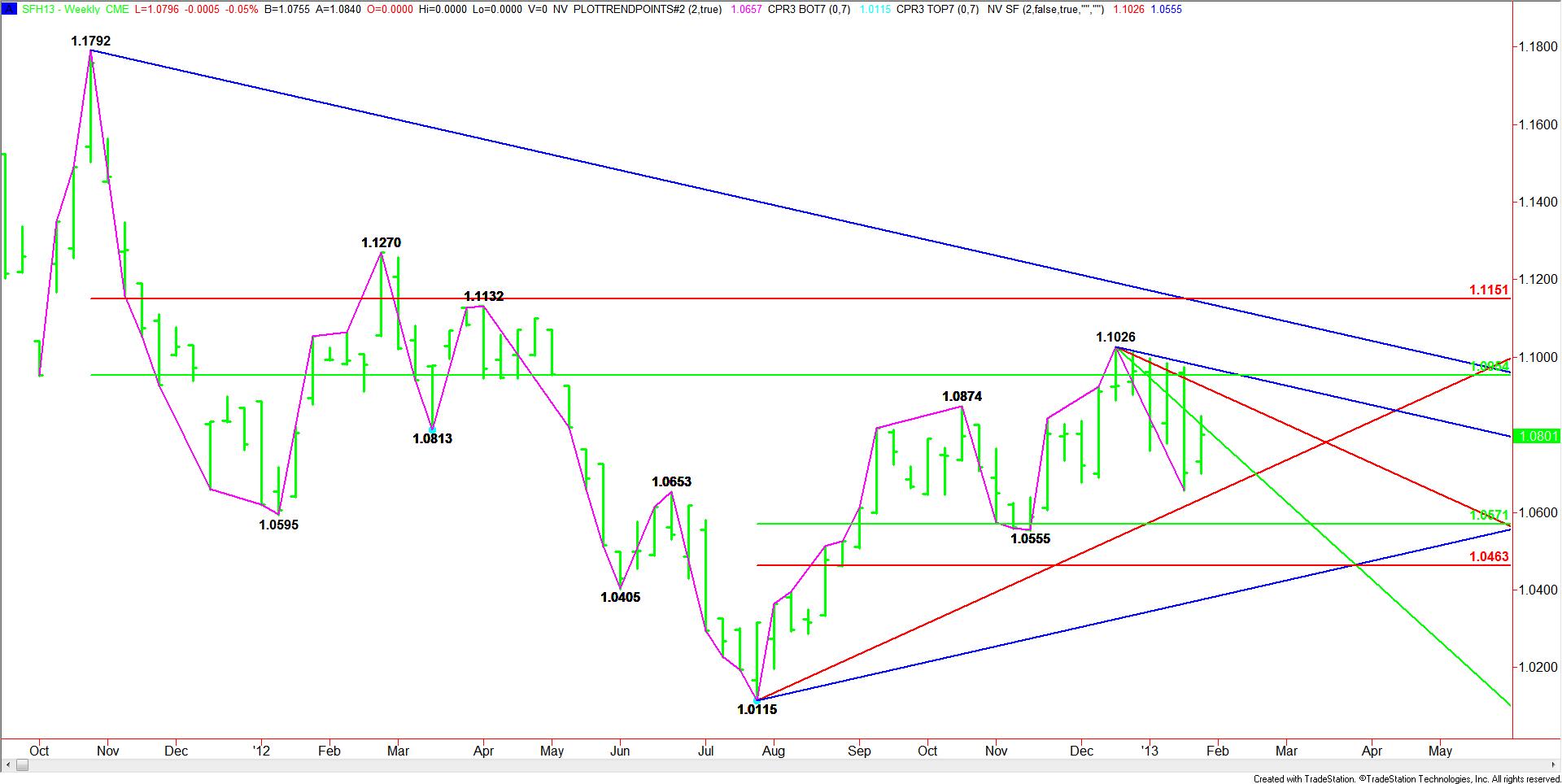

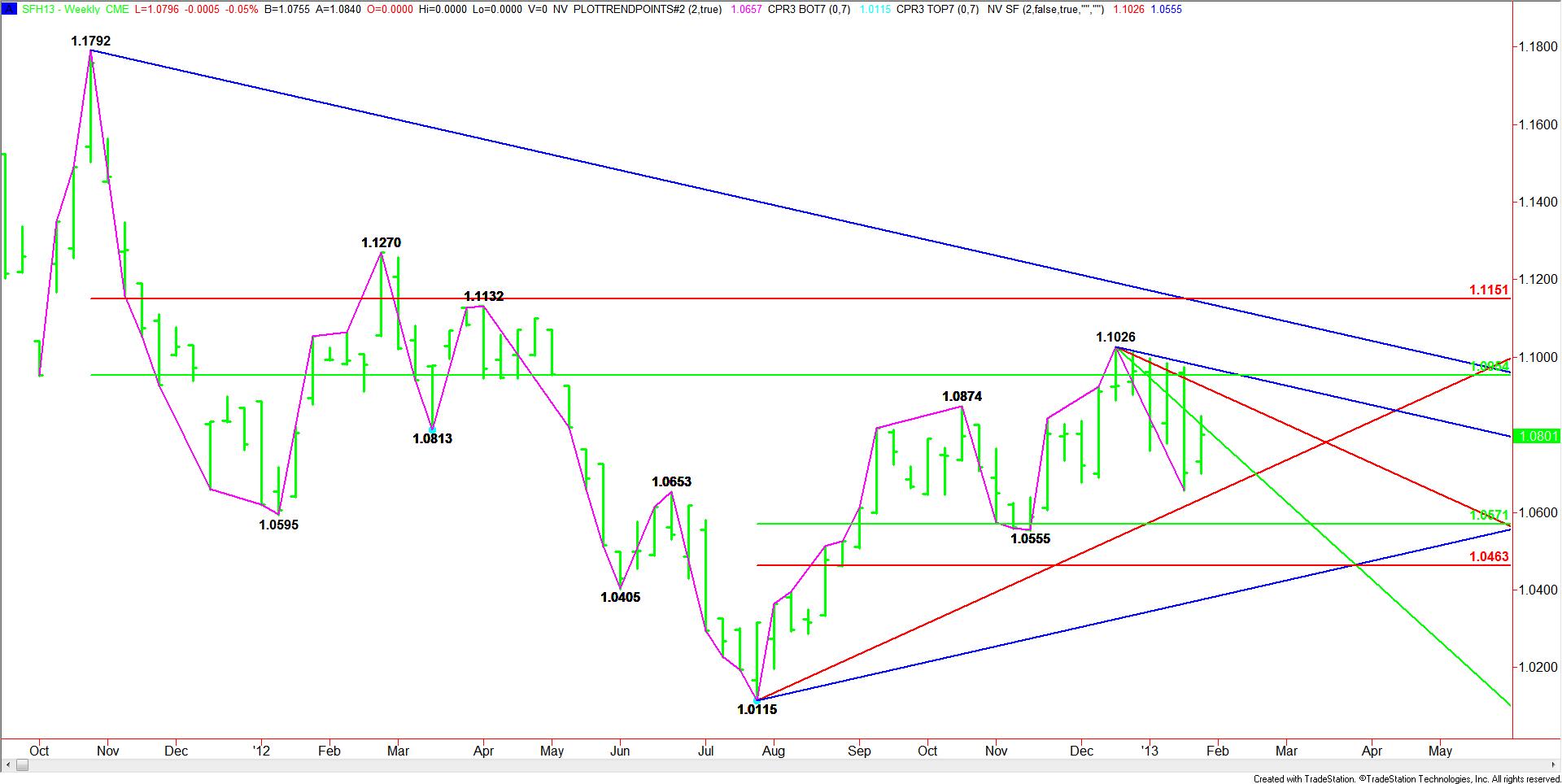

After a sharply lower close the week-ending January 18, the March Swiss Franc futures contract posted an inside week and higher close on Friday. With the main trend up on the weekly chart, last week’s move could be an indication that traders are preparing to resume the trend after a four-week sell-off from the December 20 top at 1.1026.

During the break, it looked as if the market was headed toward uptrending Gann angle support at 1.0655. If this had failed then the market could’ve changed the trend to down while testing a 50 to 61.8 percent retracement zone at 1.0571 to 1.0463.

In order to resume last week’s rally, the market will have to overcome a downtrending Gann angle at 1.0786 early in the week. A move through this angle could trigger a further rally to 1.0906. Based on the main range of 1.1792 to 1.0115, a retracement zone was created at 1.0954 to 1.1151. The former could prove to be solid resistance since it forms a cluster with 1.0966.

The main trend is up because of the higher-tops and higher-bottoms. A trade through 1.0555 turns the main trend to down. A move through 1.1026 will mean the uptrend has resumed.

During the break, it looked as if the market was headed toward uptrending Gann angle support at 1.0655. If this had failed then the market could’ve changed the trend to down while testing a 50 to 61.8 percent retracement zone at 1.0571 to 1.0463.

In order to resume last week’s rally, the market will have to overcome a downtrending Gann angle at 1.0786 early in the week. A move through this angle could trigger a further rally to 1.0906. Based on the main range of 1.1792 to 1.0115, a retracement zone was created at 1.0954 to 1.1151. The former could prove to be solid resistance since it forms a cluster with 1.0966.

The main trend is up because of the higher-tops and higher-bottoms. A trade through 1.0555 turns the main trend to down. A move through 1.1026 will mean the uptrend has resumed.