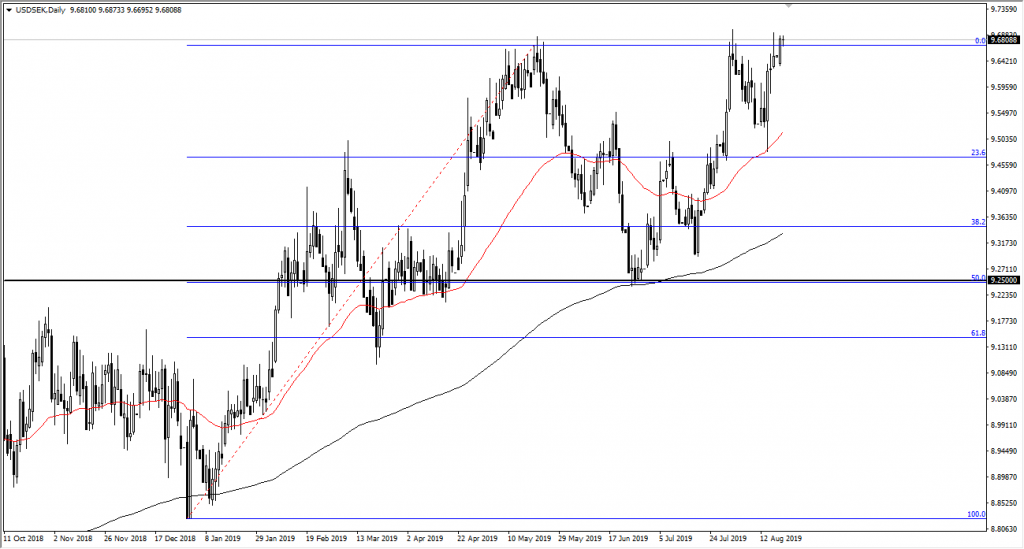

The Swedish krona continues to suffer at the hands of the greenback, as we are reaching the most recent highs. At this point, it’s obvious that the 9.7 SEK level is significant resistance but the fact that we continue to grind towards that area and seemingly without fear tells me that it’s only a matter of time before we break out. If you look back at the last couple of weeks, we have formed shooting stars at this level, and the fact that the Monday candle stick is very bullish and pressing the top of those two shooting stars, I believe that a lot of the resistance is starting to give way.

Major round figures

One thing that’s always obvious to me is that large amounts of money flow into the Forex market at big figures. It’s obvious that the 9.7 SEK level has attracted a lot of money, it of course profit taking. I think at this point though, it’s only a matter of time before we break out and then we will go looking towards the next obvious resistance barrier, which of course is the 10 SEK level. At this point I believe that it’s far to juicy of a target for longer-term traders to ignore.

Technical analysis for Swedish krona

The technical analysis for the US dollar/Swedish krona pair is relatively straightforward. We are at the exact highs, formed a massive bullish candle digging into the top of a couple of shooting stars, and have recently bounced from not only the 50% Fibonacci retracement level, but also the 50 day EMA which is pictured in red on the chart. Looking at the chart, there’s nothing bearish about this and even if we do get a bit of a pullback, one would have to think that the extraordinarily bullish candle stick from last week that bounced so drastically from the 50 day EMA will come into play and attract a lot of buying pressure anyway. With that, it’s an either “buy the breakout” type of market, or it’s a “buy on the dips” type of market.

Risk appetite

Keep in mind that the Swedish krona is considered to be a bit of a “risk on” type of currency, as it is so highly levered to the technology sector. With that in mind, this is a bit of a barometer as to whether people wish to own US Treasuries or play the situation a little on the riskier side by going into technology. At this point, it’s obvious that the US dollar and the Treasury market continues to win. With so many geopolitical issues out there and of course global growth concerns, it’s hardly a surprise that would be the case. As for myself, I will continue to buy this pair.