Is Two Out Of Three Good Enough?

Last summer, the Fed said they were using three main criteria for reducing their monthly bond buys – economic growth, employment, and inflation. How do things stand relative to these benchmarks?

From The Wall Street Journal:

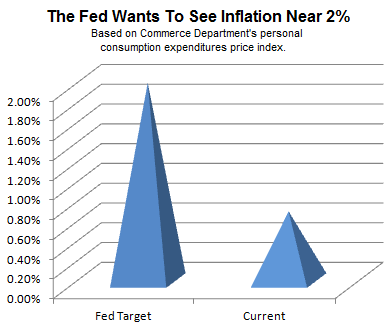

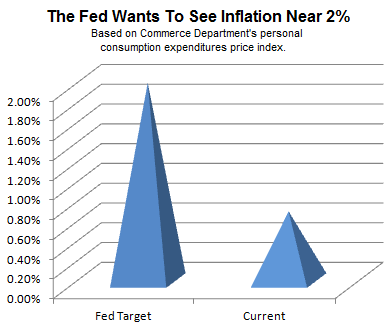

Recent data show progress on the first two criteria, but not on the third. The inflation rate has been persistently below the Fed’s objective and reflects weak consumption and wage growth, which bode poorly for the economic recovery. Fed officials will likely differ on whether the gains overall are good enough to clear Mr. Bernanke’s hurdles. One argument against taking action this week is that inflation isn’t moving toward the Fed’s target. If anything, it is going the wrong way. The Fed’s preferred measure—the Commerce Department’s personal consumption expenditures price index—fell to an annual clip of just 0.7% in October, less than half the 2% target rate.

Taper Odds

While the best strategy is to see how the markets react to the Fed’s message this week, it is helpful for planning purposes to handicap Wednesday’s outcome. From The Wall Street Journal:

Of 43 economists polled recently by The Wall Street Journal, just 11 expected the Fed to cut its bond purchases this week, while 30 said it would wait until early next year.

According to Bloomberg, taper odds are a bit higher:

The share of economists forecasting such a move rose to 34 percent in a Bloomberg survey conducted the day of the jobs report from 17 percent on Nov. 8. Fifty-three percent predicted last month that tapering would begin in March, compared with 40 percent this month. Bill Gross, co-chief investment officer at Pacific Investment Management Co., said Dec. 6 that the pace of payroll growth in November made the probability of a taper on Dec. 18 “at least 50-50 now” after he previously saw “some logic for a January starting point.”

Market Leadership Favors Economic Bulls

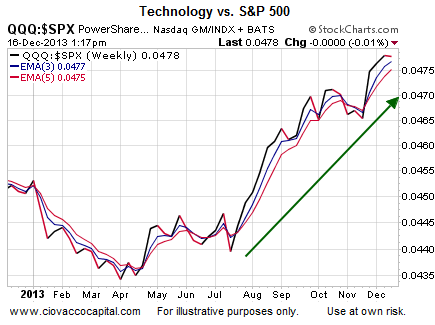

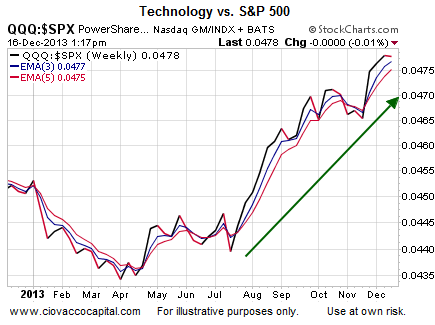

What are the markets telling us pre-Fed? As shown in the chart below, technology (QQQ) continues to provide leadership relative to the broader S&P 500 Index (SPY). All things being equal, that sides with the bullish economic outcome camp.

Cyclical Sectors Trying To Perk Up

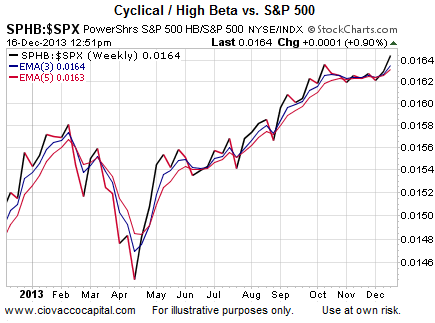

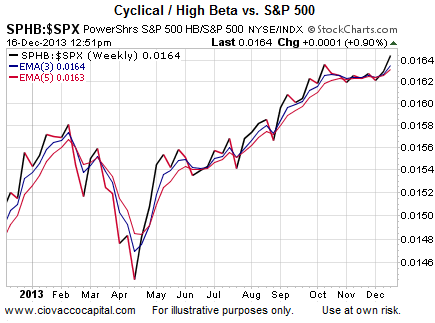

The high beta ETF (SPHB) overweights economically sensitive sectors of the economy, such as financials (XLF), consumer discretionary (XLY), energy (XLE), and technology (XLK). As shown in the chart below, high beta stocks are trying to reestablish their leadership relative to the broader S&P 500. The chart below, in its present form, aligns with investor confidence, rather than taper fears.

Defensive Stocks Lagging

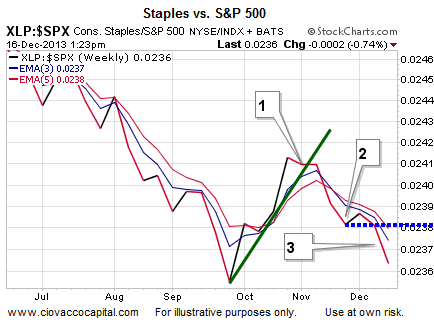

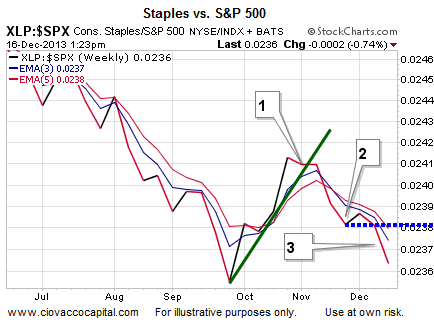

When money managers with a fully-invested-all-the-time mandate are nervous, they tend to overweight defensive consumer staples stocks. Their rationale is consumers will all continue to buy toothpaste and groceries, even during an economic downturn. The chart below shows stocks of consumer staples companies are lagging the broader S&P 500 Index, which is indicative of relatively low fear heading into the Fed announcement. The three steps of a bearish trend change recently “confirmed” weakness in defensive staples.

Two Forms Of Indecisiveness

There was a lot of chatter about the “indecisive nature” of Monday morning’s rally in the equity markets, which is not surprising given what lies ahead this week.

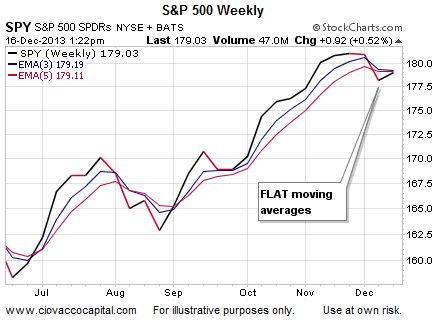

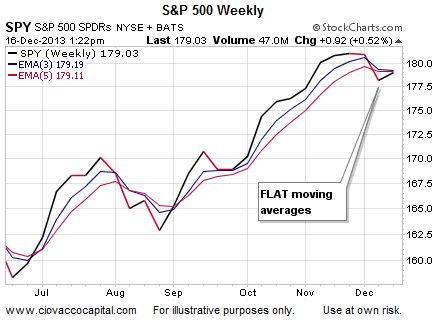

The market’s understandably hesitant nature can be seen in the two charts that follow. The flat blue and red moving averages below on the weekly chart of the S&P 500 tell us bullish economic conviction and bearish economic conviction have been fairly evenly matched in recent weeks.

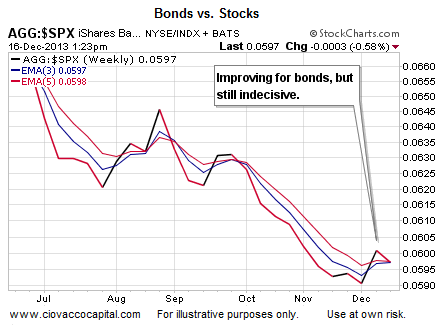

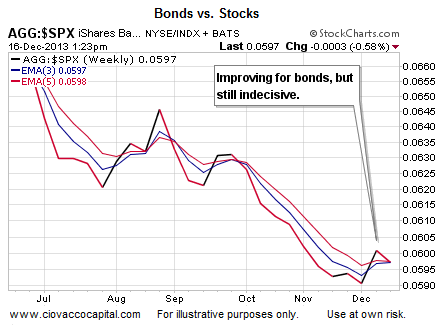

While defensive and deflation-friendly bonds are still in a clear downtrend relative to growth-oriented stocks, bonds have made some progress in recent weeks. Charts, like the one below, tell us to keep an open mind about the balance of the week and year.

Investment Implications – Tentatively Bullish

We do not need to be a Harvard economics professor to understand why the charts presented above still align with the bullish case for the economy and equities. However, just as the market was unprepared for the “no taper” announcement in September, we have to keep an open mind about another sharp reversal in sentiment following the release of the Fed statement this Wednesday at 2:00 p.m. ET.

Market Is Understandably Hesitant

Since volatility can spike near Fed meetings (remember May and September), part one of this week’s stock market outlook video covers what could be the most important thing in the world of investing – managing volatility. Part two shows longer-term bullish trends remain intact, but observable deterioration is present on shorter time frames.

Last summer, the Fed said they were using three main criteria for reducing their monthly bond buys – economic growth, employment, and inflation. How do things stand relative to these benchmarks?

From The Wall Street Journal:

Recent data show progress on the first two criteria, but not on the third. The inflation rate has been persistently below the Fed’s objective and reflects weak consumption and wage growth, which bode poorly for the economic recovery. Fed officials will likely differ on whether the gains overall are good enough to clear Mr. Bernanke’s hurdles. One argument against taking action this week is that inflation isn’t moving toward the Fed’s target. If anything, it is going the wrong way. The Fed’s preferred measure—the Commerce Department’s personal consumption expenditures price index—fell to an annual clip of just 0.7% in October, less than half the 2% target rate.

Taper Odds

While the best strategy is to see how the markets react to the Fed’s message this week, it is helpful for planning purposes to handicap Wednesday’s outcome. From The Wall Street Journal:

Of 43 economists polled recently by The Wall Street Journal, just 11 expected the Fed to cut its bond purchases this week, while 30 said it would wait until early next year.

According to Bloomberg, taper odds are a bit higher:

The share of economists forecasting such a move rose to 34 percent in a Bloomberg survey conducted the day of the jobs report from 17 percent on Nov. 8. Fifty-three percent predicted last month that tapering would begin in March, compared with 40 percent this month. Bill Gross, co-chief investment officer at Pacific Investment Management Co., said Dec. 6 that the pace of payroll growth in November made the probability of a taper on Dec. 18 “at least 50-50 now” after he previously saw “some logic for a January starting point.”

Market Leadership Favors Economic Bulls

What are the markets telling us pre-Fed? As shown in the chart below, technology (QQQ) continues to provide leadership relative to the broader S&P 500 Index (SPY). All things being equal, that sides with the bullish economic outcome camp.

Cyclical Sectors Trying To Perk Up

The high beta ETF (SPHB) overweights economically sensitive sectors of the economy, such as financials (XLF), consumer discretionary (XLY), energy (XLE), and technology (XLK). As shown in the chart below, high beta stocks are trying to reestablish their leadership relative to the broader S&P 500. The chart below, in its present form, aligns with investor confidence, rather than taper fears.

Defensive Stocks Lagging

When money managers with a fully-invested-all-the-time mandate are nervous, they tend to overweight defensive consumer staples stocks. Their rationale is consumers will all continue to buy toothpaste and groceries, even during an economic downturn. The chart below shows stocks of consumer staples companies are lagging the broader S&P 500 Index, which is indicative of relatively low fear heading into the Fed announcement. The three steps of a bearish trend change recently “confirmed” weakness in defensive staples.

Two Forms Of Indecisiveness

There was a lot of chatter about the “indecisive nature” of Monday morning’s rally in the equity markets, which is not surprising given what lies ahead this week.

The market’s understandably hesitant nature can be seen in the two charts that follow. The flat blue and red moving averages below on the weekly chart of the S&P 500 tell us bullish economic conviction and bearish economic conviction have been fairly evenly matched in recent weeks.

While defensive and deflation-friendly bonds are still in a clear downtrend relative to growth-oriented stocks, bonds have made some progress in recent weeks. Charts, like the one below, tell us to keep an open mind about the balance of the week and year.

Investment Implications – Tentatively Bullish

We do not need to be a Harvard economics professor to understand why the charts presented above still align with the bullish case for the economy and equities. However, just as the market was unprepared for the “no taper” announcement in September, we have to keep an open mind about another sharp reversal in sentiment following the release of the Fed statement this Wednesday at 2:00 p.m. ET.

Market Is Understandably Hesitant

Since volatility can spike near Fed meetings (remember May and September), part one of this week’s stock market outlook video covers what could be the most important thing in the world of investing – managing volatility. Part two shows longer-term bullish trends remain intact, but observable deterioration is present on shorter time frames.