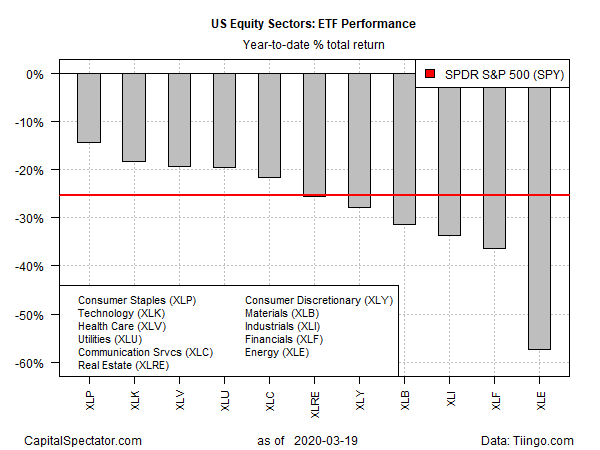

It’s been a brutal year to date for U.S. stocks, but the pain varies substantially from sector to sector, based on a set of exchange traded funds as of Thursday’s close (Mar. 19). Consumer staples, tech and health care are suffering the least among the main sectors that comprise the U.S. market. Energy, by comparison, is deep in the hole, posting the biggest loss by far in the sector space.

Consumer Staples Select SPDR (NYSE:XLP) is the current leader by way of posting the smallest year-to-date loss: a relatively modest 14.4% decline. The softer setback is linked to the view that companies in this sector are selling products that are considered essential to day-to-day life and therefore are mostly immune to the coronavirus blowback that’s roiling the economy.

Stocks in the consumer staples sector tend to be lower beta-risk shares, notes John Petrides at Tocqueville Asset Management. “They’re less volatile. They have higher yields. So, in an environment where global bond yields have really collapsed, people are looking for income,” he advises. “Those three trends are really holding this group higher.”

Petrides also predicts that “if we do have a market rebound from here on out, I would assume this group would probably be a relative underperformer.”

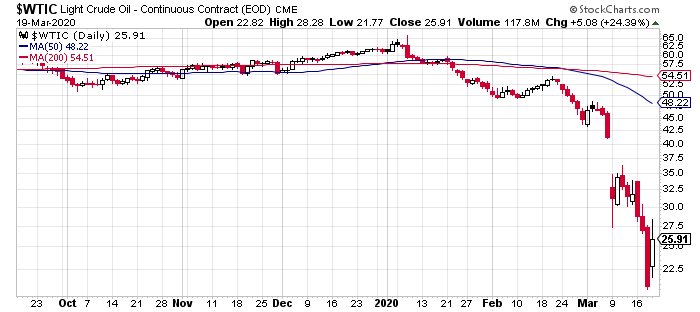

Energy, by contrast, has been crushed so far in 2020. Energy Select Sector SPDR (XLE (NYSE:XLE)) is down 57.4% year to date—the biggest decline by far. The outlook for a deep and perhaps short recession is driving the negative sentiment for energy shares. The challenges that energy companies face in the near term starts with the collapse in crude oil’s price. West Texas Intermediate, the U.S. benchmark, has fallen from the low-$60 range in January to under $21 at one point this week.

“A sustained drop in oil prices would cost the sector 50,000-75,000 jobs if employment returned to its low from a few years ago,” predicts Nathan Sheets, chief economist at PGIM Fixed Income.