The following are the key takeaways from this week's COT report as provided by Scotiabank. (Data in this report cover up to Tuesday Oct 20 and were released Friday Oct 23).

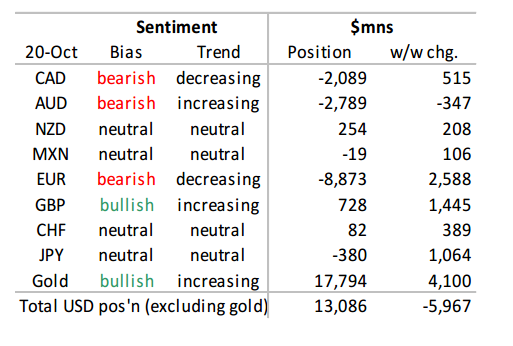

This week’s changes in G4 positioning hint to a capitulation in bearish sentiment toward GBP and JPY alongside sizeable moderation in bearish sentiment toward EUR. The combined changes in G4 positioning drove most of the decline in the aggregate USD long—falling $6.0bn w/w to $13.1bn, its lowest level since July 2014. EUR remains the largest held net short position, followed by AUD and CAD. Sentiment toward JPY, MXN, CHF and NZD is neutral, and investors are modestly bullish GBP.

The bearish EUR position has narrowed a remarkable $21.5bn off the multi-year -$30.4bn low from late March, with early short covering followed by several months of tentatively built longs. This past week’s $2.6bn pace of narrowing was the fastest since the turbulence from mid-August, with investors paring $1.9bn in shorts while building $0.7bn in longs— the latter most vulnerable to reversal on the subsequent declines in spot.

Bearish CAD sentiment has softened further, narrowing $0.5bn w/w to levels last seen in late June. The bulk of the improvement in CAD sentiment continues to be driven by short covering, with longs remarkably stable over the past year.