Target Healthcare REIT Ltd (LON:THRLT) portfolio of high-quality purpose-built care homes continues to grow and perform well with RPI-driven rental growth, increased property valuations, continuing acquisitions of operational homes and progress with pre-let forward-funded developments. Due diligence on potential further acquisition opportunities continues, in aggregate sufficient to fully deploy remaining debt capital resources.

Q419 2.1% EPRA NAV total return

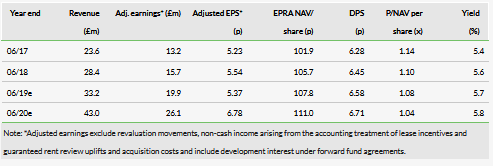

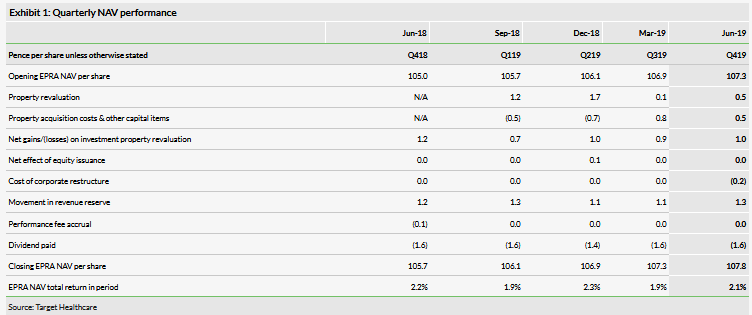

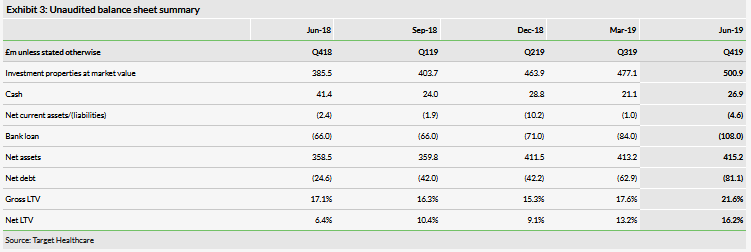

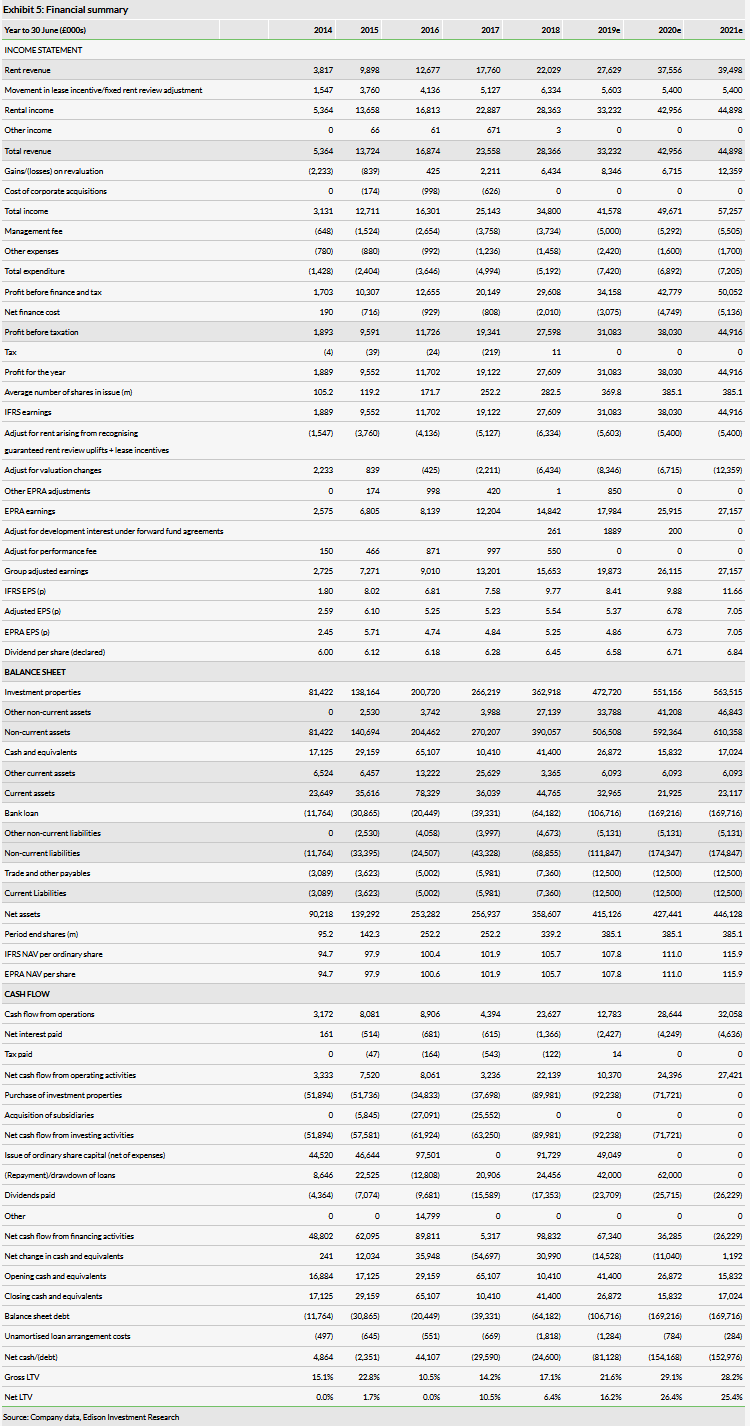

EPRA NAV per share was 107.8p at 30 June 2019 (Q419), an increase of c 0.5% in the quarter and 2.0% in the year. Including dividends paid, the quarterly EPRA NAV total return was 2.1% or 8.2% for the year. Aggregate quarterly DPS for the year increased 2% to 6.58p. The portfolio value increased 5.0% in the quarter to £500.9m, including two acquisitions, continuing investment in the forward-funded developments (two completed in the period and three under construction) and underlying valuation gains. The latter were supported by rental growth on the mainly RPI-linked leases, with modest yield tightening in the period. Acquisitions have taken longer than we assumed but the pipeline remains strong with debt funding available. The share placing programme approved by the EGM along with the new corporate structure provides additional funding flexibility. We continue to forecast DPS growth in FY20, fully covered by earnings.

Demographics support long-term growth

Demographics should support growing care-home demand for years to come, while there is an undersupply of the modern, well-designed homes, fully equipped with en-suite wet rooms and suitable communal spaces that differentiate Target’s investment strategy. Investors continue to be attracted by long lease lengths and upwards-only RPI-linked rental growth, with strong competition for assets. Although increasing asset prices have a positive impact on the NAV, they make Target’s disciplined approach to acquisitions, targeting ‘future-proof assets’, an essential ingredient in delivering attractive and sustainable long-term returns.

Valuation: Visible income supports premium to NAV

Target (NYSE:TGT) offers a growing dividend with visible inflation-linked potential for growth, which we expect to be fully covered by adjusted earnings in FY20. The dividend represents a highly attractive yield (FY19: 5.7%) that supports the continuing 8% premium to Q419 EPRA NAV.

Business description

Target (NYSE:TGT) Healthcare REIT invests in modern, purpose-built residential care homes in the UK let on long leases to high-quality care providers. It selects assets according to local demographics and intends to pay increasing dividends underpinned by structural growth in demand for care.

Investment summary

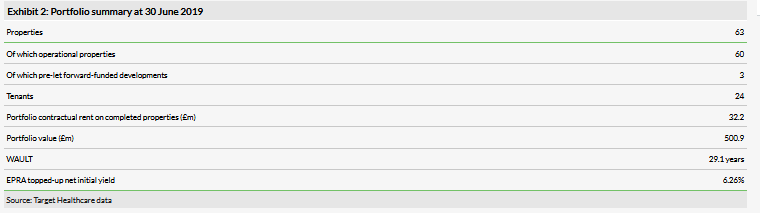

Target’s portfolio continues to grow and perform well. During the three months to 30 June 2019 (Q419) the company generated a NAV total return of 2.1% (an annualised c 8.7%) and we estimate a full-year (FY19) return of 8.2%. We expect audited full-year results to be reported in late September. While some areas of the mainstream commercial property market (most clearly the retail sector) have recently experienced more challenging conditions, Target (NYSE:TGT) continues to benefit from effectively full occupancy (the operators, Targets tenants carry any void risk) and predominantly RPI-linked uplifts on its very long leases (29.1 years at 30 June 2019).

The key features of the Q419 financial performance were:

EPRA NAV per share increased to 107.8p compared with 107.3p at the end of March 2019 (Q319) and 105.7p at the end of June 2018 (FY18). Including the quarterly DPS paid of 1.645p, the Q4 NAV total return was 2.1%. A fourth interim dividend of 1.645p was paid on 2 August 2019, bringing the aggregate DPS declared for FY19 to 6.58p, a 2% increase on FY18.

One-off costs related to the corporate restructuring negatively affected Q419 NAV per share by 0.2p (c £800k). Excluding this, NAV total return in the quarter would have been c 0.2% higher. We expect some additional but much lower costs in the current quarter (Q120) and going forward the company expects the corporate restructuring to generate a recurring benefit to costs.

Recurring profits, shown in the revenue reserve movement (which excludes the corporate restructuring costs), increased to 1.3p during the quarter and reflected the benefits of portfolio growth and continued increases in rents. Rental growth was the main driver of valuation gains, with the portfolio topped up net initial yield tightening only modestly from 6.29% at end-Q319 to 6.26%. NAV also benefited from the completion of two forward-funded developments with the discount applied by the external valuer during construction released at completion.

Portfolio development and rental growth

At 30 June 2019 (end-FY19) the portfolio was externally valued at £500.9m (the balance sheet value is adjusted for lease incentives and fixed rent uplifts and we estimate was c £473m). It comprised 63 assets of which 60 were fully completed and operational care homes and three were pre-let assets being developed under forward-funding commitments with established development partners.

The annualised contracted rent from the 60 completed properties was £32.2m (passing rent after lease incentives £30.5m), let to 24 tenants, with an average weighted unexpired lease term of just over 29 years. Completion of the three forward-funded development assets as well as Target’s commitment to acquire an additional home at completion are expected to add an additional £2.3m of annual contractual rent in 2019.

The portfolio value increased by £23.8m, or 5.0%, to £500.9m during Q419. The majority of this (4.4%) represented acquisitions and ongoing investment into the forward-funded development assets, with the balance (0.6%) coming from revaluation movement, largely driven by annual inflation-linked rent reviews. Contractual rent increased by £2.5m, or 8.4%, to £32.2m during the quarter with acquisitions adding 3.1%, the two development completions 4.7% and like-for-like rental increases 0.6%. During the quarter, 16 rent reviews were completed at an average uplift of 2.8% pa.

The two operational homes acquired in Q419 were:

A 40-bed care home in Formby, Merseyside, an affluent area with a shortage of alternative care options, for £6.9m. Opened in 2017, the home is let to Athena Healthcare, an existing tenant of the group.

A 64-bed care home, in area of low supply, close to the centre of Nottingham, for £7.6m. The home was purpose built in 2013 and is let to Acacia Care, a local operator and existing tenant of the group.

Both homes meet the group’s strict acquisition criteria, providing flexible layouts and high-quality residential facilities, including single-occupancy bedrooms complete with en-suite wet rooms. They are let on long (35 years at inception) leases linked to RPI with caps and collars and were acquired at yields that Target (NYSE:TGT) says are consistent with the overall portfolio yield.

The two forward-funded development assets completed and opened in the quarter, in Shropshire and Kent, added 128 high-quality beds with full en-suite wet-room facilities.

Reflecting the increasing size and breadth of the portfolio and Target’s close monitoring and active management of its assets, two care homes have been disposed of since the end of Q419. No price has been given for the disposals although Target (NYSE:TGT) says the two assets combined accounted for less than 3% of the portfolio by value (ie less than £15m) and that combined sales value was more than 5% above the 31 March 2019 book value.

Strong pipeline of potential acquisitions with funding available

A number of further investment opportunities are progressing through Target’s due diligence processes and Target (NYSE:TGT) says that if they all complete as anticipated they will fully utilise the group’s existing equity and debt capital resources by the end of 2019 (or end-H120).

Drawn debt at end-Q419 was £108m of aggregate debt facilities of £170m, comprising £70m of fixed-term debt and £100m of more flexible debt in the form of revolving credit facilities. The gross loan to value ratio was 21.6% and taking account of the £26.9m of period-end cash the net LTV was 16.2%. We estimate that full drawing of available debt facilities would take the net LTV to around 30%. The recent EGM held to consider and approve the new corporate structure (see below) also agreed a new ordinary share placing programme that allows Target (NYSE:TGT) to issue up to 125m new ordinary shares to fund suitable acquisitions. If issued, it is the board’s intention that this would be done at a premium to NAV. At the current share price, the issue of all 125m shares would raise new equity of more than £140m.

New corporate structure agreed

A shareholder EGM recently approved changes to the group’s corporate structure, which has established a new English-incorporated parent company ( Target (NYSE:TGT) Healthcare REIT) at the head of the group. The main driver for moving the group’s ultimate parent company to a UK domicile from Jersey is to align the group with its existing UK tax jurisdiction, maintain and enhance its important relationships with UK local authorities and health services and help reduce administrative costs and regulatory complexities. Importantly, there is no change to the way the group will be run, its investment strategy or dividend policy.

Financials and estimates

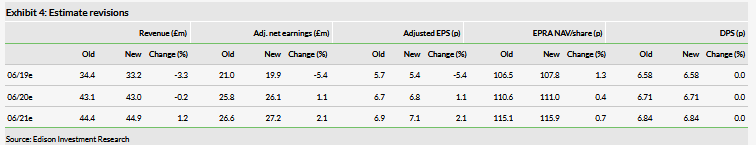

We have reviewed our estimates to bring our FY19e balance sheet into line with the Q419 update and will review our estimates in greater detail with the full-year results. The main difference to our previous forecasts is that the acquisitions we forecast for end-FY19 have taken a little longer to complete, pushing activity (and income) into FY20. We had previously assumed £55m in new investment commitments compared with the £14.5m completed. In our revised forecast the additional investment commitment that we had previously assumed for FY19 is pushed into FY20 and, given management’s comments about the strength of the pipeline and currently available debt funding, we have also increased the amount by c £20m. We now look for Target (NYSE:TGT) to commit a net c £60m to new investment by the end of H120 (£40m carried over from FY19 plus the additional £20m). Given the recent disposals, this suggests gross new commitment of c £75m.

The additional assumed investment contributes to a slight increase in FY21e revenues and adjusted earnings. We have made no changes to our dividend growth assumptions and continue to look for dividends to be fully covered by adjusted earnings in FY20.

Valuation

With increasing economic and Brexit uncertainty, the mainstream UK commercial property market has entered a more challenging period. In this environment investors have continued to target long leases and visible secure income. With its long average WAULT (c 29 years) and predominantly upwards-only RPI-linked rent reviews backed by demographic trends and demand/supply imbalances, Target (NYSE:TGT) provides investors with considerable income visibility protection against inflation and has continued to outperform the broader UK property sector and FTSE All-Share Index over the past 12 months.

Based on the FY19 DPS of 6.58p, the shares provide an attractive yield of 5.7% and we forecast further dividend growth with full cover in FY20 as available capital is deployed. This supports a share premium to the last reported NAV of 8%.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI