Forex News and Events

Swiss CPI disappoints

In Switzerland, consumer prices increased less than expected in September, rising 0.1% month-over-month, versus an expected increase of 0.2% as the period of the summer sales ended. On a year-over-year basis, the inflation gauge contracted 0.2%, well below median forecast of 0.0%. The lower reading is mainly due to the downside pressure of transport (-1.9%y/y), goods & furniture (-2%y/y) and alcohol & tobacco (-0.9%y/y) components. Overall, the strength of the Swiss franc will continue to weigh on prices as international investors are not yet ready to give up on the security embedded in the Swiss currency.

Just last week the SNB had to intervene in the FX market to defend the Swiss franc. This assumption is strongly supported by the sharp increase in domestic sight deposits in the week ending September 30. Domestic sight deposits rose by more than 8 billion CHF to 452.9 billion, the largest increase since the removal of the floor back in January 2015. Last week, EUR/CHF dropped sharply towards the 1.08 level before bouncing to 1.0975, up 1.50% on the move. FX reserves are due for release tomorrow morning and are expected to increase accordingly.

USD rally nearly finished

Better than expected US economic data and hawkish Fed speak has reinforced view that a 25bp interest rate hike could come in December. Both Richmond Lacker and Chicago Evans stated there was a solid argument for the Fed to raise rates once by the end. While ISM non-manufacturing, factory orders and rebound in exports highlighted an economy accelerating. Even the September ADP employment report which showed considerable decelerating in private jobs gains, due to weakness in service-providing sector, 154k from 177k prior read was not the collapse many had forecast. The net results have been a rapid increase in Fed fund expectations to 65% for December while US front-end yields have rallied. The move has not been drastic enough to unhinge high yielding positions (ie wide real yield differential). However, those assets low yielding assets have come under selling pressure. Within the currency space JPY, CHF and GBP has been victim of steady liquidations. Should we continue to see US yields increase the exodus will only escalate. However, we don’t see US economic data providing a conclusive indication of economic strength but rather a mixed-uncertain picture which will constrain further pressure on December rate hike expectations. While Asia EM growth remains an encouraging story, the rest of the global outlook is weak. This external pressure should continue to drag on any real acceleration of US growth. Even if a Fed rate hike gets fully price in, the tepid economic outlook will limit a steeper interest rate path. In regard to the Fed making 2017 look very much like 2017. So in this scenario we continue to see high yielding high beta currencies as attractive trades.

EUR/JPY - Challenging its resistance at 116.37.

The Risk Today

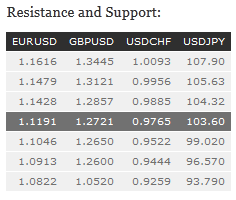

EUR/USD has bounced near the key support support at 1.1160 (rising trendline). A further decline towards the support at 1.1123 favoured as long as prices remain below the resistance at 1.1288 (declining trendline). Strong support can be found at 1.1046 (05/08/2016 low). In the longer term, the technical structure favours a very long-term bearish bias as long as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD has broken the support at 1.2789, confirming strong selling pressures. There is no real support below 1.2775, with marginal intraday demand around 1.2720. Resistance is located at 1.2873 (03/10/2016). Expected to show continued downside pressures. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY continues to recover with the break of resistance at 102.30 (declining trendline), negating bearish technical structure. Hourly resistance is given at 102.83 (21/09/2016 high). Psychological support at 100 is not far away. A key support lies at 99.02 (24/06/2016 low). Expected to further weaken. We favor a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF is fading near the resistance at 0.9820. A break of this level is needed to open the way for further short-term strength. Key resistance lies at 0.9956 (30/05/2016 high). Support can be located at 0.9750 (04/10/2016 base) then 0.9662 (26/09/2016 base low). In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.