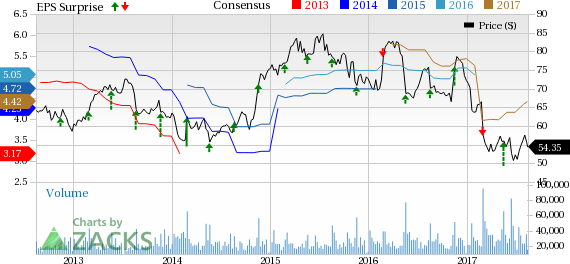

Target Corp. (NYSE:TGT) , department store retailer, came out with second-quarter fiscal 2017 results, wherein adjusted earnings of $1.23 per share surpassed the Zacks Consensus Estimate of $1.20 and remained flat year-over-year.

Management raised fiscal 2017 earnings guidance. For fiscal 2017, Target now envisions adjusted earnings in a band of $4.34–$4.54 per share, up from the prior projection of $3.80–$4.20 per share.

For the third quarter fiscal 2017, the company expects adjusted earnings per share in the range of 75 cents to 95 cents.

Earnings Estimate Revision: The Zacks Consensus Estimate for fiscal 2017 has witnessed upward revisions in the last 60 days. In the trailing four quarters, excluding quarter under review, the company outperformed the Zacks Consensus Estimate by an average of 16.5%.

Revenues: Target generated net sales of $16,429 million that increased 1.6% year over year and outpaced the Zacks Consensus Estimate of $16,282 million. Comparable store sales gained 1.3% during the quarter.

Key Events: Target returned about $627 million to its shareholders in the form of share repurchases and dividend payments in the second quarter. The company bought back shares worth $296 million and paid dividends of $331 million in the reported quarter.

Zacks Rank: Currently, Target carries a Zacks Rank #2 (Buy) which is subject to change following the earnings announcement. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stock Movement: Target’s shares are up nearly 6% during pre-market trading hours following the earnings release.

Check back later for our full write up on Target’s earnings report!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaries,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >

Target Corporation (TGT): Free Stock Analysis Report

Original post

Zacks Investment Research