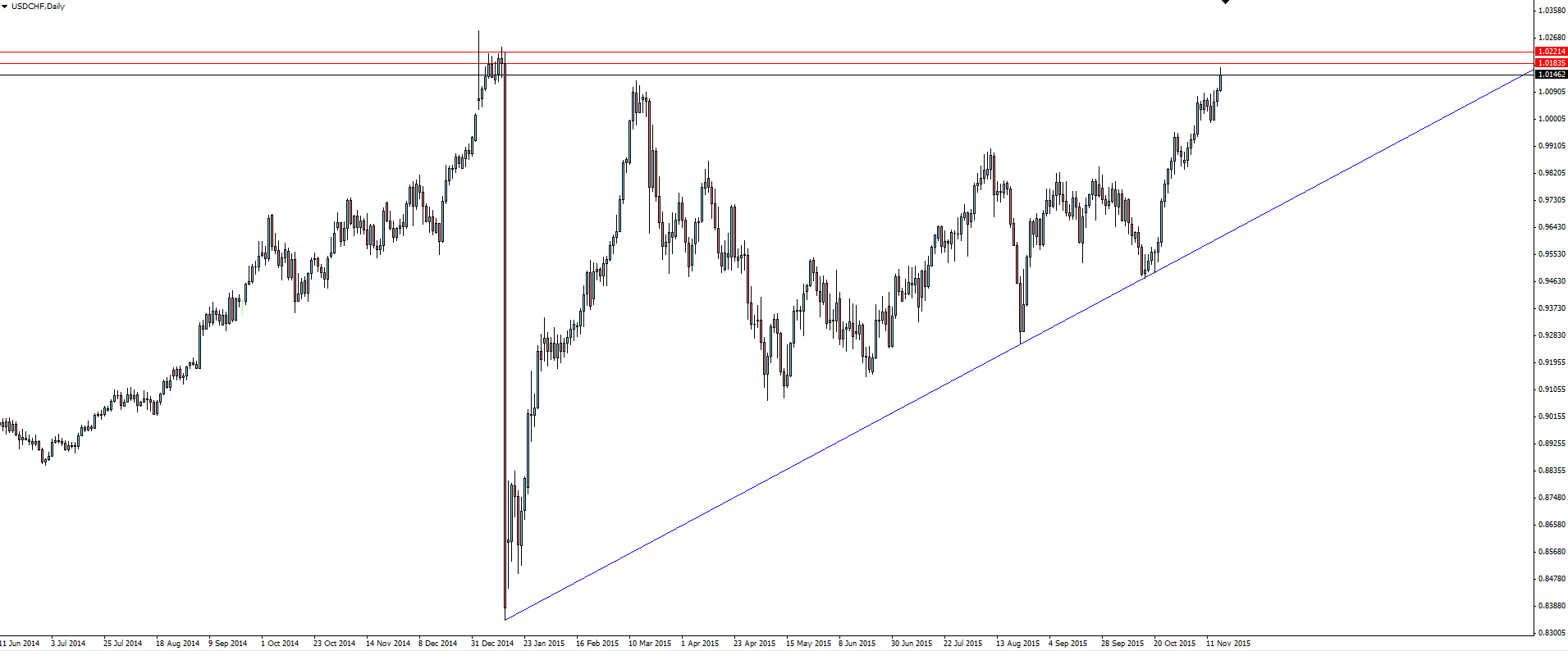

And just like that, USD/CHF is back trading at the strongest level since the 1.20 EUR/CHF Swiss National Bank price floor was abandoned back on January 15.

The Swissy is back at 10 month highs, reaching the high as I publish this article of 1.01699. Remember that price did get up close to this level back in March but this time has a feeling of inevitability around a break.

USD/CHF Daily:

Click on chart to see a larger view.

So are we expecting a pop above the level? Definitely!

I’m not a fan of Central Bank intervention as 99% of the time, fighting the market is absolutely useless. We saw this when the SNB tried to keep the CHF at unnaturally weak levels against the Euro and we all know that the market was the winner in that battle.

But this isn’t intervention. The SNB of course hasn’t changed its stance of looking for a weaker CHF to help stimulate their own economy. While the ridiculous EUR/CHF price floor has gone, the central bank’s monetary policy muscle hasn’t, with negative rates now in full swing.

With the Fed also on track to raise rates in December, could this be your pre-pop opportunity to get long?

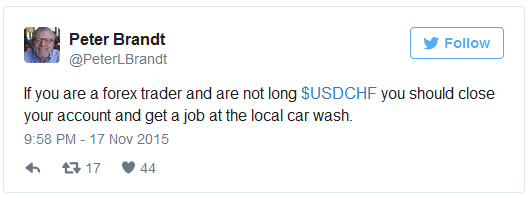

I just had to include this piece of Peter Brandt brilliance to wrap it up.

I haven’t yet got a short term entry signal so handed in my resume at the local car wash. I was quickly rejected with the following message:

“So your experience is you swap imaginary money for more imaginary money? You have zero applicable skills for the real world and your application has been rejected.”*

A simple no would have sufficed… Guess I’ll stick it out in the trading world!

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd, does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, Forex news, research, Forex technical analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.