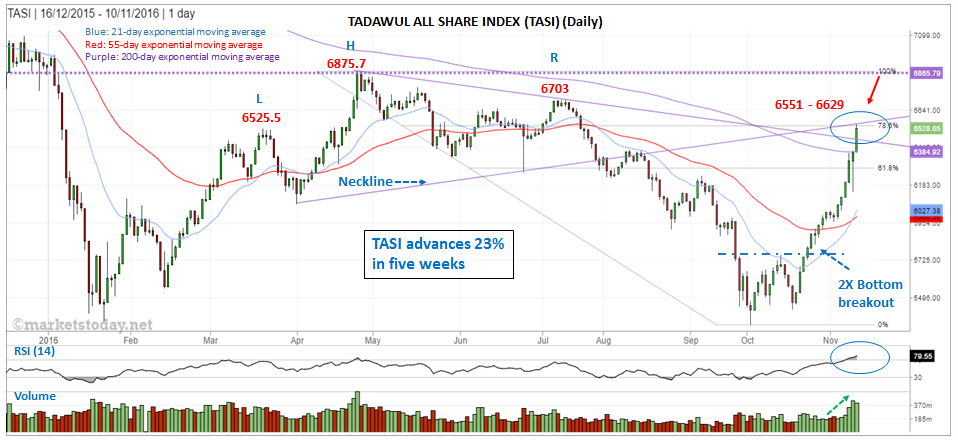

There is now a reasonable argument that the Tadawul All Share (Saudi Stock Exchange) is extended with the probability of a retracement of some note the highest it’s been since hitting the bottom at 5,327.49 five weeks ago.There’s no sign yet that this rally has come to an end, but there are indications that the move is getting extended with the index now hitting a key potential resistance area identified by multiple indicators.

At last week’s high of 6,550.61, the TASI had advanced 23% off the 5,327.49 low from five weeks ago. A 78.6% Fibonacci retracement was hit on Thursday at 6,544.38 and the week’s high hit resistance of the neckline of a head and shoulders top formation. A little above last week’s high is resistance of the 55-week exponential moving average at 6,629. Together this creates a high probability potential resistance zone from 6,550.61 to around 6,629.

Alternatively, if the TASI can sustain upward momentum above the 55-week ema then the next higher targets include 6,703 (prior minor peak, right shoulder of head and shoulders top), followed by the 2016 high at 6,875.70.

When looking at the 14-day relative strength index (RSI) momentum oscillator you can see that it is now clearly overbought – the most overbought since August 2014. That’s when the index peaked leading to a two year downtrend, where it remains today. By itself not a strong enough signal but when combined with other elements,as noted above,it adds to the weight of evidence that the odds of going higher before a pullback are decreasing.

Another way to look at momentum is to look at the speed of the 23% current ascent. It took only 28 days. This is not unprecedented, as the TASI gained around 24% in 8 days back in December 2014, but it is unusual. It is the second most dramatic rise within such a short time when compared with all other similar advances that occurred since the 2014 peak. This speaks to the strength of the rally but also highlights the increasing probability that the risk of a correction is growing.