Negative 15 Basis PointsSwitzerland`s 10-Year Bond Yield is now negative 15 basis points;Yeah that`s right we don`t even have to bring up the notion of inflation and real rates of return, the actual 10-year bond for Switzerland is charging investors 15 basis points for the privilege of buying Swiss debt. And you thought CD rates were bad.

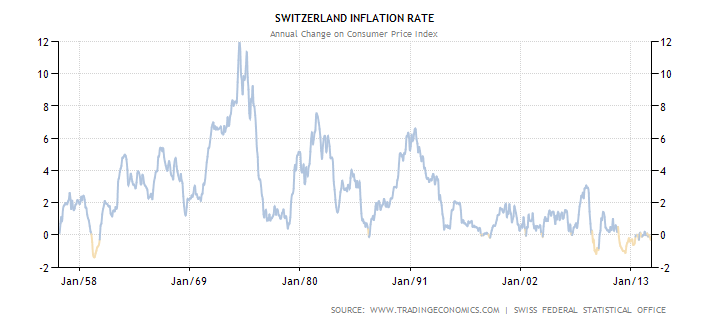

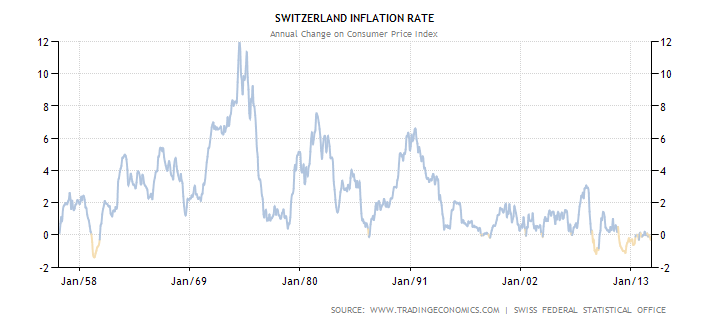

A whole lot of Inflation can happen in 10 years!

This isn`t some safe haven bond for 30 days or even 3 months, but for a duration of 10 long years. The Swiss National Bank has mastered the art of Tom Sawyer—getting paid by others for ‘the privilege’ of painting his fence.

Energy Deflation Mirage

Swiss consumer prices did drop 0.3 percent year-on-year in December of 2014 following a 0.1 percent fall in November, due mainly to the drop in energy costs. But this is hardly a deflationary death spiral where consumers in Switzerland are going to delay purchasing goods that they utilize every year because these same goods are going to be much cheaper in the future. Looking at the gasoline and heating oil charts the last 2 weeks I am sure everyone wishes they'd stocked up on these cheap goods heading into the heart of the winter storms and gasoline formulation change-over season.

Bad year-over-year Energy Comps will roll out of the Data Set

A whole lot of Inflation can happen in 10 years!

This isn`t some safe haven bond for 30 days or even 3 months, but for a duration of 10 long years. The Swiss National Bank has mastered the art of Tom Sawyer—getting paid by others for ‘the privilege’ of painting his fence.

Energy Deflation Mirage

Swiss consumer prices did drop 0.3 percent year-on-year in December of 2014 following a 0.1 percent fall in November, due mainly to the drop in energy costs. But this is hardly a deflationary death spiral where consumers in Switzerland are going to delay purchasing goods that they utilize every year because these same goods are going to be much cheaper in the future. Looking at the gasoline and heating oil charts the last 2 weeks I am sure everyone wishes they'd stocked up on these cheap goods heading into the heart of the winter storms and gasoline formulation change-over season.

Bad year-over-year Energy Comps will roll out of the Data Set

The point is that energy comps late in the year are transitory. They come out of the year-over year numbers as each expensive comp gets replaced by a cheaper comp, so what appears to be dire deflation in Europe, isn`t near as ‘dire’ as the numbers indicted towards the end of the year, and the first half of 2015 as the energy comps are just bad right now. But guess what if energy takes off 2 years from now, or 5 years from now the comps are going to explode higher, and Europe will be talking about an inflation problem.

No Need for Bond Vigilantes – Simple Reversion to Historical Mean

The problem I have with dysfunctional Central Bank Policies is the absurdity of a broken bond market, a bubble so big that it cannot possibly sustain itself. The higher bond prices go, and the lower bond yields go, the deeper and more extreme the massive reversion to the historical mean or just ‘long squeeze’ that occurs causing major market instability to not only the bond market, but every single market in the entire financial system because all markets in a sense price themselves and revolve around what the bond market does.

When there is no more place to seek safety because the bond market has been pushed to such extremes that the unwind becomes a crash during the unwind process, and mind you we are not even talking about needing a major black swan or huge tail risk event, we only need a reversion to the mean of what constitutes average bond yields that occurred within the last decade, and these are not even near the extremes to the upside when the decade average yields are juxtaposed with historical average yields of global bonds.

I will believe in the possibility for a ‘Deflation Era’ when overall cost of basket of goods and services goes down for 3 consecutive years on a global scale

And forget about deflation being some kind of new age phenomenon here to stay like global warming, if there is one thing for sure in this world besides death and taxes, it is that almost everything becomes more expensive in the future taken over the aggregate basket of goods and services consumed on this planet!

I am sure all those Swiss are forestalling their purchases, waiting for the return of 5 cent Beverages and $3,000 Automobiles to hit their markets sometime in the not too distant future. So inflation will revert to historical norms as well, and when someone buys a 10 year bond, they are supposed to be compensated in yield for these inflation contingencies under a normal, functioning healthy market!

Monetary Extremism: Cost/Benefit Analysis

But forget all this technical finance theory, I will break this down to its simplest fundamental core element. When someone loans another person or entity money in a healthy, normal functioning system of commerce, they are supposed to receive compensation for providing said service in terms of yield or interest on the principle of the loan. To completely screw this fundamental market concept up by manipulating interest rates far below basic market borrowing principles which would be set in a normal market condition, and thereby in the process destroy the entire notion of what yield and interest represents in the basic borrowing exchange is the most destructive result of ZIRP.

And I believe the destruction of this sacred market concept by the Monetary Extremists probably rises to the level of Central Banks “Being Put on Performance Review” and at the very least Central Banks have absolutely overstepped their bounds. I mean come on ok you added a couple quarter points to GDP calculations great Job Monetary Extremists, but you broke the bond market, it no longer functions how bonds were intended, you allowed for asset purchases which completely violated the rule and role of price discovery in financial markets, which thereby means you broke the entire free market financial system. Great Job, those ends sure justified the means…where do I sign up for QE4?

What Could Possibly Go Wrong With a Policy of Free Money for 7 Straight Years Plus Asset Purchases on a Multi-Trillion Dollar Scale?

This is my main criticism of ZIRP methodology and Central Banks right now; their cures are far worse than the diseases they are trying to treat. This isn`t all on the Swiss National Bank, in some sense the Federal Reserve and ECB failing to extrapolate the ‘unintended consequences’ of their Extreme Monetary policies beyond GDP growth and inflation targets to the bigger picture of healthy markets, sustainable bond yields, and stable global currency markets is to blame.

Bonds such a Bubble: Even Letting Air out slowly will cause Market Tremors

But coming out of the financial crisis, and all the reflective thinking about not having the big banks lever up their balance sheets on risky assets, to avoid promoting bubbly market conditions, that there were unintended consequences of too much easy credit, and in just 7 years we are right back in the same position we were before the financial crisis; except with bigger bubbles in stocks, and the largest bubble in any asset class, this being the bond market, that there has ever been in any mainstream asset class.

At least with Credit Default Swaps there were percentage models about how many firms would go out of business; but I wonder what the financial models say for the US 10-Year Bond yielding 4%, yeah this would be such a rare occurrence in the history of bond market valuation metrics – yet nobody is buying bonds using any financial valuation models right now, and they are buying long duration to further ramp up the risk profile to this trade.

The bubble in the bond market is so big, and so extended that even a ‘prickling’ of it is going to cause massive reverberations in the entire market landscape, how could the Central Banks have ever let it get this extreme? This scenario is just waiting for Frontline to show up to cover the carnage after the resultant crash! These are all economists with PhDs in economics who studied decades of market dynamics, economic theory, and historical unintended consequences of monetary policy initiatives. How could they ever let it get to the point of negative 15 basis point yields on 10-year Swiss bonds?

Monetary Extremism has destabilized Global Bond Markets: Set the Stage for Mega- Crash

It is rather remarkable what has occurred over the last 7 years of ZIRP in financial markets! What did you do with your career? Well the economists of the Central Banks broke financial markets, which wouldn`t be such an astonishing feat as financial markets have had their troubles during very bad times, but they broke the conservative bond market of all markets, in basically a 2% plus Global GDP growth environment not some cataclysmic global tsunami once in a century recession, and that is no easy feat of incompetence to pull off. Moreover, Central Banks didn`t just break a single bond market in some small banana republic, no Central Banks broke the largest bond markets all across the globe, every single one of them from Japan, Europe to the United States.

No Neutrality in Globally Intertwined Bond Markets

And yes even neutral Switzerland`s bond market has been broken; so it may be debatable whether Central Banks saved us from more of a downturn after the financial crisis, but there is no debate at all that they have broken global bond markets! The real concern going forward, and in my view Central Banks single most important focal point with regard to monetary policy objectives, how do they normalize the bond markets with as little damage as possible? There is no getting around that bond markets are going to normalize one way or another, with or without Central Bank help; the real question is can Central Banks do anything from here to minimize the collateral damage on the rest of the financial markets during the normalization phase?