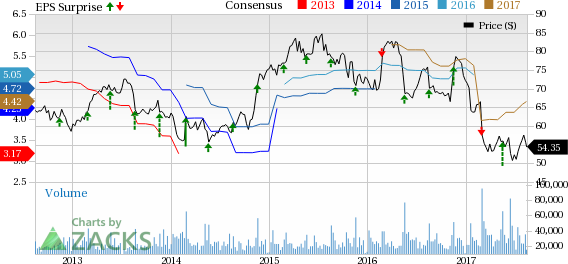

Target Corporation (NYSE:TGT) continued with its upbeat performance in fiscal 2017, as reflected from its impressive second-quarter results and an encouraging earnings outlook. Better-than-expected results propelled the shares of this Zacks Rank #2 (Buy) company during the pre-market trading hours that are up roughly 4%. The company’s strategic endeavors as well as improved traffic trends helped boost performance. However, in the past one month, the stock has increased 1.2% compared with the industry’s growth of 0.9%.

Let’s Unveil the Picture

The company posted second-quarter adjusted earnings of $1.23 per share that came ahead of the Zacks Consensus Estimate of $1.20 but remained flat year over year. We observed that higher sales and lower interest expense provide cushion to the bottom line. The company generated total sales of $16,429 million that also surpassed the Zacks Consensus Estimate of $16,282 million and jumped 1.6% from the year-ago quarter.

We believe that the initiatives such as the development of omni-channel capacities, diversification and localization of assortments along with emphasis on flexible format stores, bode well for this Minneapolis-based company. Target is investing in merchandise categories such as Style, Baby, Kids and Wellness and rolled out Target Restock program. It intends to launch new brands and be more competitive in terms of price. Further, in order to expand delivery capabilities the company has entered into a deal to acquire Grand Junction, the transportation tech company.

.jpg)

Comparable sales for the quarter increased 1.3%. The number of transactions rose 2.1%, while the average transaction amount declined 0.7%. Comparable digital channel sales surged 32% and added 1.1 percentage points to comparable sales.

Gross profit inched up 0.3% to $5,010 million, while gross margin contracted 40 basis points to 30.5%. Operating income fell 10.3% to $1,114 million, while operating margin shriveled 90 basis points to 6.8%.

Target’s credit card penetration expanded 50 basis points to 11.6%, whereas debit card penetration increased by 30 basis points to 13% during the quarter. Total REDcard penetration climbed to 24.6% from 23.9% in the year-ago quarter.

Other Financial Details

During the quarter, Target repurchased shares worth $296 million and paid dividends of $331 million. The company still had about $4.1 billion remaining under its $5 billion share buyback program. The company ended the quarter with cash and cash equivalents of $2,291 million, long-term debt and other borrowings of $10,892 million and shareholders’ investment of $11,098 million.

A Glance at the Outlook

Management now anticipates that both the third and fourth quarter comparable sales growth will lie within the range Target had witnessed in the first and second quarters.

Target now envisions third quarter earnings in the band of 75–95 cents and fiscal 2017 earnings between $4.34 and $4.54 up from $3.80 to $4.20 per share projected earlier. The current Zacks Consensus Estimate for the third quarter and fiscal 2017 stands at 78 cents and $4.42, respectively.

Interested in the Retail Space? Check Out These

Investors interested in the retail space may consider some better-ranked stocks such as Michael Kors Holdings Limited (NYSE:KORS) , The Children's Place, Inc. (NASDAQ:PLCE) and Gildan Activewear Inc. (TO:GIL) . These stocks carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Michael Kors delivered an average positive earnings surprise of 10.6% in the trailing four quarters and has a long-term earnings growth rate of 8.3%.

The Children's Place delivered an average positive earnings surprise of 16.3% in the trailing four quarters and has a long-term earnings growth rate of 9%.

Gildan Activewear delivered an average positive earnings surprise of 5.5% in the trailing four quarters and has a long-term earnings growth rate of 13.5%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Gildan Activewear, Inc. (GIL): Free Stock Analysis Report

Michael Kors Holdings Limited (KORS): Free Stock Analysis Report

Original post

Zacks Investment Research