Technology infrastructure concern Switch Inc (NYSE:SWCH) is about to release earnings for the fourth time since going public in October, with the company set to report after the close Monday, Aug. 13. Last quarter, the shares fell 14.9% the day after earnings, and 15.6% the quarter before that. Going by options data, Wall Street is expecting another huge move this time, with implied volatility data pricing in a 12.5% swing for Tuesday's session.

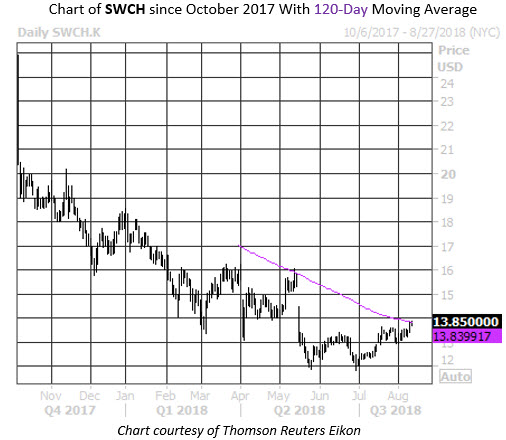

Such a bleak history doesn't bode well for a stock that has struggled so poorly on the charts. SWCH has carved out a series of lower highs and lows since its October IPO. Year-to-date, the equity has shed 24%, guided lower by its descending 120-day moving average since March. SWCH fell to a record low of $11.85 on June 28, and another post-earnings move to the downside could have the stock testing these lows once more.

Continued technical struggles could spark a flurry of bear notes. Of the 10 brokerages covering SWCH, 70% rate it a "buy" or "strong buy," with zero "sells" on the books. Furthermore, the security's average 12-month price target of $16.82 is a 22% premium to its current perch of $13.85. Downgrades and/or price-target cuts could certainly pressure the beleaguered stock lower.

Meanwhile in the options pits, the top open interest strike by far is the August 15 call, with more than 3,000 contracts outstanding. At the same time, any call activity on SWCH could be coming from short sellers hedging, with more than one-third of the total float tied up in short interest.