The following are the key takeaways from this week's COT report as provided by Scotiabank. (Data in this report cover up to Tuesday Oct 13 and were released Friday Oct 16).

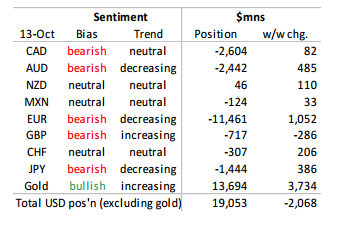

The aggregate long USD position fell $2.1bn w/w to $19.1bn, its lowest level since late July 2014. Positive changes in sentiment were observed for most currencies with the exception of GBP. Investor sentiment is neutral for NZD and MXN, modestly bearish for CHF and GBP, and notably bearish for EUR, CAD, AUD and JPY.

EUR sentiment improved w/w, however the details are intriguing as they highlight a build in longs rather than a covering of shorts, leaving those newly build positions vulnerable to the recent decline in spot. EUR remains the largest held net short at $11.5bn.

Bearish JPY sentiment narrowed modestly for a fourth consecutive week, with details suggesting a paring back of risk to both long and short positions, likely reflecting the range bound movement in spot. The net short is relatively narrow, at $1.4bn, around the upper end of its 52 week range.

Bearish CAD sentiment moderated for the 8th week in 9, as market participants pared back risk to both sides. The net short CAD position is relatively modest at -$2.6bn, its narrowest since late June.

Investors pared their gross short AUD position for the 7th consecutive week, building on the aggregate $2.4bn narrowing since late August.