The share price of Synaptics Inc. (NASDAQ:SYNA) dropped to a new 52-week low of $42.50, eventually closing a tad bit higher at $42.58 on Aug 8.

The underperformance can be attributed to growing headwinds related to sluggish demand in China. Notably, management had lowered fourth-quarter fiscal 2017 guidance following the announcement of the acquisitions of Conexant Systems and Multimedia Solutions business of Marvell Technology Group in mid-June.

We note that these headwinds have pulled down current year earnings estimates over the last 30 days. The Zacks Consensus Estimate for fiscal 2018 declined 0.65% to $3.02 over the last 30 days, as both the analysts covering the stock revised their estimates downward.

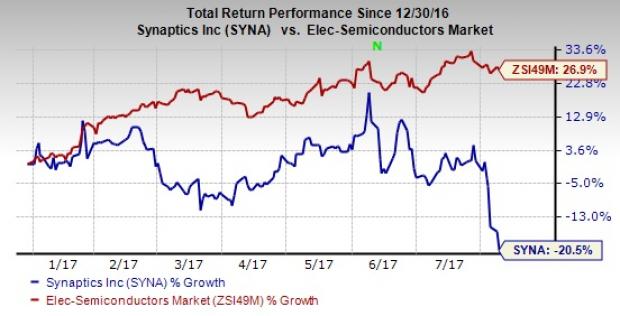

We note that since its first-quarter results (announced on Aug 3), the stock has plunged a massive 21.2%. Shares of Synaptics have lost 20.5% of its value year to date against 26.9% growth of its industry.

Key Factors

Synaptics reported adjusted fiscal fourth-quarter 2017 earnings (including stock-based compensation) of 85 cents per share, which beat the Zacks Consensus Estimate of 74 cents.

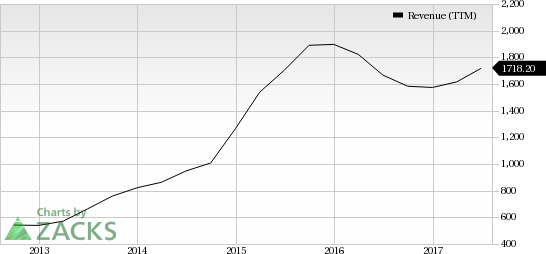

Revenues were almost in line with the Zacks Consensus Estimate of $427 million. However, there was a sequential decline of 4%. The decline in revenues can primarily be attributed to a 6% decrease in mobile revenues sequentially. The decline in mobile revenues was mostly because of continued weakness in the China mobile market.

Moreover, non-GAAP gross margin of 32.6% for the fourth-quarter was below the guided range. Management stated that overall product mix and ramping up of a particular product played massive roles for the lower than expected margins.. Lastly, non-GAAP net income of $173.9 million for fiscal 2017 was down 4% from $180.5 million last fiscal year.

Also, competition from Atmel, Elan Microelectronics, Focaltech Systems, Goodix remains a concern for the company.

Zacks Rank and Stocks to Consider

Currently, Synaptics has a Zacks Rank #4 (Sell).

Better-ranked stocks in the broader technology sector include Alibaba Group (NYSE:BABA) , Lam Research (NASDAQ:LRCX) and Activision Blizzard (NASDAQ:ATVI) all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Alibaba, Lam Research and Activision Blizzard are projected to be 28.97%, 17.20% and 13.63%, respectively.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Synaptics Incorporated (SYNA): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post

Zacks Investment Research