In one of the most overlooked currency pairs, the CHF/JPY pair has pulled back rather drastically over the last several sessions. However, I think it’s a bit of a disservice traders due to themselves overlooking this pair. It’s essentially a battle between two safety currencies, and it can give you a heads up as to where you trade both of these currencies against other currencies. For example, if the Swiss franc is rallying against the Japanese yen, and the Euro is falling. It’s simple, you sell the EUR/CHF pair. Of course, the opposite is true. It’s a principle I use all the time called triangulation.

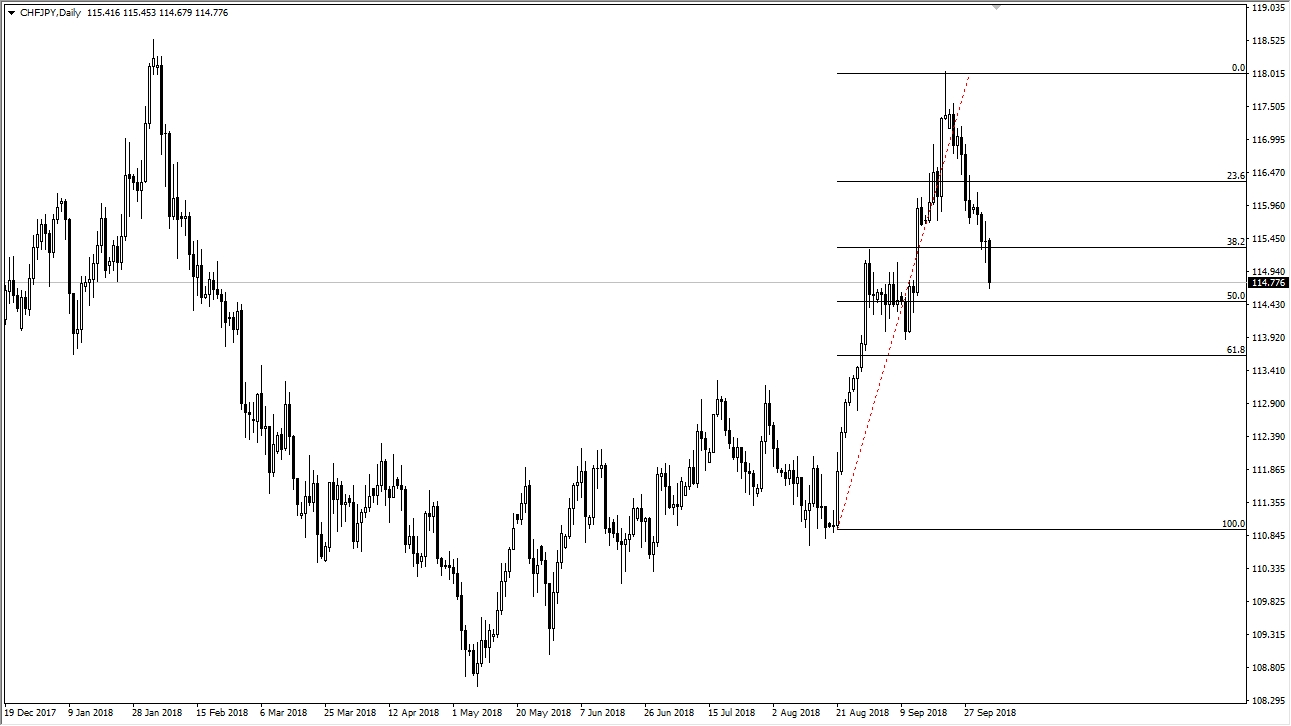

However, this is also a very stable pair as it is to relatively stable currencies. During the session on Thursday, we have fallen back towards the ¥114.50 level, an area that has seen a lot of clustering and a bullish flag as of late. Beyond that, the 50% Fibonacci retracement level is found at that region also. Because of this, I think the first signs of support on the short-term charts make an excellent trade featuring reasonable reward to risk ratio. For example, if I were to go long of this market I would anticipate a move all the way to the ¥118 level over the longer-term. However, if we break down below the ¥113.85 level, then it’s time to bail out.