Take-Two Interactive Software Inc (NASDAQ:TTWO) is slated to report fiscal fourth-quarter earnings after the market closes this Monday, May 13. Ahead of the event, TTWO stock is trading down 1.5% at $100.63, and if recent history is any guide, the shares could be headed even lower next week.

Specifically, Take-Two Interactive stock has closed lower in the session following the video game maker's last two turns in the earnings confessional, averaging a loss of 9.6%. Widening the scope, TTWO shares have averaged a next-day move of 8.6% over the past two years, regardless of direction, with the options market pricing in a bigger 10.2% swing this time around.

Options traders, meanwhile, are positioned for an upside move. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), TTWO's top-heavy 10-day call/put volume ratio of 4.34 ranks in the 81st annual percentile, meaning calls have been bought to open over puts at a quicker-than-usual clip.

This optimism is seen outside of the options pits, too, with 16 of 17 analysts maintaining a "buy" or better rating on TTWO stock. Plus, the average 12-month price target of $122.44 is a 21% premium to the security's current perch.

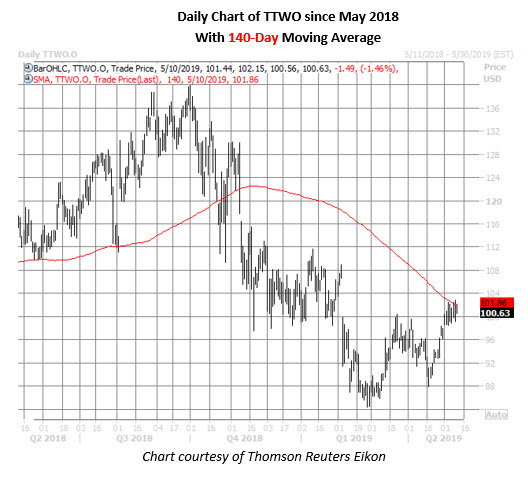

Looking at the charts, Take-Two Interactive Software stock has been trending lower since its Oct. 1 record high of $139.91. While the shares have recovered from their Feb. 27 18-month low of $84.41, they have recently stalled out in the $99-$101 range -- near their year-to-date breakeven mark, early February bear gap highs, and a descending 140-day moving average. Should the shares resume their longer-term downtrend, a shift in bullish sentiment could exacerbate losses for TTWO stock.