A momentous thing just happened -- Bitcoin breached $1,000.

Is it a bubble? Who knows, but one thing is certain, you can buy a lot more gold and silver with one bitcoin than you could a year ago.

Fiat Alternatives

There are many parallels between bitcoin and gold, both are alternatives to fiat money, both are faceless currencies and both have limited supplies. However, in the last two years one has seen its price climb from $7 to $1000, the other has fallen from $1,900 to $1200.

Which begs the question: is bitcoin is the new gold?

We don’t see it like that. Instead, bitcoin is another alternative to fiat money. If it is a safe haven or a hedge against inflation, as gold and silver are so often seen to be, we won’t know for a long time.

Sound Wealth Storage

However what we can see right now is that people are choosing to park their wealth in the virtual currency as they speculate on its continued rise. They can spend bitcoin and they can save in gold and silver. Both the precious metals and bitcoin seem to have one thing in common -- they are viewed as sounder money.

So how much would it cost if you wanted to spend your bitcoin on the ultimate sound money?

Since 2010 the price of gold has climbed all the way from $1,100 to $1,900/oz to then slowly tumble back down to not too dissimilar levels. Silver has had a similar story, climbing from $18/oz in July 2010 to touching the dizzying heights of near-$50/oz. Since then it has fallen by more than 50%, suffering a more tumultuous ride than gold.

Enter Bitcoin

Prior to 2009 gold and silver were the only two forms of sound money anyone was really aware of. But then Bitcoin slowly crept onto the scene.

Throughout the first half of 2010, the prices of the precious metals were climbing while Bitcoin remined fairly static and somewhat volatile. Since October 2010, however, the price has steadily appreciated and at a faster rate than gold and silver, both of which were headed to new highs in September 2011 and May 2001, respectively.

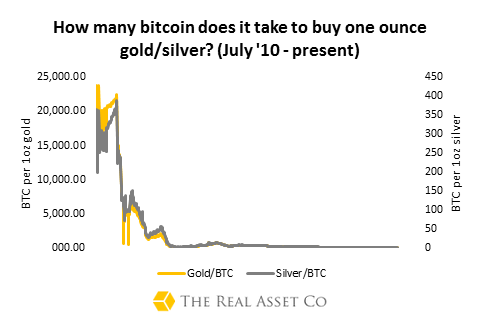

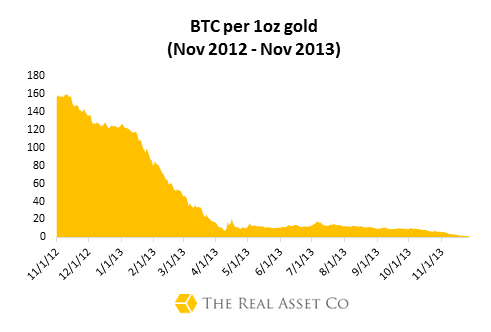

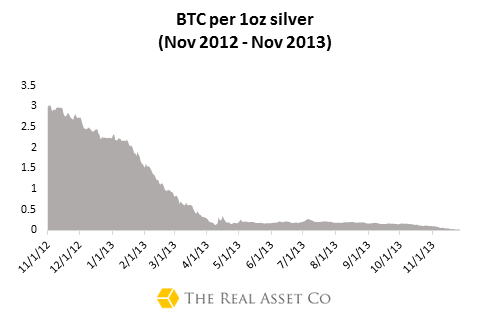

Back in July 2010 (when Mt Gox records begin) it cost 23,764 bitcoin to buy 1 ounce of gold at $1,188.20/oz. Silver was a bit more of a bargain at 365 bitcoin per ounce ($18.25).

Since then, bitcoin owners have never looked back.

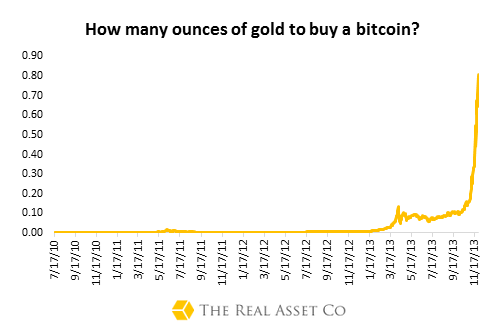

If you spent $0.06 on 1.2 bitcoin on the 17th July 2010, today you could buy an entire ounce of gold.

To all those who can’t quite believe bitcoin is the new digital gold, take a look at the ratio. At the time of writing the bitcoin gold ratio is close to 1:1.

Historically the gold silver ratio is 15:1. Bitcoin, supposedly a digital version of gold surpassed a 15:1 ratio to silver all the way back in January 2011. It is now, similar to gold at a ratio of 50:1 to silver. Yes, you could now spend those very same 1.2 bitcoin you bought in July 2010 on 50 ounces of silver.

Tulips, PMs And Bitcoin

No one really knows what this means about the future of Bitcoin. We might be writing to you in a year’s time talking about tulip 2.0, but we’re not so sure.

Equally we’re not so sure that this is gold 2.0. But what we can clearly see from the above is that for the time being investors are choosing to put their faith in the virtual currency, as well as gold and silver.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Talking Bitcoin, Gold And Silver

Published 11/29/2013, 09:00 AM

Updated 05/14/2017, 06:45 AM

Talking Bitcoin, Gold And Silver

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.