Forex News and Events

The FX trading follows a typical risk-off trend amid Saudi Arabia’s air strikes in Yemen. The tensions in the Middle East lead to a broad sell-off in equity markets, sizeable capital outflow in high-yield EM and safe heaven flows into the Gold, Swiss franc, the yen and the USD. The US dollar is broadly weaker against the majority of its G10 peers (following the surprise contraction in US durables goods in February and related dovish Fed positions), while the high yielding EM (TRY, ZAR and BRL) come significantly under selling pressures. Oil currencies are the best performers this Thursday verse the USD with RUB, NOK and CAD pushing gains to 1.55%, 1.01% and 0.75% at the time of writing.

Gold hits $1,220, WTI rallies more than 5% on bombings in Yemen

As Saudi Arabia and its allies start bombing Yemen, the risk sentiment in the market reverse abruptly. Gold rallied to $1,220 as Middle East rush into the safe heaven assets while the WTI and Brent crude reversed March weakness on speculations that the unrest in the Middle East should disrupt the oil supply from world’s largest oil producers. As the hike in oil prices boost demand in oil currencies, led by NOK, CAD and the RUB, the oil dependent BRL and TRY underperform creating interesting theme trading opportunities for short-term profit seekers.

Following the risk-off rally, the XAU/USD fully gained back March losses and advanced to Fibonacci 50% ($1,219.89) on January-March sell-off. The SPDR (ARCA:GLD)gold holdings which have eased to 743.21 metric tons as of March 25th from 771.25 metric tons end of February, signal there is room for further recovery in the gold market. With trend and momentum indicators pointing the buy side, an advance to 200-dma ($1,237.75) is now comfortably envisaged.

Risk-off adds on CHF-positive pressures

The risk-off pressures due to Yemen bombing understandably reinforce the safe heaven inflows into the franc. On top of euro-skeptical flight-to-security, the broad-based risk-off sentiment prevent the EUR/CHF from holding ground above 1.05. As the support from the USD/CHF wanes, we see two possible scenarios for the EUR/CHF. First, the SNB’s struggle to prevent the franc from appreciating will surge tensions on the Swiss rate markets by increasing the probability of an emergency rate cut. In this context, the SNB’s implicit commitment to keep EUR/CHF within 1.05/1.10 will revive the market appetite to challenge the SNB and keep the EUR/CHF more close to 1.05 bottom rather than to 1.10 ceiling. With the EUR correction underway and the political discontent regarding the negative rate environment, we however see no immediate need to add more pressure on banks and pension funds. And the easing pressures on the euroswiss futures support this view. This reasoning bring us to the second alternative where, the SNB will take advantage of its post-January 15th vague communication and implicit target strategy and let the EUR/CHF fade at acceptable pace toward the parity and hope that the upside pressures verse the US dollar would not take long so to counterbalance the overall franc strength.

The Risk Today

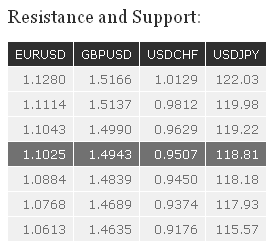

EUR/USD continues to post higher lows since its March low, indicating a persistent short-term buying interest. However, given the key resistance area between 1.1043 and 1.1114, the upside potential seems limited. Hourly supports can be found at 1.0884 (intraday low) and 1.0768. In the longer term, the symmetrical triangle favours further weakness towards parity. As a result, any strength is likely to be temporary in nature. Strong resistances stand at 1.1114 (05/03/2015 low) and 1.1534 (03/02/2015 high). Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support).

GBP/USD has bounced near the support at 1.4839. A decisive break of this support is needed to suggest the end of the current bounce. A resistance can be found at 1.4990, while a key resistance area stands between 1.5137 and 1.5166. Another hourly support lies at 1.4689 (19/03/2015 low). In the longer-term, the break of the strong support at 1.4814 opens the way for further medium-term weakness towards the strong support at 1.4231 (20/05/2010 low). Another strong support stands at 1.3503 (23/01/2009 low). A key resistance can be found at 1.5552 (26/02/2015 high).

USD/JPY has broken the key support at 119.30 (see also the rising trendline). A support now stands at 118.18 (61.8% retracement). Hourly resistances can be found at 119.22 (24/03/2015 low) and 119.98. Another support lies at 116.66 (02/02/2015 low). A long-term bullish bias is favoured as long as the key support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favoured. A key resistance stands at 121.85 (see also the long-term declining channel).

USD/CHF remains weak after the break of its key support at 0.9629. A test of the support at 0.9450 (see also the 38.2% retracement) is likely. Hourly resistances can be found at 0.9629 (previous support) and 0.9695 (24/03/2015 high). In the longer-term, the bullish momentum in USD/CHF has resumed after the decline linked to the removal of the EUR/CHF floor. A test of the strong resistance at 1.0240 is likely. A key support can be found at 0.9374 (20/02/2015 low, see also the 200-day moving average).