With a first possible start date on Tuesday 11 June (depending on market conditions) Stadshypotek is set to introduce a new SEK covered bond within the benchmark programme, SHYP1589. The coupon rate is set to 1.5% and the maturity date is 3 December 2024. Hence, the bond falls between the SHYP1588 (Mar 2024) and SHYP1594 (Sep 2028). The first possible day of trading is set to 11 June and Stadshypotek targets an initial volume reaching benchmark size within the first trading days.

Covered bond ASW levels have eased up a bit from recent lows, but the overall picture is still that the low-yield environment and hunt for yield makes covered bonds attractive despite the historically tight levels against the swap curve. Also, the June index extension, where indices including covered bonds will be extended by 0.3-0.4 years, is likely to increase demand for covered bonds near term.

Pricing

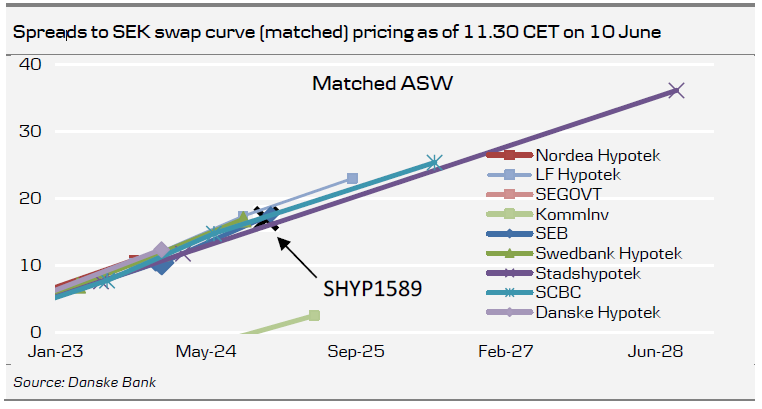

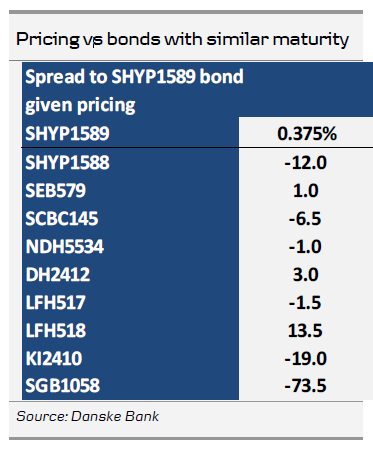

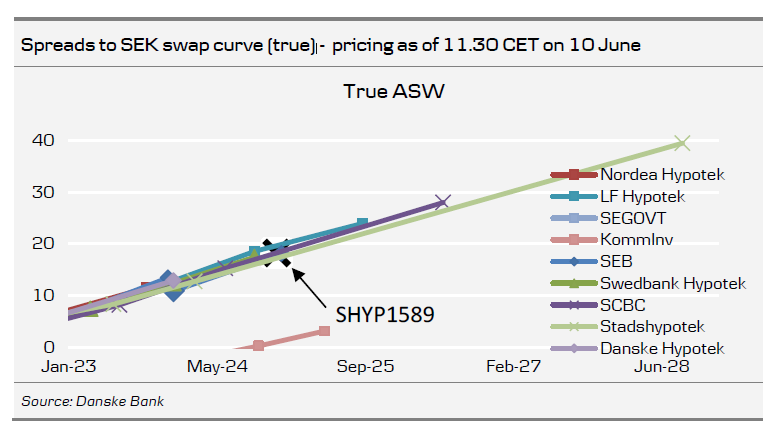

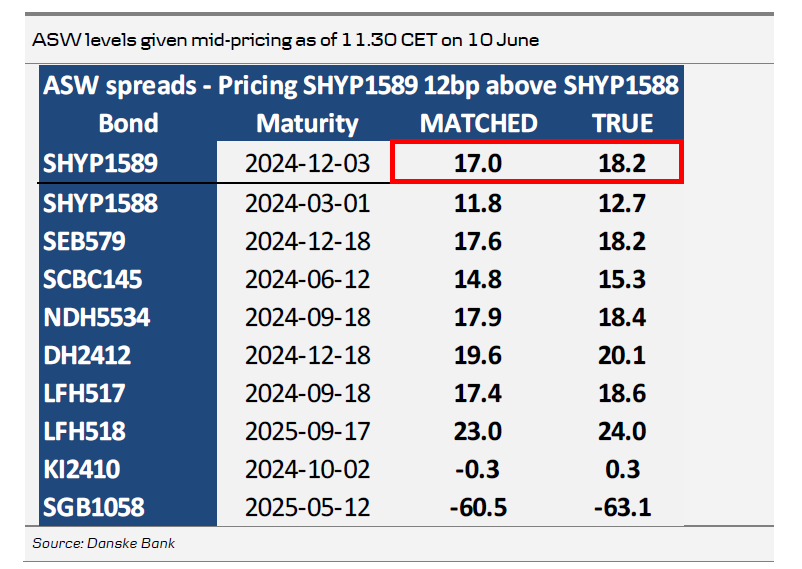

The maturity date of SHYP1589 is close to the SEB579 and DH2412, which both mature on 18 December 2024. Given the coupon of 1.5%, which is higher than SEB579 and DH2412 (both at 1%), we prefer to assess the true-ASW spreads for the bonds, to adjust for the coupon difference. We expect the SHYP1589 to price relatively in line with SEB579 on a true-ASW basis, perhaps even a touch richer. A true-ASW spread in line with SEB579 at around 18.2bp corresponds to a matched-maturity spread of 17bp and a spread to the SHYP1588 at 12bp. Thus, we see the fair value for SHYP1589 at 11.5-12.5bp above SHYP1588. In the charts/tables below, we have assumed a 12bp spread.