Target Corp. (NYSE:TGT) engages in the operation and ownership of general merchandise stores. It offers food assortments including perishables, dry groceries, dairy, and frozen items. It has been modernizing the supply chain to compete with pure e-commerce players.

It’s acquisition of “Shipt” to provide same-day delivery of groceries, essentials, home, electronics as well as other products. Target provides an array of owned & premium branded goods ranging from household essentials and electronics to toys and apparel for men, women, and kids. It also houses food and pet supplies, home furnishings and decor, home improvement, automotive products, and seasonal merchandise.

It also offers in-store amenities, consisting of Target Caf', Target Photo, Target Optical, Portrait Studio, Starbucks (NASDAQ:SBUX), and other food service offerings.

TGT Q3 2024 reports earnings at 6:30 AM ET Wednesday, Nov 20, 2024

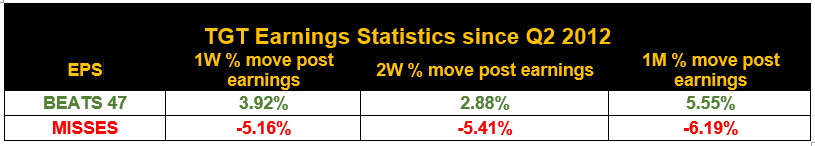

- 34 beats since Q2 2012

- 11 Misses since Q2 2012

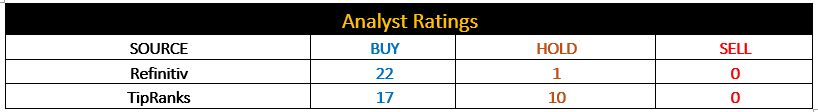

Analyst Ratings

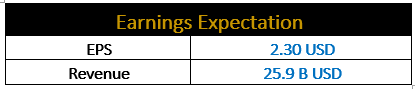

Earnings Expectation

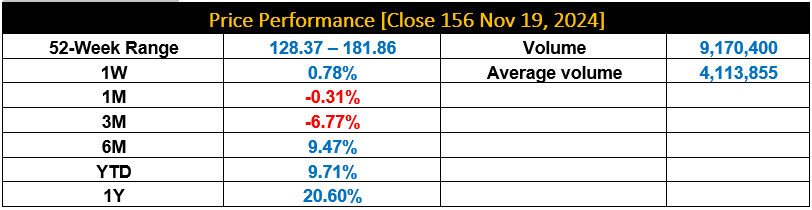

Price Performance:

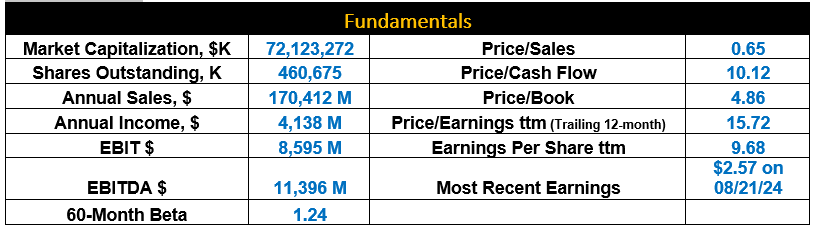

Fundamentals:

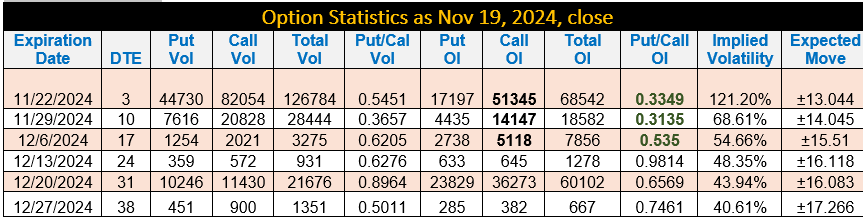

Option Statistics:

- Put/Call ratio for Nov. 22 expiry is 0.3349% more calls than puts which suggests the following three scenarios:

- With Put/Call ratio is lower than 0.50 for the next 3 upcoming expiry suggests that the traders are very bullish.

- Earning miss or lower guidance could trigger a short-lived sell-off followed by more buyers.

- Earning and guidance in line or better than estimates trigger a sharp rally.

Key Highlights:

- Target strong omnichannel strategy has boosted traffic across both physical stores and digital platforms.

- TGT visitor traffic was up 1% YoY as per data from Placer.ai and has outpaced Walmart (NYSE:WMT), which had 0.9% visitor growth YoY.

- Company strategy of price reduction for necessary items helped it to attract conscious shoppers to stores.

- The company has strategically charted a comprehensive course to strengthen its market presence and boost sales performance. This includes a significant investment of approximately $3-$4 billion in fiscal 2024, focused on expanding operations, attracting new customers, and optimizing services and supply chain facilities.

Technical Analysis Perspective:

- TGT is gradually heading towards a long-term falling trendline from November 2021 high of 268.98, this week between 161 -169 range.

- A large complex inverse head and shoulders bullish formation is in the making which will be completed once the stock penetrates 185/186 resistance and may take a couple of weeks to months.

- The above-mentioned formation is a bullish pattern and appears as a base for the upcoming large move in the medium to longer term.

- Key obstacle post earnings are sitting between 161 -169 range, which if not taken out then a range trade between 161 to 145 will continue.

TGT Weekly Chart

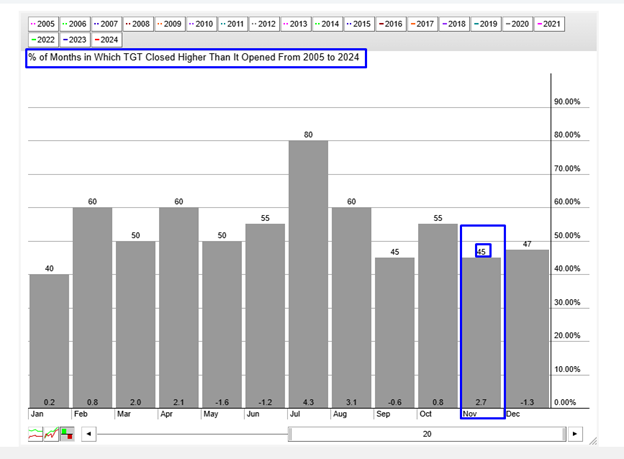

TGT Seasonality Chart

- TGT 19 years seasonality suggests that it closes 2.7% higher in November 45% of the time.

Conclusion:

Technical setup suggests that the stock is forming a long-term base in the form of a large inverse head and shoulders, which will be triggered once prices break 185/186 and remains valid as long as 132/130 support remains intact. Key obstacle post earnings are between 161 – 169 range.

A word of wisdom:

Plan your trade and trade your plan.