Synchrony Financial (NYSE:SYF) will release second-quarter 2017 results on Jul 21, before the market opens.

Last quarter, the company delivered a negative earnings surprise of 17.57%. Let’s see how things are shaping up for this announcement.

Q2 Flashback

Synchrony Financial’s top line is likely to have grown on the back of strong deposit generation, loan receivables as well as increased online purchases.

Rapidly rising CareCredit receivables are likely to have driven top-line growth.

The launch of Synchrony Car Care program is likely to have bolstered the company’s membership growth.

Strong value propositions and promotional offers in the cards should have boosted active accounts growth, in turn, driving revenues.

The company expects its net margin to further improve in the second quarter on the back of loan receivables growth.

However, continued strong growth in lower yielding payment solution receivables has likely put pressure on margins in the to-be-reported quarter.

The company expects the net interest margin to come in at the low-end of the range in the second quarter, as it intends to carry more liquidity in the quarter.

An increase in spending on strategic investments is expected to have drained the bottom line in the second quarter.

Earnings Whispers

Our proven model does not conclusively show whether Synchrony Financial is likely to beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Synchrony Financial has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate stand at 58 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Synchrony Financial carries a Zacks Rank #3. Though the company has a favorable Zacks Rank, its ESP complicates surprise prediction.

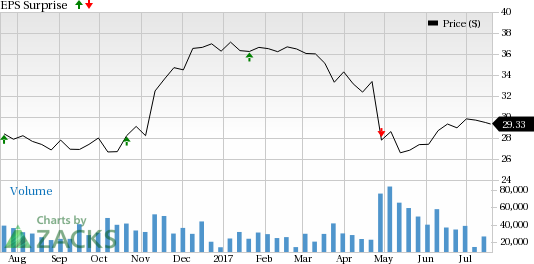

Synchrony Financial Price and EPS Surprise

We caution against Sell-rated stocks (Zacks Rank #4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some other companies from the Finance sector that you may want to consider as these have the right combination of elements to post an earnings beat this quarter:

Aon plc. (NYSE:AON) , which is set to report second-quarter earnings on Aug 4, has an Earnings ESP of +0.69% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cigna Corp. (NYSE:CI) has an Earnings ESP of +0.81% and a Zacks Rank #2. The company is set to report second-quarter earnings also on Aug 4.

Sun Life Financial Inc. (TO:SLF) has an Earnings ESP of +4.17% and a Zacks Rank #2. The company is set to report second-quarter earnings on Aug 9.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Synchrony Financial (SYF): Free Stock Analysis Report

Aon PLC (AON): Free Stock Analysis Report

Sun Life Financial Inc. (SLF): Free Stock Analysis Report

Cigna Corporation (CI): Free Stock Analysis Report

Original post