What Forex Target Traders See

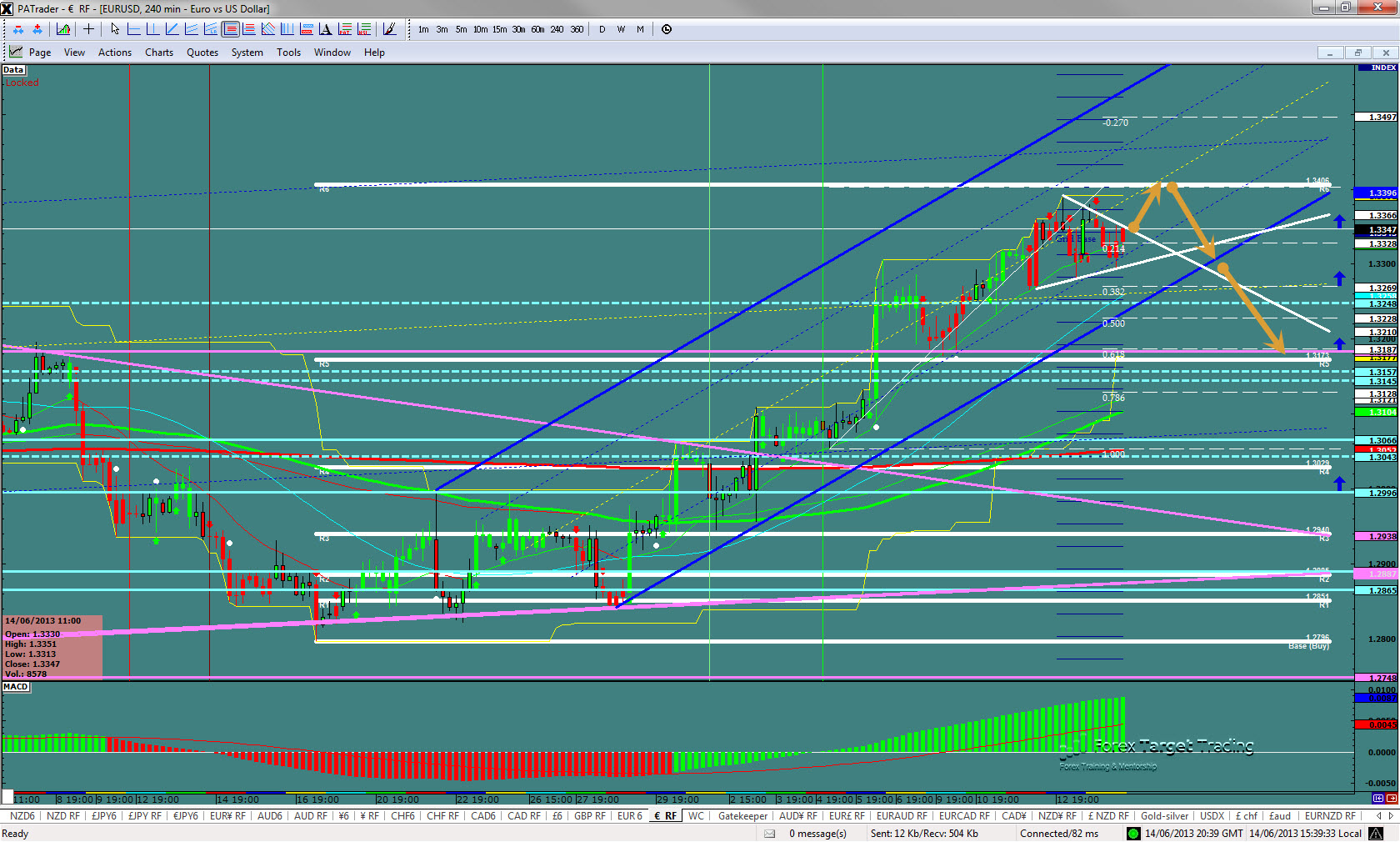

: We are currently sitting at 1.3347 in a wedge suggesting maybe one more move to the top. We are looking for that move to the R6 at 1.3406 and then a reversal back to the 0.618 fibo at 1.3187. The average (14 day) daily true range (ATR) for the pair currently is 110 pips.

——————————————————————————–

USD/JPY

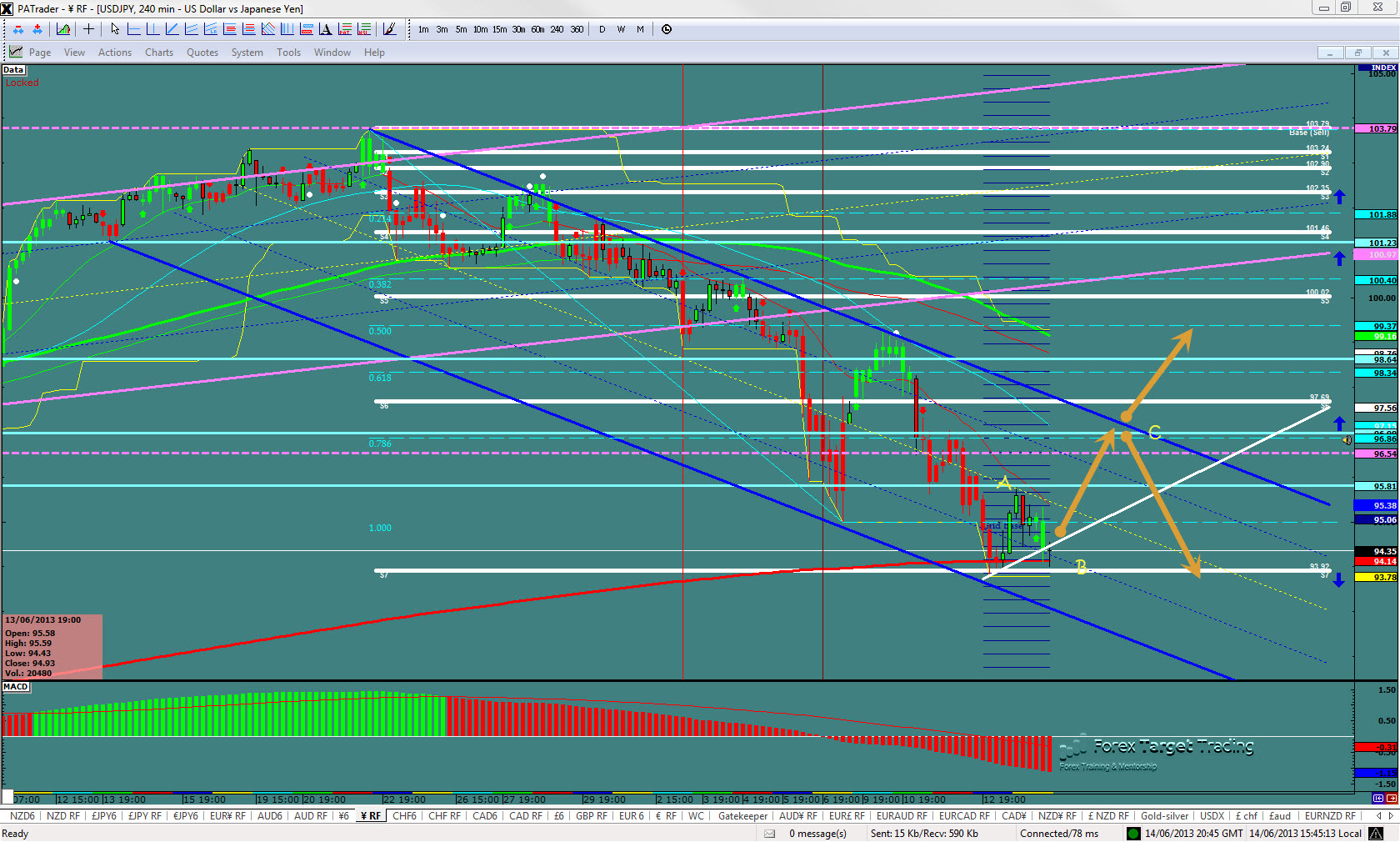

What Forex Target Traders See: We are currently at 94.35 in what could be the bottom and the start of an a-b-c retracement back to the 96.86. Should we see a break up there, look to the 99.37 area ( 0.500 Fibo) and a break down there and look for a double bottom at 93.92. The average (14 day) daily true range (ATR) for the pair currently is 199 pips.

——————————————————————————–

GBP/USD

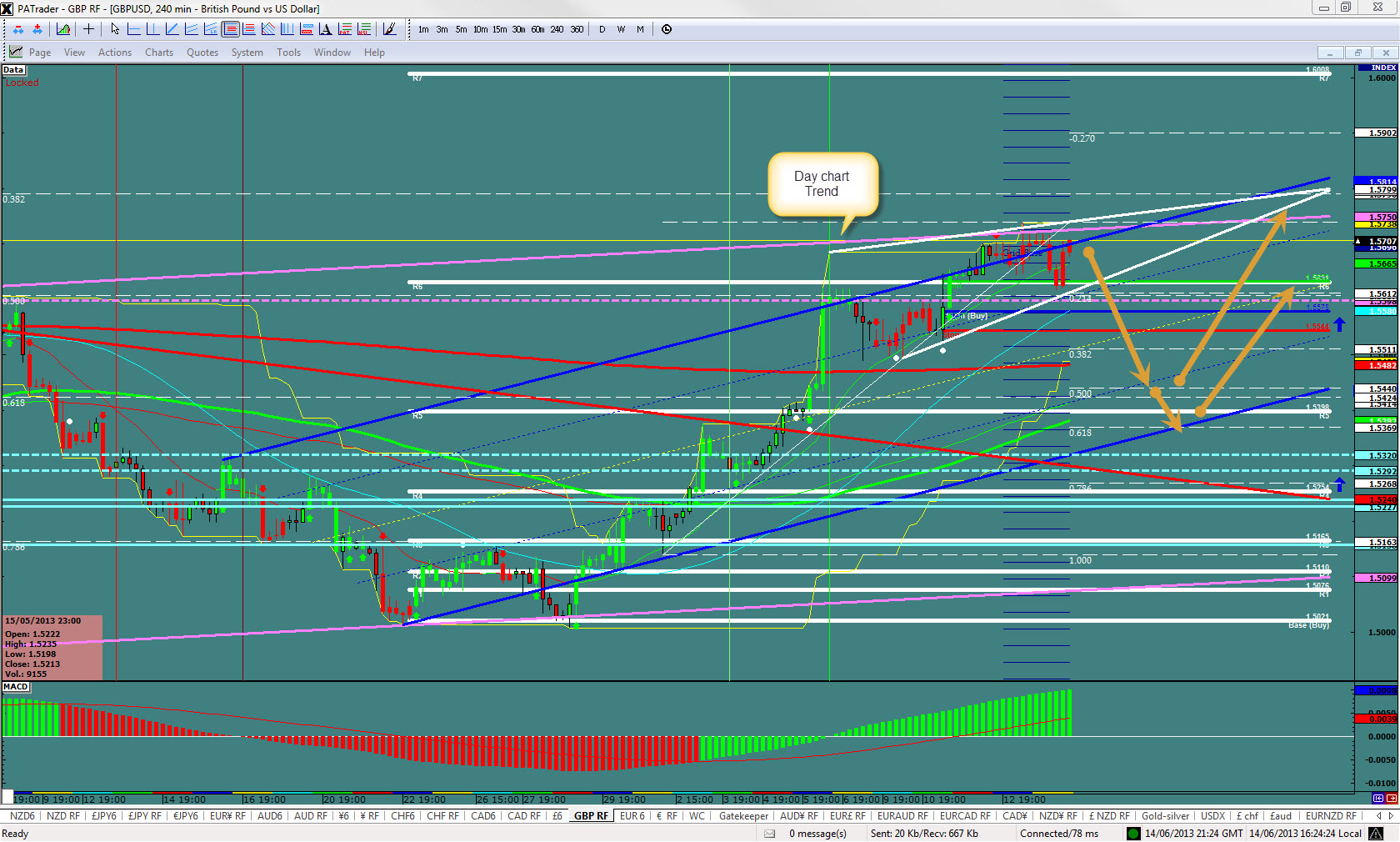

What Forex Target Traders See: Cable is currently at 1.5707 at the day chart trend line in a rising wedge. All are bearish signs. Look to the short side to the support (.500 Fibo) at 1.5440 and then bounce or back to the bottom. The average (14 day) daily true range (ATR) for the pair currently is 126 pips.

——————————————————————————–

AUD/USD – A great smooth currency for Newbie’s!

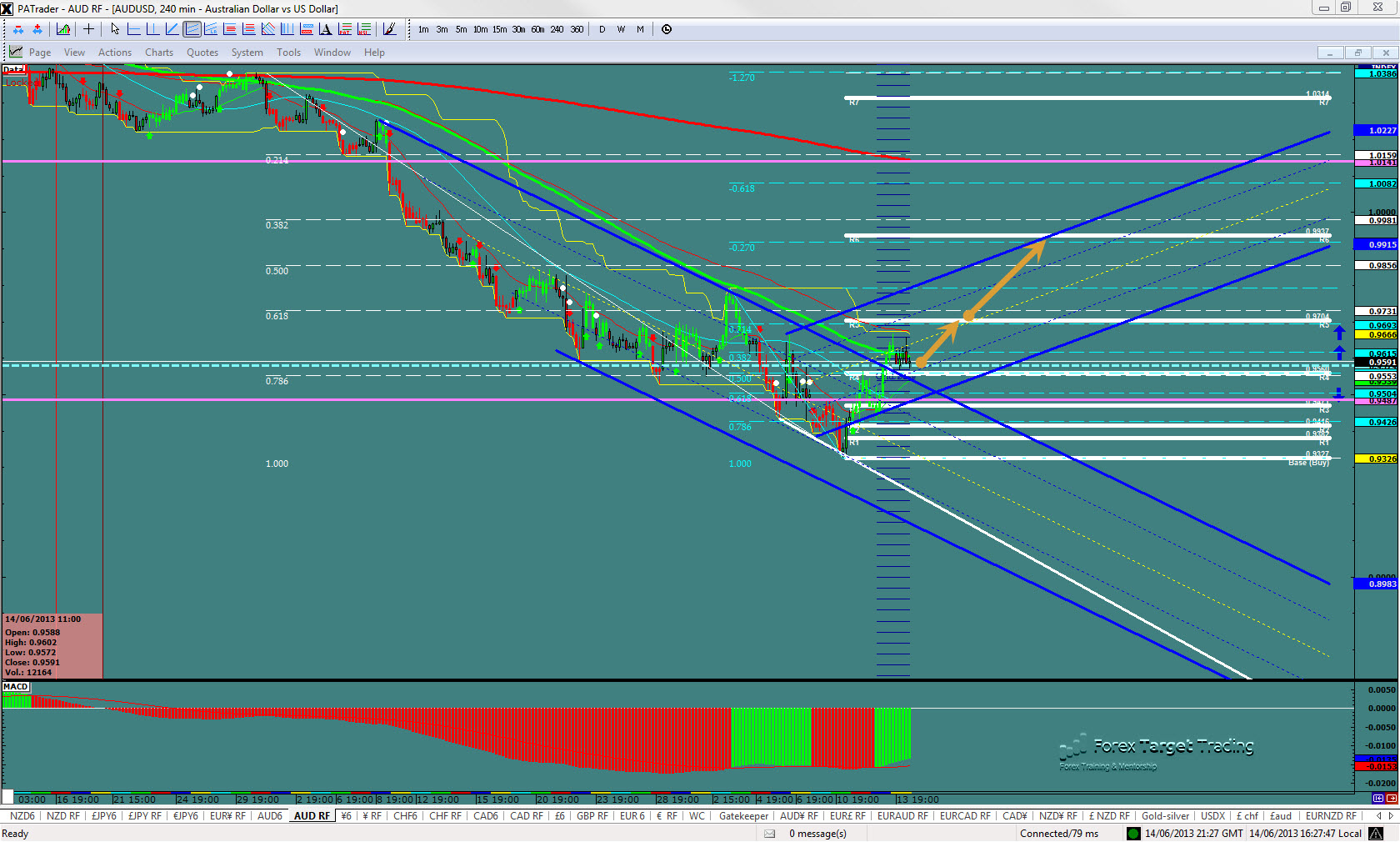

What Forex Target Traders See: Aussie is currently at 0.9591 after breaking the down trend line. Expecting a bounce to the upside to the R3 at 0.9700 and then another break to the R6 target at 0.9937 area. We would finish up 5 waves at the R3 so don’t rule out the downside risk there. The average (14 day) daily true range (ATR) for the pair currently is 154 pips.