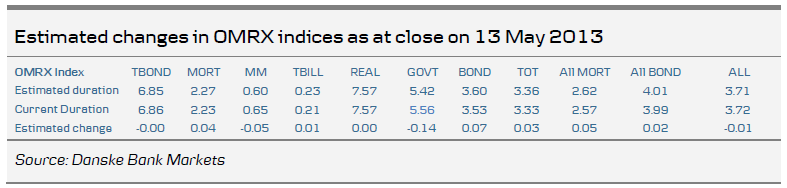

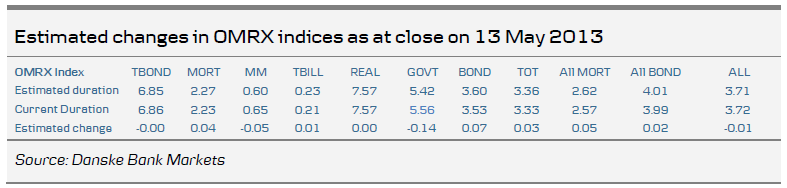

This month, we will see small index duration changes on the ordinary rebalancing day on May 13. Some longer dated mortgage bonds have been issued, affecting OMRX-MORT and OMRX-MORT ALL. Also, as the share of mortgage bonds has fallen slightly, OMRX-BOND will get slightly longer (see table below).

In June, we will get a larger extension as three covered bonds get shorter than 1Y, and are thus removed from the bond indices. These loans (SHYP1575, SEB567, NDH5526) are also relatively large. This will result in duration jumps of around 0.44Y in OMRX-MORT, 0.34Y in OMRX-MORT ALL and in excess of 0.5Y in OMRX-BOND. Historically, these are very large extensions and we would be surprised if there was no market impact.

It is worth noting that Statistics Sweden has updated its methodology for calculating the total outstanding amount in mortgage bonds (used for the weighting of OMRX-BOND). NasdaqOMX is still in the process of determining how the calculations should be made. In the meantime, the May rebalancing will occur using a number calculated by the old methodology.

In the past month, mortgage bonds have fared well andhave now outperformed both nominal and index-linked government bonds in the same maturity buckets. Coming index extensions should continue to primarily benefit the longer dated maturities.

To Read the Entire Report Please Click on the pdf File Below.

In June, we will get a larger extension as three covered bonds get shorter than 1Y, and are thus removed from the bond indices. These loans (SHYP1575, SEB567, NDH5526) are also relatively large. This will result in duration jumps of around 0.44Y in OMRX-MORT, 0.34Y in OMRX-MORT ALL and in excess of 0.5Y in OMRX-BOND. Historically, these are very large extensions and we would be surprised if there was no market impact.

It is worth noting that Statistics Sweden has updated its methodology for calculating the total outstanding amount in mortgage bonds (used for the weighting of OMRX-BOND). NasdaqOMX is still in the process of determining how the calculations should be made. In the meantime, the May rebalancing will occur using a number calculated by the old methodology.

In the past month, mortgage bonds have fared well andhave now outperformed both nominal and index-linked government bonds in the same maturity buckets. Coming index extensions should continue to primarily benefit the longer dated maturities.

To Read the Entire Report Please Click on the pdf File Below.