Synopsys, Inc. (NASDAQ:SNPS) recently acquired Kilopass Technology, a provider of one-time programmable (OTP) non-volatile memory (NVM) IP with applications in automotive, mobile, industrial, and Internet of Things (IoT) areas.

Per the press release, “Kilopass Technology's one-transistor (1T) and two-transistor (2T) bitcell OTP NVM IP complements Synopsys' existing DesignWare® OTP and MTP NVM IP solutions with support for up to 4-Mbit OTP instances in 180-nm to 7-nm process technologies.”

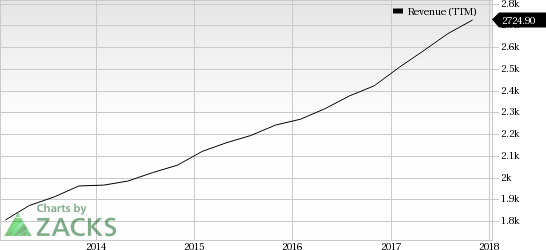

The buyout will help Synopsys offer a wide portfolio of efficient IP solutions. The customers are expected to gain from the combined force of the two companies, while the robust portfolio is expected to be a top-line booster for Synopsys going ahead.

Synopsys stock has gained 46.7% year to date, substantially outperforming the 36.7% rally of the industry it belongs to.

Synopsys’ Inorganic Tuck-Ins

Synopsys has made a few important acquisitions to build its product portfolio and stimulate growth. Also, since intense competition is making the EDA market tougher to penetrate, acquisitions have helped the company to boost revenues.

Notably, Kilopass is the company’s second acquisition aimed at expanding its designware IP portfolio within the last three months. In October 2017, Synopsys acquired Sidense Corporation, which also deals with OTP NVM IP.

Last year, Synopsys also acquired QuantumWise, which works on delivering software tools for atomic-scale modeling of materials. The integration of QuantumWise with Synopsys' Sentaurus TCAD will aid Synopsys to better manage simulation tasks and analyze simulation results.

The company also completed the buyout of Black Duck Software, which is a provider of solutions related to security and management of open source software. Black Duck’s flagship product, Software Composition Analysis is anticipated to enhance Synopsys’ solutions as well as broaden its clientele, thus boosting the top line.

Conclusion

The acquisitions have expanded the company’s product suite, thereby driving the company’s top line. This is evident from the company’s fourth-quarter revenues that jumped 9.9% year over year to $696.6 million.

We believe the unique intellectual properties and global support provided by Synopsys are likely to drive its near-term performance. The company’s recent product launches and deal wins will boost results, going ahead.

However, uncertainty regarding the exact time of realizing acquisition synergies keeps us on the sidelines. Moreover, escalating costs and expenses, which are putting pressure on margins, make us increasingly cautious about its near-term profitability. Further, customer concentration risk remains a huge concern for the company.

Zacks Rank and Stocks to Consider

Synopsys has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the sector are NetApp, Inc. (NASDAQ:NTAP) , Broadcom Limited (NASDAQ:AVGO) and NVIDIA Corporation (NASDAQ:NVDA) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term expected EPS growth rate for NetApp, Broadcom and NVIDIA is projected to be 11.3%, 13.8% and 10.6%, respectively.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

NetApp, Inc. (NTAP): Free Stock Analysis Report

Synopsys, Inc. (SNPS): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research