Forex News and Events

Swiss PMI beats expectations

The latest data from Switzerland suggest that the Swiss economy did manage to weather the summer months better than expected. After a surprised read of the KoF leading indicator, which came in at 100.7 versus 100.3 median forecast, the manufacturing PMI rose to 52.2 in August, above consensus and previous reading of 49.8 and 48.7, respectively. This good performance is mostly due to a rebound in production and backlog of orders which rose to 62.4 and 52.4 points, respectively. The quantity of purchase also increased significantly in August but this improvement has been made possible by lower commodity prices.

Despite these encouraging figures, we remain negative on the Swiss economic outlook and recommend to take these figure with a grain of salt. First of all, industrial activity has historically been more modest during the summer months. As a matter of fact, without seasonality adjustment, August’s PMI is flat compared to July, at 49.4. Secondly, the turmoil in China will likely affect negatively the Swiss manufacturing industry as we can reasonably expect a lower demand for Swiss products from the world’s second biggest economy. The reaction to the data on the currency market was muted, EUR/CHF is treading water around 1.0850.

Canada toward recession?

Low םil prices are likely to have a significant impact on the Canadian GDP figure that will be released today. The June figure is expected to print at 0.2% month-on-month while the Q2 annualized data for should come around -1.0% year-on-year. We think that the Canadian economy will enter into a technical recession. In other words, it corresponds to two quarters in a row of economic contraction. We anticipate a weak read on the GDP as the country is still suffering from low commodity prices.

The USD/CAD is trading around its highest level of the year. The recent surge in oil prices will provide a breather to the country for which oil is the major industry. However even if the WTI is now holding below $50 a barrel, it was below $40 less than a week ago. Volatility is just massive at the moment. Hence, a surge might be temporary and we are still looking for evidence of consolidation.

Nonetheless, we think that, despite a Q2 GDP expected lower, the loonie will gain positive traction as any upward move in oil prices strengthens the Canadian currency. In addition, against the backdrop of a future delayed U.S. rate hike, we target the pair to challenge the 1.3000 level.

The Fed weigh on FX

Markets continue to debate the timing of the US Feds rate hike, driving FX volatility. EUR/USD has reversed bearish its direction heading to 1.1320 in early European trading. Yet, the divergence in views is not only limited to the market but US Fed members seem also contradictory. Fed Vice Chair Stanley Fischer provided a hawkish speech at Jackson Hole Symposium conflicting with NY Fed President Dudley earlier concern over the path of inflation. This week’s incoming data has been less supportive of a September rate hike in contrast to last week’s solid data. Yesterday, ISM Milwaukee fell to 47.67 below the 50 expansion level and Chicago purchase manager dipped marginally to 54.4. Currently a 2015 US rate hike is fully price in, with the higher probability being a December increase. However, upside surprise in data will clearly have September expectations reignited. Today traders should see ISM manufacturing anticipated to come in at 52.5 from 52.7 Julys read. Given the dynamic nature of Fed expectations combined with fluidity of events in China, FX markets should stay range bound and choppy. Short-term positioning would be advantageous. We remains constructive in the USD and see current weakness in an opportunity to reload longs (primarily against the JPY and CHF).

GBP/USD - Trading Around The 200-Day MA

The Risk Today

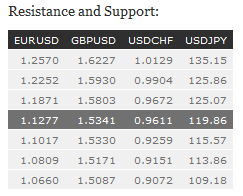

EUR/USD is setting higher lows. We consider that we are in a short-term upside momentum. Hourly resistance lies at 1.1714 (24/08/2015 high). Hourly support can be found at 1.1236 (27/08/2015 low). In the longer term, the symmetrical triangle from 2010-2014 favored further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). We have broken the resistance at 1.1534 (03/02/2015 reaction high). We are entering an upside momentum.

GBP/USD has broken hourly support at 1.5425 (07/08/2015 low). Hourly resistance is given at 1.5930 (18/06/2015 high). We now target hourly support at 1.5330 (08/07/2015). In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USD/JPY is now below the 200-day moving average. Support is given at 115.57 (16/12/2014 low) which is also a long term support. Stronger support can be found at 113.86 (10/11/2014 low). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF is pushing downward. Hourly resistance is located at 0.9690 (31/08/2015 high). Hourly support is given at 0.9151 (18/06/2015 low). The pair is likely to consolidate above 0.9600. In the long-term, the pair has broken resistance at 0.9448 suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).