This may be the most important column I’ve ever written. If you understand the ideas I outline below, your chances of building and, most importantly, maintaining serious wealth are sure to rise.

It all starts with a column we published earlier this week.

Alexander Green took a common-sense look at the robotics industry. In the end, he told readers they could play the profitable trend through the ROBO-STOX Global Robotics and Automation GO UCITS (MI:ROBO)(Nasdaq: ROBO).

The piece was quite popular with readers. We got lots of feedback. But there was one question that we feel obliged to address publicly.

The answer has the power to change your financial fate.

Alex, I always enjoy your investment analysis and ideas. I try to achieve some discipline in my investing by following a couple of The Oxford Club newsletter portfolios (including your Gone Fishin' long-term buy-and-hold portfolio), and that has worked out well. But what to do with the random, but well-argued, cases you make for other investment opportunities like the ROBO ETF situation above? Where do they fit in with the OC portfolios and the Wealth Pyramid?- Oxford Club Member Chris I.

It’s that last question - more specifically, the last two words of it - where we want to concentrate. The Oxford Club’s Wealth Pyramid is an incredibly powerful tool. It allows investors to increase their returns, without taking on any undue additional risk.

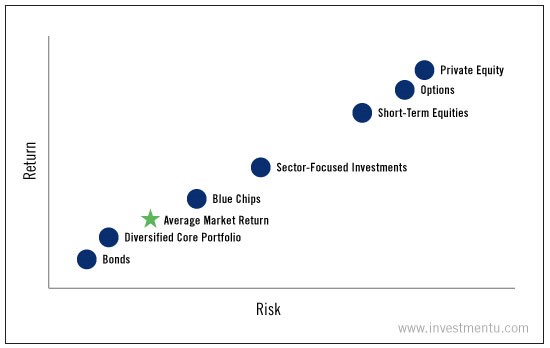

We’ll start by taking a look at this chart...

If you’ve ever used a full-service broker or money manager, you’ve likely seen something like it. If not, you’ve at least heard the pitch. The chart simply shows the traditional amount of risk and return of various asset classes.

It’s simple stuff. In fact, it’s too simple.

Sure, options are a risky asset class... when used alone.

And sure, plenty of folks have lost their shirts in the private-equity game.

And yes, bonds are often low-risk, low-return investments.

But what we’ve uncovered is that successful investing hinges on just two things. Those two things, unlike conventional models, are NOT risk and return.

What we look at instead are two elements lost in conventional Wall Street guidance: time horizon and something else that goes far beyond simple asset allocation.

Time horizon is easy to understand. It’s simply how much time your money will work for you. The key is that it has less to do with your age and more to do with how much time you have to build wealth.

We can explore it another time.

For now, it’s vital that you understand the concept of strategy allocation.

It’s what allows you to take advantage of the fast-moving opportunities Alex highlighted earlier this week... without risking your core wealth. You can target specific sectors, private equity ventures, even short-term income strategies.

And, again, you can do it all without taking on any unnecessary risk to your overall wealth.

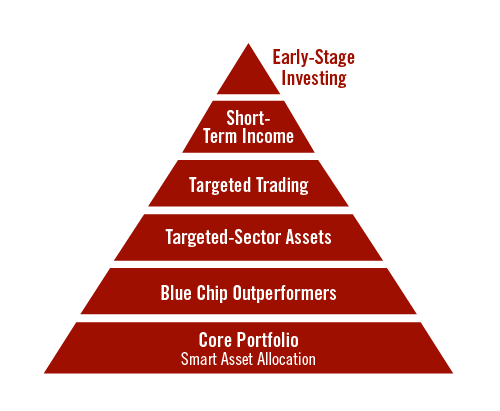

That concept is the backbone of our unique Wealth Pyramid.

The Oxford Club’s system builds on Nobel Prize-winning research by famed economist Harry Markowitz, the father of modern portfolio management.

Markowitz knew that it was futile to measure an investment entirely on its own. After all, it’s how each of your assets interact with each other that determines your true investing success. That idea served as the genesis for what Markowitz calls his “efficient frontier” model.

Instead of measuring stocks individually, he measured their correlation to each other. By adding to some positions and underweighting others, he was able to create a portfolio with significantly more reward and drastically reduced risk.

But where Markowitz stopped at security selection, we’ve taken it even further. We’re using his model to find the ideal mix of investment strategies... not just individual stocks.

In the end, we carefully selected six specific strategies to build our Pyramid.

Depending on your unique risk tolerance, you can use the Pyramid - starting with a dependable asset- allocated portfolio at the bottom - to select a mix of strategies and assets that’s tailored exactly to your needs.

The key, just as in the groundbreaking Markowitz model, is to understand that the ideal mix (the highest return per “unit” of risk) requires at least some exposure to each asset class. Again, the idea here is strategy diversification.

So in the case of Alex’s nod to the robotics ETF, the selection would fall in what we call our “Targeted-Sector Assets” strategy. That’s because it specifically aims at a quick-moving sector. It’s the same place we put our energy investments or our healthcare picks.

Again, as the Member above hints at, the key to this model is to start with a long-term buy-and-hold portfolio. From there, the higher you go on the Pyramid, the more diversified your strategy mix will become... meaning you’ll have higher gains and lower risk.

We are convinced - because our research proves it - that this unique model has the power to build incredible wealth.

If you understand it and implement it properly, you’ll get rich faster, more easily and with far less volatility. And better yet, because of the powerful effects of diversification... you’ll keep that money.