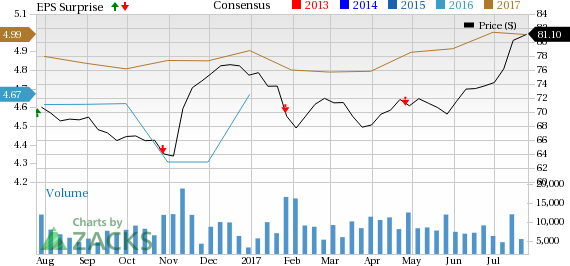

T. Rowe Price Group, Inc. (NASDAQ:TROW) reported positive earnings surprise of 0.8% for second-quarter 2017. Adjusted earnings per share of $1.28 outpaced the Zacks Consensus Estimate by a penny. Further, the bottom line improved 15.3% from the year-ago figure of $1.11.

Better-than-expected results were driven by higher revenues and assets under management (AUM). However, escalating expenses were a concern.

Including certain non-recurring items, net income came in at $373.9 million or $1.50 per share compared with $203.3 million or 79 cents per share recorded in the prior-year quarter.

Revenue Growth Recorded, Expenses Flare Up

Net revenue rose 12.1% to $1.17 billion from the year-ago quarter. The rise was primarily stemmed by higher investment advisory fees that grew 13.4% year over year to $1.04 billion. Moreover, net revenue surpassed the Zacks Consensus Estimate of $1.16 billion.

Distribution and servicing fees rose 2.2% to $36.4 million. In addition, administrative fees improved 3.2% to $91.3 million on a year-over-year basis.

Investment advisory revenues earned from the T. Rowe Price mutual funds, distributed in the U.S., were up 12.7% year over year to $754.3 million. Investment advisory revenues earned from other investment portfolios, managed by the company, rose 15.1% from the prior-year quarter to $289.6 million.

Total adjusted operating expenses were up 11.6% year over year to $662.3 million in the quarter. Including certain one-time items associated with the Dell appraisal rights matter, expenses were $664.0 million, down 12.8%.

As of Jun 30, 2017, T. Rowe Price employed 6,651 associates, 6.8% higher than the last year.

Strong Assets Position

As of Jun 30, 2017, total AUM climbed 16.4% year over year to $903.6 billion. During the quarter, net market appreciation and income, came in at $38.3 billion, while net cash inflow was $3.7 billion after client transfers.

T. Rowe Price remains debt free with substantial liquidity, including cash and sponsored portfolio investment holdings of about $3.6 billion as of Jun 30, 2017, which enable the company to keep on investing.

Capital Deployment Activity

During second-quarter 2017, T. Rowe Price repurchased 1.9 million shares of its common stock for $130.7 million, and invested $82.6 million during the first half of 2017 in capitalized technology and facilities using available cash balances.

For 2017, the company projects capital expenditures to be approximately $200 million, comprising two-third for technology development.

Our Viewpoint

T. Rowe Price’s financial stability has the potential to benefit from growth opportunities in the domestic and global AUM. The company’s debt-free position, higher return on earnings and improvement in investor sentiment, as a whole, makes us confident of its robust fundamentals, moving ahead. Furthermore, a relatively better mutual fund performance is a positive.

However, higher operating expenses and stringent regulatory norms remain concerns.

Currently, T. Rowe Price carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other investment managers, Federated Investors, Inc. (NYSE:FII) and Lazard Ltd. (NYSE:LAZ) are scheduled to report June quarter-end results on Jul 27, while Franklin Resources, Inc. (NYSE:BEN) will release quarterly numbers on Jul 28.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

T. Rowe Price Group, Inc. (TROW): Free Stock Analysis Report

Federated Investors, Inc. (FII): Free Stock Analysis Report

Franklin Resources, Inc. (BEN): Free Stock Analysis Report

Lazard Ltd. (LAZ): Free Stock Analysis Report

Original post

Zacks Investment Research