At face value Q3 GDP in Sweden was much stronger than we expected, growing 1.6%

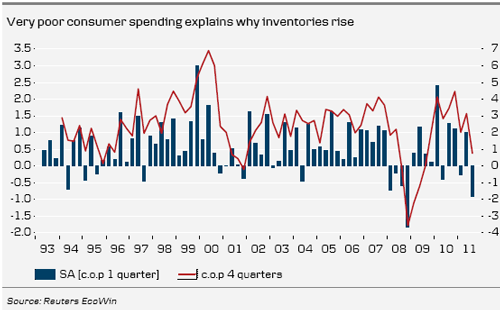

q/q and 4.6% y/y (our forecast was 0.4% and 3.6%). One observation stands out as very

important – namely that consumer spending was much weaker than imagined (0.8% y/y

vs expected 2.0% y/y), while inventories added 0.2% to GDP, rather than shaving off

1.3% as we expected. These two facts are closely connected and have important

ramifications going forward.

We have heard complaints from retailers that a very mild start of the autumn and winter

has been detrimental for sales of seasonal clothing and sports equipment. Obviously

things are even more depressed than we thought. In fact, the 0.9% q/q decline in overall

consumer spending is the second sharpest on record since 1993 (second only to Q4 08).

This again explains the unexpected inventory accumulation. It is simply a matter of

unsold goods in the retail sector. Of course retailers can’t keep a quantity of unsold goods

for long – so they will either have to hope for winter finally showing up, or be forced into

aggressive discounts to get rid of inventory:

- If anything, the message in the Q3 GDP report is a reason for reducing expectations on Q4 – in one way or another retailers must get rid of their inventories of unsold goods.

- Inflation could get even lower. Unless winter shows up soon (we are approaching December), price discounts could be introduced earlier and turn out more aggressive than is seasonally typical.