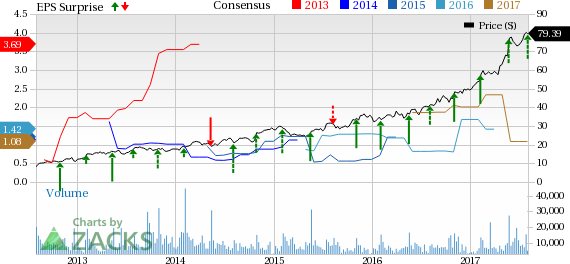

Take Two Interactive Software Inc (NASDAQ:TTWO) reported spectacular first-quarter fiscal 2018 results, sending shares up over 11% in the aftermarket session. Adjusted earnings were 44 cents per share compared with the Zacks Consensus Estimate of breakeven. Net sales (excluding deferred revenues) of $348.3 million beat the Zacks Consensus Estimate of $287.1 million.

On a year-over-year basis, revenues were up 11.8%. Continued increase in digital revenues and strength in games like Grand Theft Auto V,Grand Theft Auto Online, NBA 2K17, WWE 2K17 and Mafia III were the driving factors.

The company reported earnings of 56 cents per share against the prior-year quarter’s loss of 46 cents. Revenues (including deferred revenues) came in at $418.2 million, higher than $311.6 million reported in the year-ago period.

Per the company, digital revenues (64% of total revenue) increased 55.9% to $268.2 million while revenues from Physical retailer and other segments (36% of total revenue) were up 7.5% to $150 million.

Region-wise, revenues from the United States (62% of total revenue) were up 33.7% to $258.3 million, while from the International markets, revenues surged 35% to $160 million.

Given the strong performance of Grand Theft Auto Online and Grand Theft Auto V, NBA 2K17, WWE2K17, Monster Legends, Dragon City and Mafia III, digitally-delivered net sales were up 47% to $280.9 million. Recurrent consumer spending bookings increased 71% and represented 72% of total digitally-delivered bookings.

Margins

Take Two’s gross margin was 53.5% compared with 38.6% reported in the prior-year quarter.

Operating profit was $50.2 million, compared with loss of $39 million reported in the prior-year quarter.

Balance Sheet and Cash Flow

As of Jun 30, 2017, Take Two had $1.28 billion in cash and short-term investments compared with $1.39 billion as of Mar 31, 2017. During the first quarter, net cash used in operating activities came in at $18.6 million.

Outlook

Take Two provided guidance for the second quarter and fiscal 2018. Strength in franchises like Grand Theft Auto, NBA 2K and WWE 2K will boost the top line in the fiscal year, despite a light slate of new releases. The company has pushed the release of its much-anticipated Red Dead Redemption 2 from fall of 2017 to spring of 2018. NBA 2K18 will be released on Sep 19, 2017 while WWE 2K18 comes out on Oct 17, 2017. Earlier this year, Take Two acquired the popular simulation game, Kerbal Space Program. A new Kerbal game, Kerbal Space Program: Making History Expansion, is also slated for launch this year.

For the second quarter, the company expects GAAP net revenues to be in the band of $400–$450 million. The company projects earnings per share in the range of 15–25 cents. Net sales (operational metric) are projected in the band of $465–$515 million.

For fiscal 2018, the company has increased outlook for net sales and net cash provided by operating activities whereas reducing expectations for net revenue and net income. Reduction of outlook stems from the fact that company is extending life of Grand Theft Auto V and Grand Theft Auto Online for purposes of calculating deferral. Though this will not impact net sales, the company will incur higher internal royalties, hence the downgrade.

Net sales are projected in the band of $1.65–$1.75 billion compared with $1.42–$1.52 billion. Operating cash flow is estimated to be around $200 million compared with $150 million expected earlier.

GAAP net revenues are likely to be in the band of $1.62–$1.72 billion compared with $1.95–$2.05 billion projected earlier. The company now projects earnings per share in the range of $1.00–$1.25.

Our Take

The company continues to benefit from its popular offerings like Grand Theft Auto V and Grand Theft Auto Online, along with its other releases like NBA 2K and WWE 2K. In fact, higher sales of the digital version of the games add to the company’s margins. Take Two continues to expect growth in digital revenues, driven by higher sales of full game downloads and increase in recurrent consumer spending.

The company recently forayed into the free-to-play games space with the acquisition of game developer, Social Point. The acquisition will help it to boost performance, going ahead. Management expects Social Point to contribute 6% of the total revenue in the current fiscal.

Nonetheless, stiff competition from other game makers, such as Activision Blizzard Inc. (NASDAQ:ATVI) , Electronic Arts (NASDAQ:EA) and Glu Mobile Inc. (NASDAQ:GLUU) , remains a major concern.

Currently, Take Two carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the last one year, the company has returned 94.6% compared with the industry’sgain of 36.8%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

(We are reissuing this article to correct a mistake. The original article, issued earlier today, should no longer be relied upon.)

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Take-Two Interactive Software, Inc. (TTWO): Free Stock Analysis Report

Electronic Arts Inc. (EA): Free Stock Analysis Report

Glu Mobile Inc. (GLUU): Free Stock Analysis Report

Original post

Zacks Investment Research