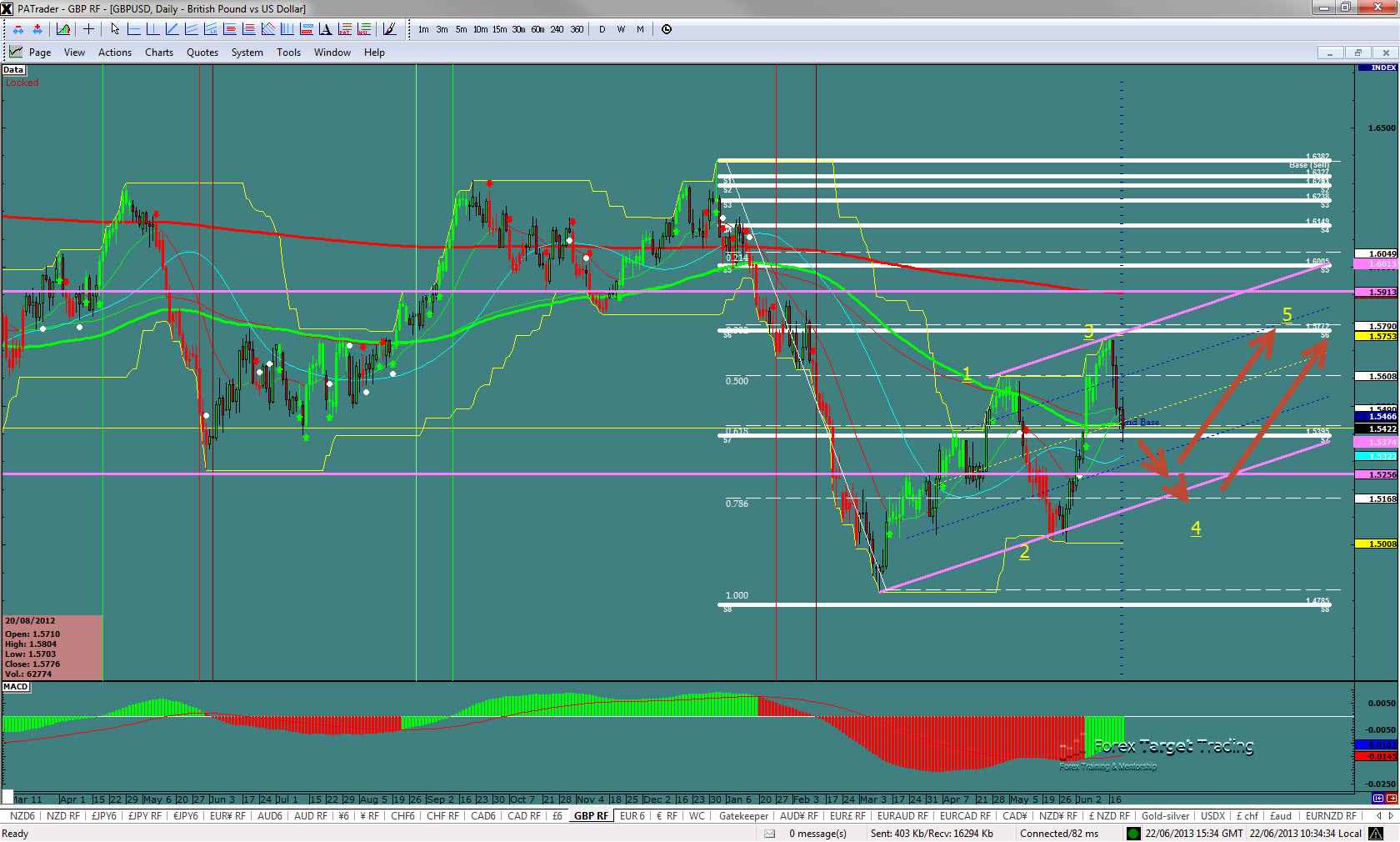

What Forex Target Traders See: Cable is currently at 1.5422 at the day chart up trend. The recent move however indicates a correction down to 1.5256 so look to the short side to the support (.786 Fibo) at 1.5168 (or prior to that the day chart bottom at 1.5256) and then bounce or back to the bottom. The average (14 day) daily true range (ATR) for the pair currently is 130 pips.

——————————————————————————–

AUD/USD – A great smooth currency for Newbie’s!

What Forex Target Traders See: Aussie is currently at 0.9235 after breaking the down S7 support. It is in a sideways move which spells more downside. Expecting a move to the downside to the .500 fibo form the 5/24/10 bottom to the 1/11/10 top at 0.9125 and then another break to the 0.9000 area. The average (14 day) daily true range (ATR) for the pair currently is 158 pips.