Global food products maker and distributor Sysco Corporation (NYSE:SYY) reported fourth-quarter fiscal 2017 results, wherein both earnings and revenues exceeded expectations. The acquisition of London-based Brakes Group (completed in July 2016) and margin improvement drove earnings.

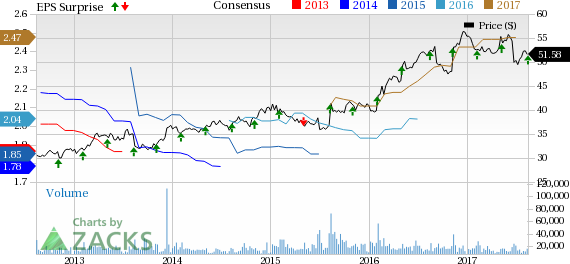

Adjusted earnings, including extra week of fiscal 2016, of 72 cents per share beat the Zacks Consensus Estimate of 71 cents by 1.4% and were up 12.5% year over year. In fact, the company’s earnings have outpaced the Zacks Consensus Estimate in six out of the past 7 straight quarters, including this one. Growth in sales, expense management, and improved gross and operating margin led to the upside. Excluding the Brakes acquisition and extra week, earnings increased 15.5% to 70 cents per share.

Quarter in Detail

Sysco's sales of $14.42 billion exceeded the Zacks Consensus Estimate of $14.23 billion by 1.4% and increased 5.7% on a year-over-year basis in fourth-quarter fiscal 2017. Excluding the Brakes acquisition and extra week, sales grew 3.4% to $13.1 billion.

Gross profit improved 10.3% to $2.8 billion in the quarter, while gross margin improved 80 basis points (bps) to 19.1%. The improvement was backed by the company’s ongoing growth strategy, which focuses on accelerating sales, reducing costs and mitigating ongoing gross margin pressure. Excluding the Brakes acquisition and extra week, gross profit margin increased 14 bps to 18.5%.

Adjusted operating income also rose 6.1% in the quarter to $666.8 million despite a 11.6% increase in adjusted operating expenses. Adjusted operating margin improved 2 bps to 4.6%. Excluding the Brakes acquisition and on a 13-week comparable basis, operating income was up 9.0% to $636.0 million, while margins improved 25 bps.

We are impressed with the fact that Sysco has delivered higher gross margins for the last nine consecutive quarters, after witnessing declining gross margins over the last two fiscals due to multiple factors. It seems that the company’s growth strategy is paying off and its efforts to boost sales and margins are bearing fruit. The company’s sales have also improved consistently, driven by acquisitions and volume growth.

In fact, if we look into the share price performance of the company over the last one year, we note that Sysco’s shares have declined 2.8% in the said time frame. However, the fall was narrower than 9.8% decline of the industry. Notably, the industry is part of the bottom 30% of the Zacks Classified industries (186 out of the 265).

Segment Details

The company reports through these operating segments: U.S. Foodservice Operations and International Foodservice Operations.

U.S. Foodservice Operations

Segment sales declined 3.8% to $9.8 billion. On a comparable 13-week basis, sales grew 3.6%, where local case volume within U.S. Broadline operations grew 2.7% for the fourth quarter and total case volume inched up 0.2%. Gross profit declined 3.4%, while adjusted operating income was $811 million, down 0.8% from the year-ago period. Excluding one extra week of fiscal 2016, gross profit increased 4.0%, while margin increased 9 bps to 20.2%. On a comparable 13-week basis, adjusted operating income increased 6.8%.

International Foodservice Operations

Segment sales almost doubled to $2.7 billion in the fourth quarter from $1.5 billion posted in the prior-year quarter. Adjusted operating income increased 163% to $92 million. The significant improvement in both sales and adjusted operating income is primarily attributable to the Brakes Group acquisition.

Fiscal 2017 Results

In fiscal 2017, adjusted earnings, including extra week of fiscal 2016, were $2.48 per share, which beat the Zacks Consensus Estimate of $2.47 by a penny. Earnings were up 18.1% year over year. Excluding the Brakes acquisition and extra week, earnings increased 13.6%.

Fiscal year sales of $55.4 billion beat the Zacks Consensus Estimate of $55.3 billion by 0.2% and increased 9.9% on a year-over-year basis. Excluding the Brakes acquisition and extra week, sales inched up 1.6%.

Other Financial Updates

Sysco ended fiscal 2017 ending Jul 1 with cash and cash equivalents of $869.5 million, long-term debt of $7.66 billion, and total shareholders’ equity of $2.38 billion.

During fiscal 2017, the company generated cash flow from operations of $2.24 billion and incurred capital expenditure of $663 million. Additionally, the company’s total free cash flow for the fiscal year totaled $1.6 billion.

Zacks Rank

Sysco currently carries a Zacks Rank #2 (Buy).

Some other top-ranked food stocks in the industry are Post Holdings Inc. (NYSE:POST) , Ingredion, Inc. (NYSE:INGR) and The Chefs' Warehouse, Inc. (NASDAQ:CHEF) .

Post Holdings has an average positive earnings surprise of 12.09% and sports a Zacks Rank #1 (Strong Buy). You can seethe complete list of today’s Zacks #1 Rank stocks here.

Ingredion has an average positive earnings surprise of 4.98%, while Chef’s Warehouse has an average positive earnings surprise of 0.08%.

Both Ingredion and Chef’s Warehouse carry a Zacks Rank #2.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Sysco Corporation (SYY): Free Stock Analysis Report

Ingredion Incorporated (INGR): Free Stock Analysis Report

Post Holdings, Inc. (POST): Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF): Free Stock Analysis Report

Original post