T. Rowe Price Group, Inc. TROW reported preliminary assets under management (AUM) of $1.63 trillion as of Nov 30, 2021. This reflects a 2.6% decrease from the prior month’s $1.67 trillion.

Client transfers from mutual funds to other portfolios, including trusts and separate accounts, aggregated $1.1 billion in November 2021.

T. Rowe Price’s total sponsored U.S. mutual fund balance was $869 billion, down 2.6% from October 2021. Of the total U.S. mutual funds balance, almost 83% comprised investments in equity and blended assets, while the remaining came from the fixed income and money markets.

T. Rowe Price’s total sub-advised and separate accounts as well as other investment products were worth $759 billion, marking a 2.6% decline from the prior month. Equity and blended assets accounted for $621 billion or 82% of total other investment portfolios, while money-market and fixed income products constituted $138 billion or 18%.

Additionally, T. Rowe Price registered $384 billion in target date retirement portfolios, down 2.3% from the previous month.

TROW remains focused on fortifying its business through planned initiatives, which are largely tied to the launch of investment strategies and vehicles, enhancing client engagement capabilities in each distribution channel, strengthening distribution channels, and improving the technology platform. These efforts along with a diverse business model are anticipated to stoke AUM growth.

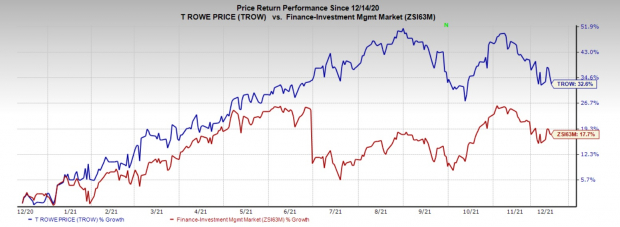

Over the past year, shares of T. Rowe Price have jumped 32.6%, outperforming the industry’s growth of 17.7%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Currently, T. Rowe Price carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Asset Managers

Invesco IVZ announced a preliminary AUM for November 2021. IVZ’s month-end AUM of $1,572.5 billion represented a decline of 1.3% from the previous month.

Invesco’s AUM was negatively impacted by unfavorable market returns, which decreased it by $17 billion. Moreover, the decline in total AUM balance was primarily due to money market net outflows of $7.5 billion. Because of foreign exchange rate movements, Invesco’s AUM declined by $4.6 billion.

AllianceBernstein (NYSE:AB) Holding L.P.’s AB AUM of $759 billion for November 2021 represented a decline of nearly 1% from $765 billion recorded at the end of the prior month.Market depreciation more than offset total firm-wide net inflows, which led to the fall in AUM for AllianceBernstein.

Nevertheless, AllianceBernstein’s global reach and solid asset balances are likely to boost top-line growth.

Franklin Resources (NYSE:BEN), Inc. BEN reported the preliminary AUM balance of $1,546.8 billion for November 2021. This reflects a marginal decrease of 0.95% from BEN’s October-end AUM balance of $1,561.7 billion.

Franklin witnessed a decrease in AUM primarily due to the negative impacts of markets, offset by long-term net inflows. Specifically, long-term net inflows were supported by $7.4 billion of new client accounts related to the Investment Grade Credit team that joined in the fourth quarter.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%.

You’re invited to immediately check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franklin Resources, Inc. (BEN): Free Stock Analysis Report

T. Rowe Price Group, Inc. (TROW): Free Stock Analysis Report

Invesco Ltd. (IVZ): Free Stock Analysis Report

AllianceBernstein Holding L.P. (AB): Free Stock Analysis Report

To read this article on Zacks.com click here.