Close payer position in 1Y swap (P/L: 0bp) and close long position in SGB1047 (Dec 2020) ASW (P/L: +9.5bp).

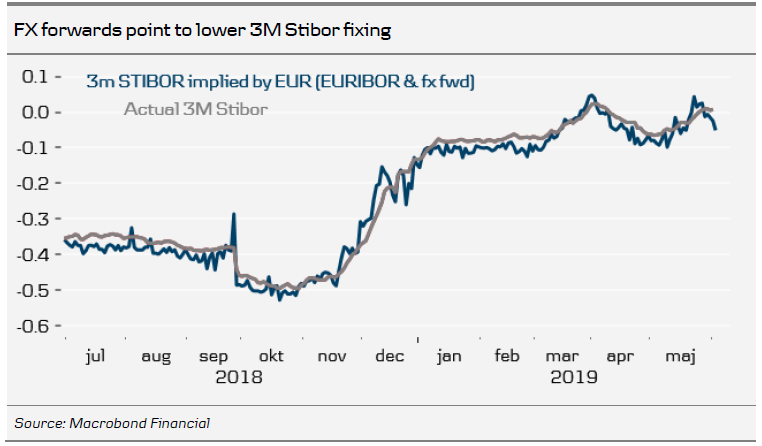

We have argued that, in the wake of the FSA’s LCR proposal published in March, 3M (NYSE:MMM) Stibor would be under upward pressure around the June IMM. On top of the usual halfyear turn, we argued that large volumes of covered bond redemptions would put pressure on SEK LCR ratios and lead to strong demand for the weekly Riksbank certificates.

This has materialised to some extent. For two weeks in a row, Riksbank certificates were oversubscribed. Since the low in early May, 3M Stibor has increased by some 7bp.

However, we note that Riksbank certificates were not fully subscribed this week and EURSEK FX forwards have moved significantly lower. It appears that the market does not expect the current liquidity squeeze to last into July and is perhaps already positioning for this.

Moreover, last week, we saw the Riksbank offer a lower amount of Riksbank certificates than can be explained by redemptions/coupon payments, thereby increasing short-term excess liquidity available in the market. The Riksbank taking a more active role in the money market is something new and could perhaps limit future upside risks for 3M Stibor.

We have previously recommended paying the 1Y swap, partly to benefit from higher fixings but also given that Riksbank pricing was extremely muted. Admittedly, we do not expect the Riksbank to be able to deliver in the end but, at least rhetorically, the Riksbank remains committed to a tightening cycle. However, with a rapidly deteriorating global trading environment, it looks increasingly difficult to price in higher rate hike probabilities in the short end.

Thus, we see good reasons to close our recommendation to pay the 1Y swap at the same level we took on the position.

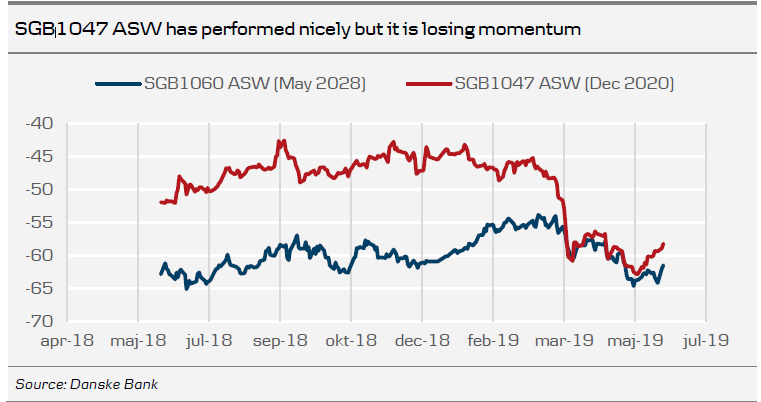

In addition, our recommendation to buy SGB1047 (Dec 2020) could be somewhat under pressure if fixings start moving lower once again. Moreover, we expected SGB1047 to benefit from the current futures roll from June to September contracts, which is nearing the end. Consequently, we choose to close this recommendation, initiated on 21 March, as well, with a 9.5bp profit.