The following are the key takeaways from this week's COT report as provided by Scotiabank. (Data in this report cover up to Tuesday Nov 03 and were released Friday Nov 06).

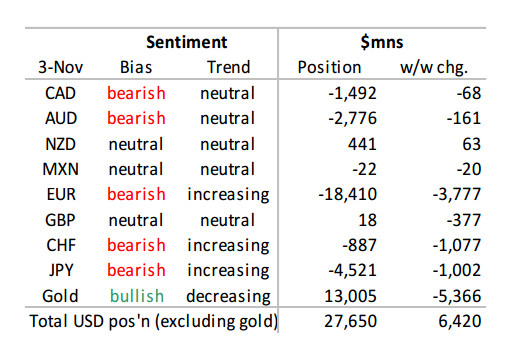

Changes in FX sentiment were concentrated among a few key currencies this week, with EUR, CHF, and JPY responsible for the bulk of the build in the aggregate USD long—jumping $6.4bn to $27.7bn. The USD build follows on last week’s $8.1bn rise, pushing the aggregate USD long back to levels last seen in mid-August.

EUR sentiment has deteriorated for a second consecutive week, though we note that the pace has moderated with a $3.8bn widening in the net short following on the prior $5.8bn build. The past two week’s changes in EUR sentiment have been almost entirely built by shorts, leaving EUR vulnerable to short covering in response to key events.

JPY is the second largest held net short, its $4.5bn position almost entirely built over the past two weeks with a $1.0bn deterioration following on the prior $3.1bn build. The relative size of the JPY short leaves it less vulnerable when compared to EUR.

Sentiment toward CAD and AUD remains modestly bearish, though we note that both saw their positions remain relatively unchanged on a w/w basis. CAD is held net short $1.5bn and investors pared back risk to both sides in the most recent week. Meanwhile, the opposite was observed for AUD as investors added to both long and short positions, the latter exceeding to provide for a modest $0.2bn widening in the net short to $2.8bn.