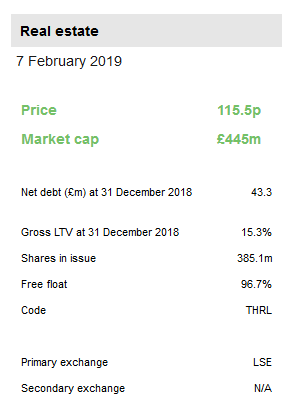

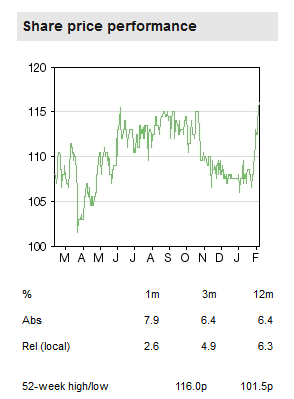

During the three months to 31 December 2018 (Q219), Target (NYSE:TGT) made good progress with deploying available capital resources, including the £50m gross proceeds from the November share placement. The portfolio also continues to perform well, delivering a 2.3% quarterly NAV total return (9.5% annualised). The attractive dividend yield is backed by very long leases, mostly RPI-linked, and supported by careful asset and operator selection. We continue to forecast a fully covered dividend in FY20.

NAV total return of 2.3% in Q219

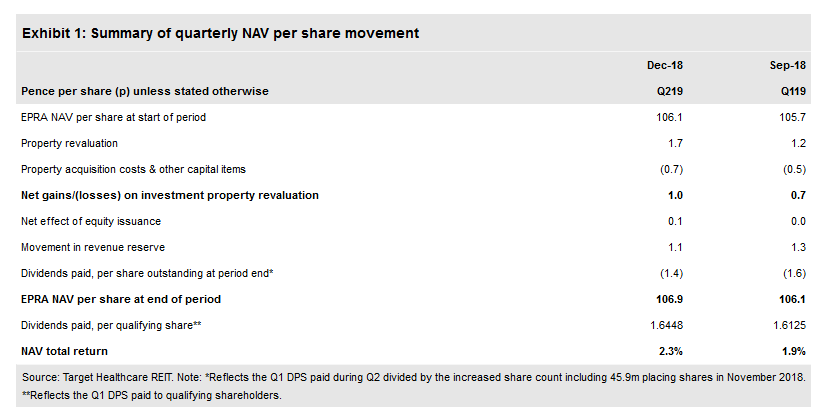

End-Q219 EPRA NAV per share increased to 106.9p (end-Q119: 106.1p) after deducting the Q119 DPS of 1.6448p paid to qualifying shareholders during the period. The portfolio increased 14.9% to £463.9m, mainly reflecting investments but also a 1.6% like-for-like valuation gain. An aggregate £50.8m was committed to three new homes in the period. Annualised rent roll has reached £28.0m, including a 0.7% like-for-like quarterly increase in rents. Pre-let, forward-funded developments and forward purchases will add £5.3m on completion. Our revised forecasts assume a re-gearing towards the company’s target LTV of 25%, with £55m of future debt-funded acquisitions from a continuing strong pipeline of opportunities. Our progressive DPS forecasts remain the same and, allowing for the November share issuance, our forecast adjusted EPS is little changed.

Demographics support long-term growth

Demographics should support growing care home demand for years to come, while there is an undersupply of the modern, well-designed homes, fully equipped with en-suite wet rooms and suitable communal spaces, that differentiate Target’s investment strategy. Investors continue to be attracted by long lease lengths and upwards-only, RPI-linked rental growth, with strong competition for assets. Although increasing asset prices have a positive impact on the NAV, they make Target’s disciplined approach to acquisitions, targeting ‘future-proof assets’, an essential ingredient in delivering attractive and sustainable long-term returns.

Valuation: Income visibility and growth

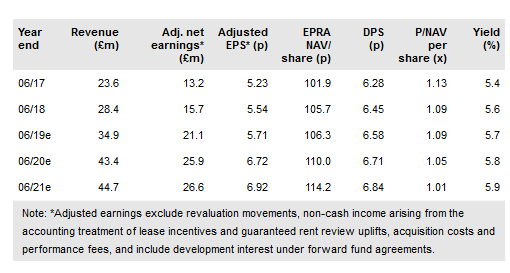

Target offers a growing dividend, with visible inflation-linked potential for growth, which we expect to be fully covered by adjusted earnings in FY20. The dividend represents a highly attractive yield (almost 6%) that supports the c 8% premium to Q219 NAV.

Business description

Target Healthcare REIT invests in modern, purpose-built residential care homes in the UK let on long leases to high-quality care providers. It selects assets according to local demographics and intends to pay increasing dividends underpinned by structural growth in demand for care.

Portfolio growth and strong return

During the three months to 31 December 2018 (Q219), Target made good progress with deploying available capital resources, including the £50m gross proceeds from the November share placement. An aggregate £50.8m (including costs) was committed to three modern, well-designed homes, fully equipped with en-suite wet rooms and suitable communal spaces. This comprises the acquisition of one new operational home (£13.8m) and two sites on which pre-let homes will be constructed through forward-funded development agreements (£37.0m). We discuss these new investments in more detail in the next section after briefly discussing the highlights of the quarter, which saw the group continue to generate a good level of NAV total return, 2.3% during the quarter or an annualised 9.5%.

End-Q219 EPRA NAV per share increased to 106.9p (end-Q119: 106.1p) after deducting the Q119 DPS of 1.6448p paid to qualifying shareholders during the period.

Compared with end-Q119, the portfolio value increased by £60.2m or 14.9% to £463.9m. The majority of the increase reflects the acquisition of standing assets, and further investment into existing and new forward-funded developments (adding 13.3% to the portfolio, net of acquisition costs and other capital adjustments), while like-for-like revaluation gains added 1.6% (equivalent to 1.7p per share). The other capital adjustments represent the discount applied to accumulated development costs of assets under construction, anticipated to unwind as the assets reach practical completion.

Like-for-like revaluation gains were supported by rental uplifts and also benefited from yield tightening. Nine rent reviews were completed at an average 3.3% uplift, resulting in a 0.7% like-for-like increase in contracted rent roll. In aggregate, the annualised contract rent roll increased by 6.1% from £26.4m to £28.0, additionally benefiting from the acquisition of standing assets (adding 3.1%) and the completion of one of the development assets at Wetherby in West Yorkshire (adding 2.3%). The end-Q219 valuation reflects an EPRA topped-up net initial yield of 6.32% compared with 6.41% at end-Q119.

There are seven pre-let, forward-funded development projects under construction, and one agreed forward purchase, which will add an additional £5.3m to the annualised rent roll when completed, and will further diversify the tenant base.

The Q118 DPS of 1.64475p paid during the period was an increase of 2% on the FY18 quarterly DPS level of 1.6125p. Reflecting the dividend increase, the near-term impact of the November share placing, and the forward funded/forward purchased assets that are yet to contribute to rental income, DPS is not currently fully covered by recurring income earnings. We forecast full cover in FY20 as continuing acquisitions and development completions contribute. A second interim dividend in respect of Q219 has been declared for payment on 22 February 2019.

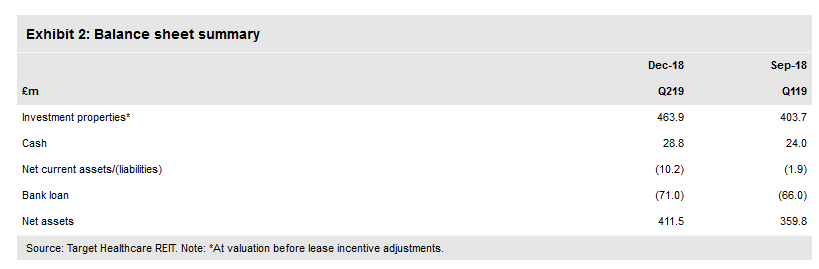

At end-Q219, £71.0m of the £130m in borrowing facilities currently available to the group had been drawn, giving a gross loan-to-value ratio (LTV) of 15.3% or a net LTV of 9.2% after adjusting for cash of £28.8m. The weighted average cost of the drawn debt, inclusive of the amortisation of loan arrangement costs, was 3.09%, with a weighted average term to expiry of 2.8 years.

Investment activity and portfolio update

At 31 December 2018, the portfolio comprised 61 homes (September: 58), of which 54 (52) were completed, operational homes and seven (six) were pre-let development sites under construction through forward funding commitments with established development partners. As well as increasing in scale, the portfolio continues to further diversify by tenant, geography and resident payment profile. Hamberley Group will become Target’s 22nd tenant when two recently acquired developments complete (see below).

The continued growth of the portfolio reflects Target’s approach to investment in the sector and its desire to provide stable and sustainable, long-duration rental income with which to support dividend policy. To this end, it puts a very strong focus on the quality of the physical asset and its location, alongside an in-depth assessment of the operational capabilities and financial performance of the tenant, both before and after investment. Target believes that modern, purpose-built homes with flexible layouts and high-quality residential facilities, including single-occupancy bedrooms complete with en-suite wet rooms, not only provide the best environment for residents and their care providers, but are more likely to provide sustainable, long-duration rental income. Target only invests in these ‘future-proof’ homes and avoids older adapted properties, and homes with small bedrooms and poor en-suite facilities, a lack of public and private space, and narrow corridors with stairs.

During the period the construction of a new home at Wetherby in West Yorkshire was completed and is now fully operational, generating rental income on a long-duration, 35-year lease with upwards-only, RPI-linked rental increases subject to a cap and collar. It is a 66-bed, residential care home, completed to a high standard, with the inclusion of full en-suite wet room facilities, and large public spaces. The home is operated by Ideal Carehomes, Target’s largest tenant. Target has identified positive underlying demographics and good levels of affordability in the local area to underpin the investment. The cost has not been disclosed for reasons of commercial sensitivity, although Target says that the yield is slightly lower than the overall portfolio average, reflecting the underlying financial covenant which benefits from the tenant’s presence in the sector.

The £50.8m of new investment commitments undertaken during Q219 comprised:

The £13.8m (including costs) acquisition of a modern, purpose-built care home in East Sussex was announced on 19 November 2018. The home was opened in September 2017 and comprises 62 bedrooms with full en-suite wet room facilities. It is designed around a residents' courtyard, complemented by a small garden to the rear of the building and a balcony on the first floor. Internally, the home provides a number of lounges, dining rooms and activity rooms, as well as a cinema and a hair salon. The home is let on a 35-year lease with RPI-linked cap and collar to a subsidiary of Caring Homes Group, an existing Target tenant. Target says that the yield on the investment is representative of assets of a similar high standard and location within the existing portfolio. A short rent-free period has been agreed, which will assist the tenant's cash flows during the early trading period.

The acquisition of two well-advanced developments, with an aggregate transaction value of £37m (including transaction costs and the future development costs to completion) was announced on 7 November 2018. The homes are at Cumnor Hill, Oxford, and Badgers Mount, near Sevenoaks in Kent, and both are due to complete by mid-2019 when they will be let to Hamberley Group, a developer and operator of luxury care homes and a new tenant to the group, backed by Patron Capital on a 35-year occupational lease including upwards-only, RPI-linked rental uplifts subject to a cap and collar. The properties will provide a combined 130 beds and will be completed to a high standard, including full en-suite wet room facilities, large communal areas and extensive on-site facilities, with the investment underpinned by the strong wealth characteristics and positive underlying demographics of the local areas. Rental payments will commence when the homes are completed and occupied, and Target says that the yield on the investment is representative of assets of a similar standard and location within the existing portfolio.

Pipeline update

The £50.8m of Q219 investment commitment broadly matches the £50m (gross) of new equity raised in November 2018. However, with net LTV at 9.2% and undrawn debt facilities of £59m, Target has existing capital resources, and headroom for additional debt resources consistent with its gearing targets, to make significant further acquisitions/investment commitments (we estimate £55m), while funding the completion of existing development assets and the forward purchase (we estimate £31m of cash investment remaining).

Target says that it continues to have a healthy pipeline of assets under assessment for investment, including near-term opportunities in advanced due diligence, which are expected to progress to completion over the coming months.

Financials

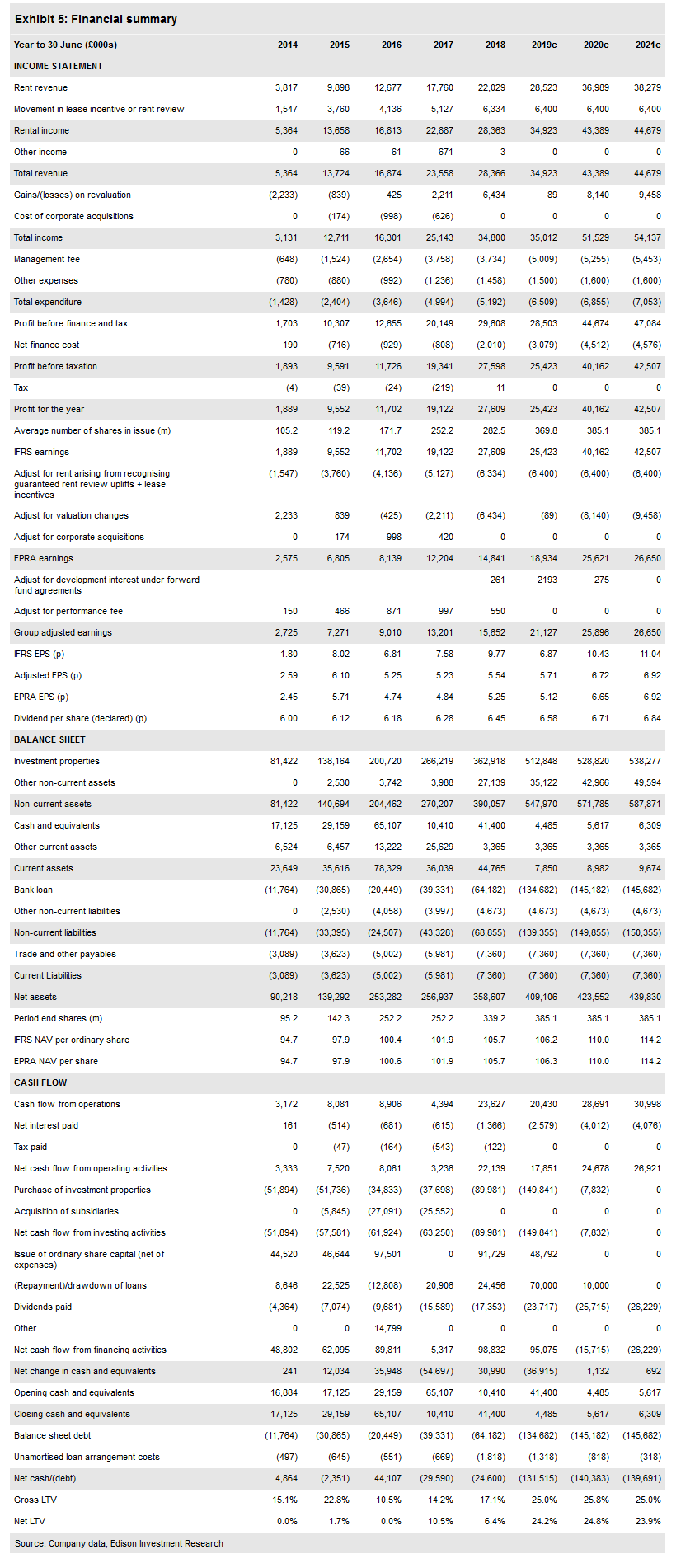

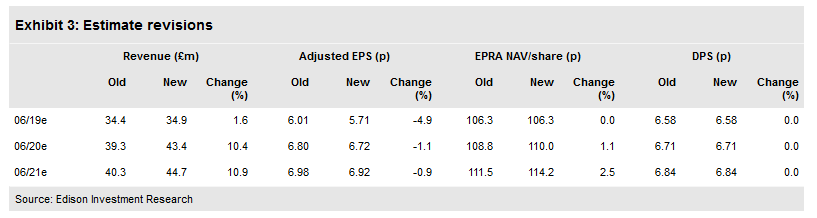

We have updated our forecasts to take account of the November share placement, progress with capital deployment and our increased expectation for future acquisitions, together with the outline financial data contained in the recently published Q219 NAV report.

Following the November share placing, and with a continuing strong acquisition pipeline, we expect Target to re-gear its balance sheet towards an LTV of c 25% by the end of the current financial year. The increase in assumed future acquisitions, discussed below, drives faster revenue growth, particularly in FY20 and FY21, as forward-funded developments complete and contribute fully to rental income. Our progressive DPS forecasts are unchanged and we continue to expect full cover, on a fully invested/developed basis, by FY20.

The key forecasting assumptions that we make relate to asset growth and funding:

We expect all of the seven pre-let, forward-funded development assets currently under construction to complete by the end of Q120 (by end September 2019). Additionally, we expect the forward purchase of a pre-let, purpose-built home in Newtown, Powys, Wales to complete by the end of the current financial year. We estimate a future cash outflow of c £31m related to these transactions and an increase in rent roll of £5.3m.

For the forward-funded developments (but not the forward purchase asset), we include in adjusted earnings the non-cash development interest that accrues on the funding advanced during the construction phase. This rolls up until completion and is offset against the purchase value of the property.

We assume £55m of further investment commitment, an amount that is consistent with re-gearing the balance sheet to a c 25% LTV, and have assumed that this is all directed towards operational assets at a cash yield on acquisition (including costs) of 5.75%. This is a slightly higher yield than we had previously assumed for standing assets (5.25%), but we estimate that it is consistent with recent experience. Should the mix of future investment commitment shift towards forward-funded development assets, we would anticipate a higher yield (6% or more). The rental income and contribution to IFRS earnings would be deferred until completion, but adjusted earnings would capture development interest.

We also assume 3.0% pa rent growth (previously 2.0%), consistent with current UK RPI inflation and the mostly RPI-linked (or fixed uplift) nature of the leases. We assume that rental growth is reflected in capital values. As a result of the assumed yield on additions to the completed portfolio being lower than the current portfolio average, the blended, topped-up EPRA net initial yield reflected in our forecasts reduces from 6.32% at end-Q219 to 6.23% at end-FY21. We estimate that the positive impact on valuations of a 0.25% tightening of market yields would be c 6p, with a broadly similar negative impact from any yield softening.

Combining the expected cash outflow from existing commitments with the assumed future acquisitions, we forecast c £86m in cash investment by the middle of FY20. We estimate a £75m requirement for additional debt funding, fully utilising the undrawn facilities at end-Q219 (£59m) and requiring additional debt facilities of at least £16m, in line with the manager’s comment that it will seek additional debt capital that will allow it to achieve its gearing targets. We forecast a gross LTV of c 25% (peak of 25.8% at end FY20).

Valuation

Target’s long-term leases and upwards-only, RPI-linked rent reviews, backed by demographic trends and demand/supply imbalances, provide investors with considerable visibility over a growing stream of contracted rental income with considerable protection against inflation.

The annualised run rate of quarterly DPS is 6.58p, a yield of 5.7%, which is well ahead of the average c 5.0% yield on the broad range of property companies and REITs that we track. Although the dividend is not fully covered by either EPRA or adjusted earnings (we estimate 86% covered by adjusted earnings in the current year), management’s aim, consistent with our analysis, is for a progressive dividend, fully covered by earnings when the group is fully invested. We forecast full cover by adjusted earnings in FY20 and FY21.

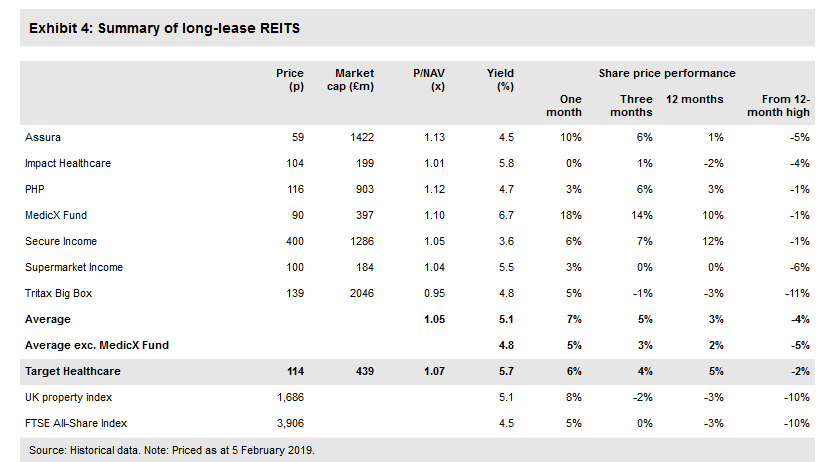

In Exhibit 4, we show the key valuation and performance metrics for Target and a group of companies that similarly target long-lease exposures across a range of property types, including healthcare property, ‘big box’ distribution centres, supermarkets and leisure assets. Although all of these companies are focused on generating long-term income and have weighted average unexpired lease terms (WAULTs) that are above the average of the broad property sector, there are considerable differences in terms of asset type and the tenant covenants that support the long-term contractual income. Compared with this narrow peer group of long income investors, in addition to having the longest WAULT, Target offers a yield that is also above the average for a broadly similar P/NAV. The average share price performance of the group has been stronger than that of the broad property sector and the FTSE All-Share Index over the past year, and the performance of Target shares has been stronger than this average.