Shares of Graco Inc. (NYSE:GGG) reached a new 52-week high of $114.65 during its trading session on Jun 20. This apex improved upon the last 52-week high of $114.52 on Jun 2.

In the last three months, shares of the company have rallied 21.06% outperforming the Zacks categorized Machinery General Industrial industry’s gain of 9.76%.

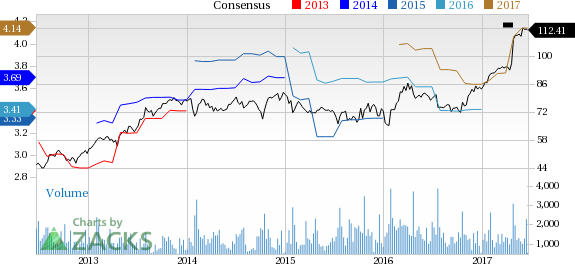

On Jun 20, Graco closed its trading session at $112.41, yielding a year-to-date return of roughly 36.4%. The trading volume for the session was approximately 0.19 million shares. Positive earnings estimate revisions for 2017 and 2018 along with an expected earnings growth rate of 10.30% for the next five years indicate the stock’s potential for further price appreciation.

Growth Drivers

In three of the last four quarters, Graco’s financial performance was impressive, with an average positive earnings surprise of 13.88%. In fact, positive market sentiments after a solid first-quarter 2017 results, with an earnings beat of 40%, led to roughly 12.6% gain in the company’s share price since Apr 26. A sneak peek into the results reveals that improvement in profitability was achieved on the back of healthy business in the Industrial, Process and Contractor segments driven by better pricing and higher production volumes. Margin profile improved while buybacks lowered outstanding shares in the quarter.

Also, upward revisions in Graco’s 2017 forecasts boosted market sentiments since the release of the results. On a constant currency basis, organic sales are now predicted to grow in mid single-digit versus the earlier expectation of sales growth in low single-digit. Geographically, sales are expected to increase in mid single-digit in all regions.

Notably, in Jun 2017, Graco revealed ToughTek CM20 continuous mixer, a more compact and portable device under the ToughTek brand of products. Also, the company announced a quarterly dividend of 36 cents per share to be paid on Aug 2 to shareholders on record as of Jul 17.

We believe the company’s solid prospects have led to the positive revisions in earnings estimates. Over the last 60 days, the Zacks Consensus Estimate for the stock gained 10.7% to $4.14 for 2017 and 10.9% to $4.46 for 2018. These estimates represent year-over-year growth of 16.65% for 2017 and 7.73% for 2018.

Zacks Rank & Other Stocks to Consider

With a market capitalization of $6.2 billion, Graco currently sports a Zacks Rank #1 (Strong Buy). Some other stocks worth considering in the machinery industry include Kennametal Inc. (NYSE:KMT) , Parker-Hannifin Corporation (NYSE:PH) and Regal Beloit Corporation (NYSE:RBC) . While Kennametal and Parker-Hannifin sport a Zacks Rank #1, Regal Beloit carries a Zacks Rank #2. (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kennametal’s earnings estimates for fiscal 2017 and fiscal 2018 were revised upward in the last 60 days. Also, the company’s average earnings surprise for the last four quarters was a positive 6.24%.

Parker-Hannifin’s average earnings surprise for the last four quarters was a positive 14.94%. Also, earnings expectations for fiscal 2017 and fiscal 2018 improved over the past 60 days.

Regal Beloit’s earnings estimates for 2017 and 2018 were revised upward in the last 60 days. Also, the company’s average earnings surprise for the last four quarters was a positive 1.48%.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Kennametal Inc. (KMT): Free Stock Analysis Report

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Regal Beloit Corporation (RBC): Free Stock Analysis Report

Graco Inc. (GGG): Free Stock Analysis Report

Original post

Zacks Investment Research