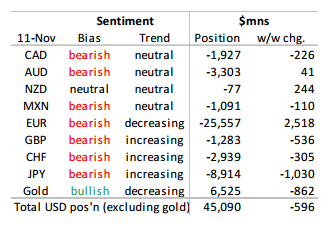

Bullish USD sentiment stabilized at $45bn this week; with minimal week‐over‐week changes. All currencies are held net short against the USD; however the only positions of significant size are EUR and JPY, followed by AUD.

For the first time in several weeks traders took profits on short EUR positions; driving the net position back to ‐$26bn. The shift warns of a slowing in bearish EUR momentum, suggesting EUR will need a fresh catalyst to push it through its recent lows.

Traders are bearish GBP, however the net short of ‐$1.3bn, leaves ample room to be built out as the fundamental outlook has deteriorated. This warns of a potential build in downward GBP momentum.

Traders added to already short JPY positions, driving the net position to $9bn, well within its recent range.

AUD traders made no changes this week; retaining a relatively large net short of ‐$3.3bn; while NZD traders are neutral.