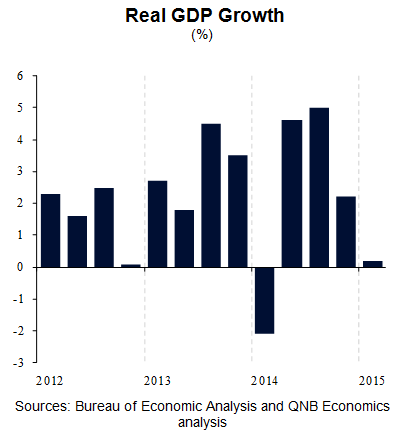

The last two weeks saw the release of important economic data in the US: an estimate of real GDP growth for the first quarter of 2015; international trade data which are important in predicting subsequent revisions to GDP; and labour market data for April. The GDP-related data showed an even worse-than-expected slowdown of economic activity in the US in the first quarter. Meanwhile, the labour market bounced back after a temporary blip in March, reducing concerns that the slowdown may persist into the second quarter.

Real GDP in the US grew by merely 0.2% in the first quarter of 2015, disappointing the already low consensus expectation of 1.0% growth. The figure represents a significant slowdown from the fourth quarter of 2014, when the economy grew by 2.2%. Trade was the main driver of the slowdown, subtracting 1.3 percentage points (pps) from growth as the strong US dollar weighed on net exports. Investment in non-residential structures subtracted another 0.4pps, mainly representing investment cutbacks in the oil and gas sector in response to lower oil prices. The expected tailwinds from lower oil prices on personal consumption did not materialise. Personal consumption spending decelerated despite significant gains in employment, higher real wages and elevated consumer confidence.

Furthermore, it now seems that Q1 GDP data is likely to be revised down, possibly into negative territory. The first release of US GDP growth is based on incomplete data and is usually subject to substantial revisions. Since the release of the initial estimate, March international trade data have become available, showing a wider trade deficit than assumed in the GDP estimate. Export growth was lower than expected, as the drag from a stronger US dollar continues to be felt. Import growth was larger than assumed as the resolution of labour strikes at the West Coast ports in February led to a surge in import activity in March. The trade numbers suggest that the second estimate of GDP will most likely show a small contraction in Q1 when it is released on May 29, 2015.

Despite the visible weakness of the economy, economists still believe that it is temporary, and that growth will be above trend this year. The consensus of market forecasters collected by Bloomberg suggests that the US will grow by 2.8% this year. For this figure to materialise given the initial estimate of Q1 GDP, growth needs to rebound to an annualised rate of 3.8% in each of the subsequent three quarters. And an even higher growth rate might be needed given the expected downward revision to Q1 GDP. If the strong growth rebound fails to materialise and the US slowdown proves to be more permanent, then we should expect downward revisions in forecasts and possibly corrections in the financial markets where these elevated growth rates are priced in.

How does the slowdown in the US impact the Federal Reserve’s (Fed) decision whether to raise interest rates? The Fed has set two conditions to raise rates. First, it needs to see further improvement in the labour market, which it views as a better indicator of short-term activity than GDP growth. Second, it needs to be reasonably confident that inflation will move back to its 2% target over the medium term. The latest Fed’s projections show that both of these conditions will be met and interest rates will be raised later this year. However, these projections had been made in March 2015 before the slowdown was fully apparent. The Fed is therefore likely to be very sensitive to the April and May data releases ahead of the publication of new projections in June, which are expected to prepare the ground for any future rate hikes.

In this context, the latest employment data, which showed strong job growth following a disappointing employment report in March, proved that at least the Fed’s first condition is on track. The economy added 223k jobs in April, broadly in line with the average of the six months before March. Unemployment rate declined to 5.4%, and is now closer to the Fed’s estimate of the equilibrium unemployment rate of 5.0-5.2%.

In conclusion, the dichotomy between the US labour market data and the rest of the economy is puzzling. Most forecasters still believe that the economy will rebound as productivity improves and consumer spending picks up. The Fed seems to have fallen into this camp so far, which has led to a surge in the US dollar. Future data will tell us if the US consumer can spend enough to prove this view right.