Synchrony Financial’s (NYSE:SYF) second-quarter 2017 earnings per share of 61 cents surpassed the Zacks Consensus Estimate by 5.1%. The bottom line also grew 5.1 % from the year-ago quarter.

Results in Detail

The company’s net revenue, represented as net interest income, increased 13% to $3.64 billion, primarily due to strong loan receivables growth. Net interest income after retailer share arrangements increased 16%.

However, other income was down 31% to $57 million, largely driven by an increase in loyalty program expenses.

Loan receivables grew 11% year over year to $75 billion.

Deposits were $53 billion, up 14% from the last-year quarter.

Purchase volume increased 6% from the second quarter of 2016

Provision for loan losses increased 3% year over year to $1,326 million, due to credit normalization and loan receivables growth.

Other expenses increased 8.6% to $911 million, primarily due to business growth.

Sales Platforms Update

Retail Card

Interest and fees on loans grew 12% year over year, driven primarily by period-end loan receivables growth of 10%.

Purchase volume growth was 7% and average active account rose 3%.

Loan receivables growth was broad-based across partner programs.

Payment Solutions

Interest and fees on loans rose 14% year over year on the back of period-end loan receivables growth of 11%.

Purchase volume growth was 6%, adjusted to exclude the impact from the hhgregg bankruptcy, and 11% rise in average active account.

Loan receivables growth was led by home furnishings and automotive.

CareCredit

Interest and fees on loans increased 12% year over year, driven by period-end loan receivables growth of 11%.

Purchase volume growth was 11% and average active account growth was 10%.

Loan receivables growth was led by dental and veterinary.

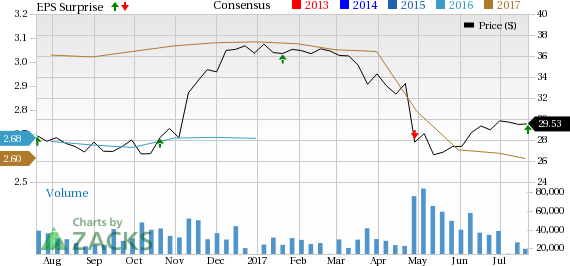

Synchrony Financial Price, Consensus and EPS Surprise

Financial Position

Total Assets as on Jun 30, 2017 was $91.1 billion, up 10.6% year over year.

Total borrowings as on Jun 30, 2017, was $20.71 billion, up 7.3% year over year,

The company’s balance sheet remained strong during the quarter, with total liquidity of $22 billion, or 24% of total assets.

Return on assets was 2.2% and return on equity was 13.8%.

Efficiency ratio was 30.1% compared with 31.9% in the second quarter of 2016, driven by strong positive operating leverage.

Share Repurchase and Dividend Update

In the second quarter, the company announced a new capital plan under which the quarterly common stock dividend rose to 15 cents per share. It also announced approved share repurchases of up to $1.64 billion of Synchrony Financial common stock.

Business Update

During the second quarter, the company signed a new partnership with Zulily and renewed relationships with MEGA Group USA, City Furniture and National Veterinary Associates. It also launched new programs with Nissan and Infiniti.

Zacks Rank

Synchrony Financial presently carries a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the Finance sector that have reported their second-quarter earnings so far, Brown & Brown, Inc. (NYSE:BRO) and RLI Corp. (NYSE:RLI) beat their respective Zacks Consensus Estimate, while The Progressive Corporation (NYSE:PGR) lagged expectations.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Synchrony Financial (SYF): Free Stock Analysis Report

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

RLI Corp. (RLI): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post