– Jefferson Airplane, White Rabbit

Watching the Presidential debates when you know the data, and you are a student of economic dynamics – brings a different perspective to the political and media spin heard following the debate. It is obvious to me that the politicos play to the weaknesses of human nature:

- if something is wrong, it can be immediately fixed.

The Presidential candidates offered their economic “pills” which they suggested would solve the economic woes. What struck me was that neither candidate displayed any vision of economic dynamics. Both used their parties “litmus” tests in the way they described what it would take to get the economy going:

- protect the little guy

- unleash greed to help the little guy

- grow small business to expand employment opportunities

- energy independence

- bring back jobs from overseas

- reduce taxes on business

- reduce taxes on the middle class

- reduce deficit

Come on – these elements are a mixture of economic headwinds and tailwinds. It depends on they way they are implemented whether it could be economically positive, and neither candidate is exposing enough detail to make any determination. Most know I tend to gravitate towards employment / unemployment analysis – and that I feel that if the USA could magically create jobs, it would be the economic magic pill. The real economy is about people working and creating.

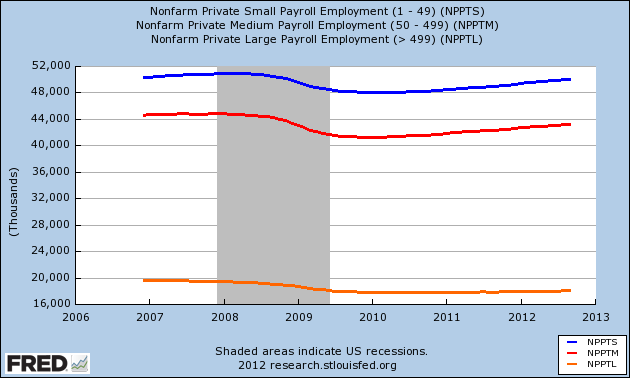

It seems economists and politicos believe money is the economy (and not one of the many measures of the economy). It appears to be true that small business is the jobs driver which is easily seen by using ADP’s employment data (the BLS does not issue data series on employment by company size). Fewer and fewer jobs exist in the USA in companies with 500 or more employees – and this trend has been in play since 2000.

Both candidates must believe the dynamics of the above graph – as both want to energize small business. The magic pill both candidates offered was increased profit potential so small business could hire more. Higher profits are not an incentive to small business to hire – an expanding economy is an incentive to hire. An expanding economy creates jobs – and jobs create more jobs (jobs multiplier).

And likely, the poor employment dynamics today is in itself creating the headwinds for economic expansion. The USA is in a real Catch-22. Is there a Catch-22 pill? Likely it is a series of pills that will be very, very slow acting. And neither candidate exposed any real pills. In fact, there is little difference between the candidates economically – or the economic approach of the previous President Bush.

Two countries jump to my mind as needing to import workers (employment demand above the population supply) – Germany and Singapore. Both countries are:

- very Austrian in their approach to their respective economies;

- resource poor;

- significantly better social safety nets than the USA (including universal health care)

Maybe the problem is the current Keynesian approach which has built up a permanent toxicity into the private sector from uncorrected government intervention errors causing imbalance -and now this is an economic headwind. I am not suggesting that pure Austrian economics is the way out of poor employment dynamics at this point.

But the magic pill will not come from maintaining the economic doctrine which has been applied since World War II. And neither candidate is offering any more than a color change of the same pills.

Other Economic News this Week:

The Econintersect economic forecast for October 2012 showed growth, but there was a serious degradation of the elements in the forecast. Overall, trend lines were broken to the downside. There is a diminishing whiff of recession in the hard data (plus a diminishing number of surveys are at recession levels), with container imports expanding for the first month in the last three.

ECRI is still insisting a recession is here (a 07Sep2012 post on their website). ECRI first stated in September 2011 a recession was coming . The size and depth is unknown. The ECRI WLI growth index value is enjoying its ninth week in positive territory. The index is indicating the economy six month from today will be slightly better than it is today.

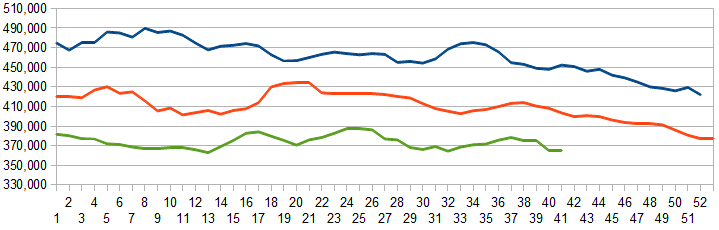

Current ECRI WLI Growth Index

Initial unemployment claims rose significantly – from 339,000 (reported last week) to 388,000 this week (the decline last week and increase this week nullify each other – and is likely due to reporting nuances). Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here). The real gauge – the 4 week moving average – rose insignificantly from 364,000 (reported last week) to 365,500. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2010 (blue line), 2011 (red line), 2012 (green line)

Data released this week which contained economically intuitive components (forward looking) were:

- Rail movements (where the economic intuitive components indicate a moderatelyslightly expanding economy).

All other data released this week either does not have enough historical correlation to the economy to be considered intuitive, or is simply a coincident indicator to the economy.

Click here to view the scorecard table below with active hyperlinks.

Bankruptcies this Week: A123 Systems,, Satcon Technology