In spite of their status as precious metals, the automotive industry accounts for a high percentage of platinum and palladium demand annually, making the pair essentially industrial metals.

Given that a high percentage of demand generated from the automotive industry relates to the use of the metals within the catalytic converter, as the automotive market moves more fully toward electric powered vehicles, demand will likely decline for both metals.

Meanwhile, according to Reuters, even though palladium- and platinum-heavy fuel cell technology in the electric car market is on the rise, the growth in this area is unlikely to offset falling autocatalyst demand.

Given that prices for palladium soared of late, let’s take another look at palladium price trends, along with its close substitute platinum.

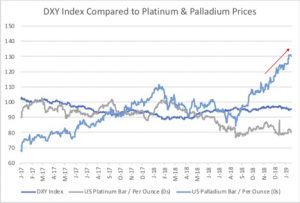

Palladium, Platinum Price Trends Compared with the Dollar Index (DXY)

Given that metals and the dollar index (DXY) tend to move in opposite directions, we can see that palladium prices gained quite a bit more value than expected when looking at the DXY trend line against the palladium trend line in light blue below.

Source: MetalMiner data from MetalMiner IndX(™) and Yahoo (NASDAQ:AABA).com

On the other hand, platinum’s price movement in the U.S. looks much more in line with what we might expect when compared with the relative performance of the U.S. dollar. Therefore, although platinum prices historically exceeded palladium prices, platinum prices still trend fairly close to the expected (recent) value, while palladium prices started to look inflated. Platinum prices peaked in 2008 at more than $2,000 per ounce.

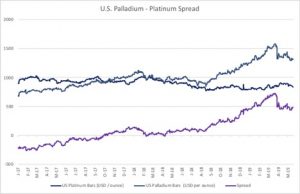

Source: MetalMiner data from MetalMiner IndX(™)

Looking at the price difference in the U.S. between the two metals, or spread, as shown by the purple line in the chart above, we see that the spread between the two flip-flopped in late 2017 to early 2018. The spread surged since last year, hitting a peak around March 1, 2019. More recently, the spread has moved sideways at around $500 per ounce.

Do Chinese Palladium and Platinum Prices Drive U.S. Prices?

Given that China consumes a high percentage of palladium, we could expect that Chinese prices lead U.S. prices.

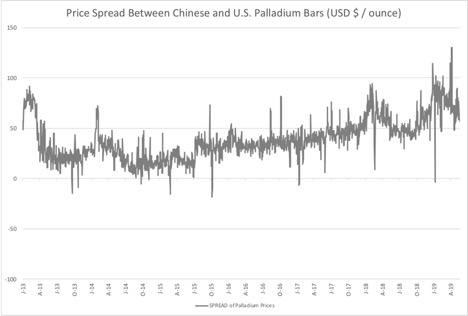

Source: MetalMiner data from MetalMiner IndX(™)

A look at the price trend lines between the two countries does in fact show a high correlation in prices between the two countries, especially long term.

More recently, U.S. and Chinese platinum prices continued to move in a tight band together.

Chinese palladium prices, on the other hand, trend above U.S. prices, with the gap growing in 2019 – not surprising given that China leads demand for the metal globally.

Source: MetalMiner data from MetalMiner IndX(™)

The zero line in the chart above indicates where the two countries’ prices are equal. At points above zero, the Chinese price is higher. The price difference tended to amount to U.S. $25-$50 per ounce, but increased into 2018. During the past few months, the difference decreased again slightly, but still looks somewhat high historically.

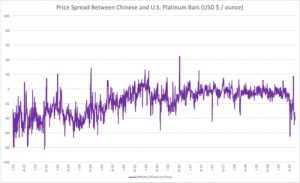

Source: MetalMiner data from MetalMiner IndX(™)

The chart above shows the spread between Chinese and U.S. prices. When the spread value is under zero, U.S. prices are higher.

The spread between U.S. and Chinese platinum prices tends to lean toward the U.S. having the higher price. However, since 2016, the prices trended very close together. U.S. prices started to look relatively more expensive again in 2019.

What This Means for Industrial Metal Buyers

For industrial metal buyers looking to track palladium prices, the Chinese price offers a solid proxy of what we might expect with regard to the future behavior of palladium prices.

While the price indicates slightly weaker Chinese demand of late, prices for palladium remain at historically high levels.

Platinum prices, however, remain somewhat low historically. The recent performance against the DXY does not necessarily suggest the metal is undervalued. However, given that platinum can serve as a substitute, it’s doubtful the price will stay suppressed long term, as high palladium prices will drive a push toward substitution.

by Belinda Fuller