Street Calls of the Week

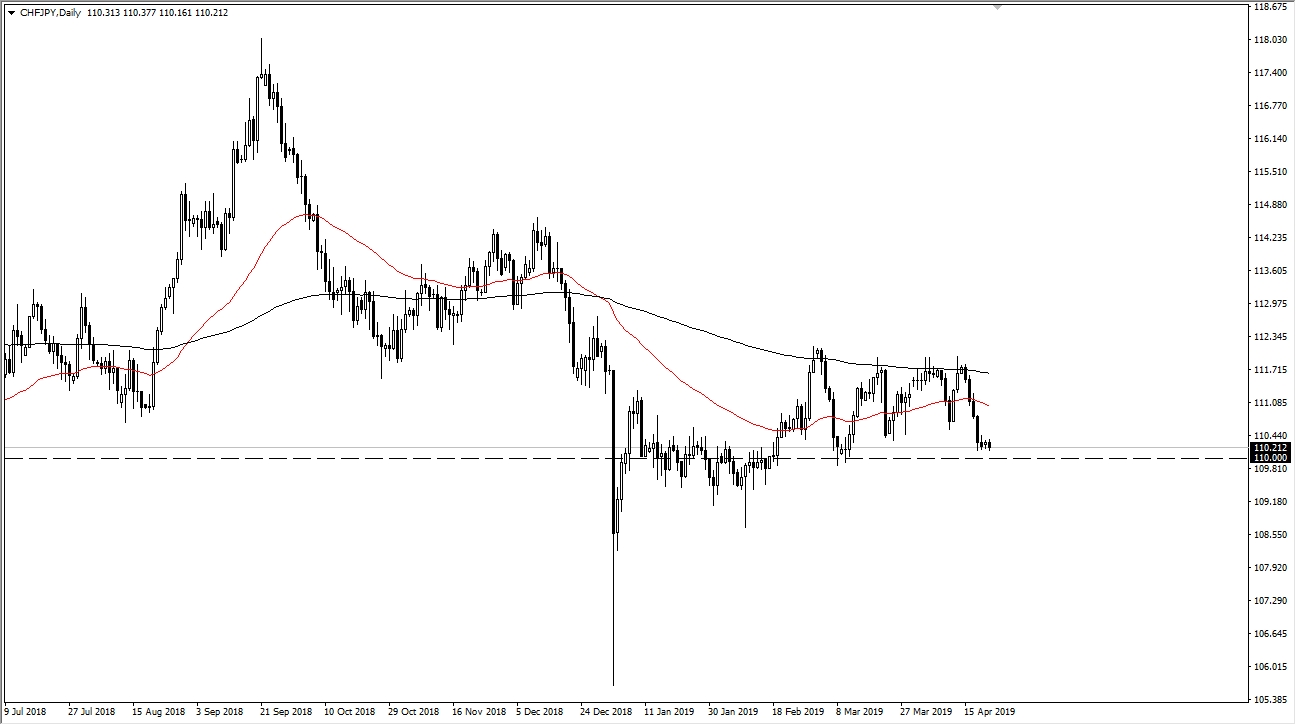

The CHF/JPY pair has done very little during the day on Monday which of course is that much of a surprise considering that the banks in Europe were closed. That being said we are approaching a rather significantly support level as far as psychological importance is concerned as the ¥110 level will, of course, would cause a bit of reaction. Beyond that, there is a lot of noise underneath that extends down to the ¥109 level, meaning that we should have a significant amount of support. At this point, it’s very likely that the buyers could return or rather soon.

That being said, there is a 50 day EMA turning lower just above, but it would make more sense for the market to reach towards the 200-day EMA, which is pictured above there at roughly ¥111.70 level. However, if we did break down below the ¥109 level, then the market could reach as low as ¥106 but that is not the base case scenario currently.

This is an interesting pair to pay attention to because both of them are considered to be safety currencies, so the most important thing about this chart is to know where to put your money in the case of a flight to safety. For example, if riskier currency such as the Australian dollar selling off, you want to short the Aussie against whatever one of these currencies is gaining. So if we bounce from here, and we want to short something such as the Aussie dollar, then you want to short the AUD/CHF pair, as it should run further to the downside than the AUD/JPY pair. Obviously, the exact opposite can work so keep an eye on this chart, even if it doesn’t give you trade by itself, can be quite profitable. Remember, Forex is all about relative strength.

As things stand now, it would be very bullish if we can break above the ¥110.50 level, as we could reach towards the previously mentioned 200-day EMA.